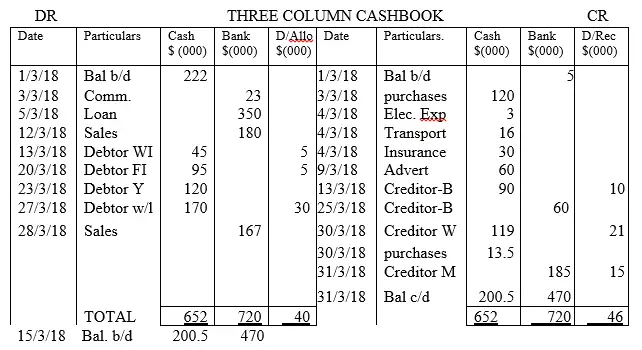

Three column cash book

A three column cash book is a book of original entry or subsidiary book where all cash transactions are transferred to. As the name suggests, the three column cash book has three columns for both cash and bank amounts and an additional column for discount. Before we look at an illustration for a three column cash book case, we will first focus on the subject of discount

Discount

A discount is a relief that is extended to a buyer of goods by the seller as a motivation of kind. The discount can assume various forms such as;

-

Trade discount

-

Quantity discount

-

Cash discount

-

Trade Discount

This is a relief extended to a buyer of goods after purchasing certain quantities of good as per the seller’s threshold (purchase in large quantities). It is a relief that commonly applies for buyers who purchase goods with an intension of re-selling hence the seller sets for them a lower selling catalogue price as compared to other customers who are onetime buyers. Where trade discount has been extended to a buyer, the invoice price would be the same for all customers but the net selling price may be different for customers depending on the quantity purchased by them. Trade discount is not recorded in the books of accounts. It is only a means of calculating the net selling price of goods. Only the net amount of goods sold is transferred to the books. An example of a trade discount scenario is if the catalogue price of a commodity is $100, for normal purchases will be charged the same price whereas, for a buyer, especially those who intent to buy for re-selling purposes, will buy in large quantities and hence charged something like $90.For more on trade discount,click here.

-

Quantity Discount

Quantity discount seems to be the same as trade discount but they are different. In this case, it refer to a relief extended to a buyer of goods after purchasing certain quantities of good as per the seller’s threshold (purchase in large quantities) especially raw materials. It is a relief that is commonly used by manufacturers for buyers who purchase materials past a certain manufacturer’s quantity threshold. Therefore, it is an incentive to a buyer that end up incurring or paying less cost per unit (remember, for trade discount the buyer pay less purchase price per unit) for he/she was given some purchasing price relief by the seller.

NB: that both trade and quantity discounts are not shown in the accounting records, be it the invoice or respective ledger accounts.

-

Cash Discount

This is a financial relief extended to a buyer of goods with the intension of prompting the buyer to pay for the debt within the shortest time possible to avoid cases of bad debts written off which may result to financial losses. Cash discount is recorded in books of accounts starting with the invoice where by the allowance is deducted from the invoice price to realize the net sales amount. Cash discount is further classified into two categories based on the party providing such privilege:-

-

Discount allowed

-

Discount received

Discount allowed is a financial relief given by the seller to the buyer of goods with the intension of encouraging quick payment of goods sold on credit. The amount of cash discount extended is usually a percentage of sales value and the rate that applies depend on the credit terms thereof. The credit terms covers the duration within which the grace period of clearing the debt covers. Therefore, the range of percentage discounts given are spread within that period and the rate that applies is determined by the time the buyer (trade debtor) pays. An example of such terms are as follows;

Credit period 30 days;

If pay within 10 days 15% cash discount

If pay within 20 days 10% ”

If pay within 30 days 0% ”

Interpretation

Therefore:

If a buyer pays within the first 10 days, he will enjoy 15% cash discount such that if total sales value as per the outgoing invoice was $100,000, then the buyer will pay $85,000. To the seller, he or she will suffer a financial loss of $ 15,000 in terms of discount allowed.

If the buyer pays within 16th to 20th day, he/she will pay $10,000 less ($90.000)

If the buyer pays between the 21st up to 30th day, he/she pays $100,000. In other words, no relief is given.

To the seller, the cash discount allowed is an operating expense hence it is written off to the profit and loss account at the end of the financial period. To the buyer, the discount received is an operating income. The learner need to understand that the two discounts are one and the same thing. So the values are the same although each party will treat the amount differently. Since an organization can be a buyer and a seller in another scenario, the accounting treatment of cash discount (allowed and received) is different to the two parties.

Discount received on the other hand is a gain to the buyer and the terms remain as those of discount allowed.

Accounting Treatment of Cash Discount

The discount allowed and received are both operating expense and income respectively and are recorded on the debit and credit side of the three column cash book. The learner need to note that discount allowed is an operating expense but the recording of the same on the debit side of a three column cash book is not related to double entry principle for we know that expenses are debited in their respective ledger accounts. Similarly, discount received is an operating income but the recording of the same on the credit side of a three column cash book is not related to double entry principle for we also know that incomes are credit in their respective ledger accounts. Remember that a three column cash book is a book of original entry and information from the respective source documents is transferred and not posted. So cash discounts are just listed in their respective columns in the three column cash book and the principle of double entry does not apply at this stage. In the following illustration , we will demonstrate how the cash discounts are recorded in a three column cash book.

Example of three column cashbook

The following transactions took place in Our Co. ltd in the month of March 2018

2018, March 1st Balance b/d; cash in hand $222,000 and cash at bank ($ 5,000)

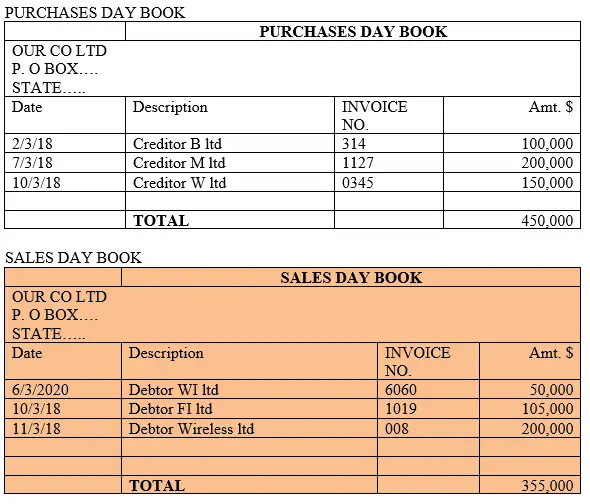

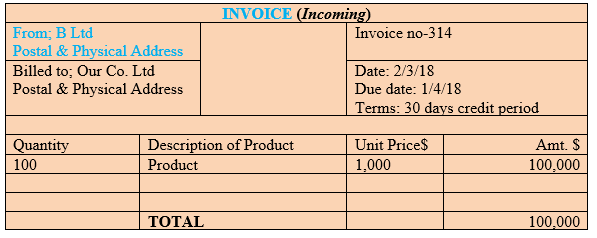

2nd bought goods on credit from B ltd $ 100,000; 30 days credit period; discount terms;10/15%; 20/10% and 30/0%

3rd bought goods $ 120,000 on cash from A ltd

3rd received commission from Dubai Agencies of $ 23,000 by check

4th paid the following expenses in cash;

Electricity $3,000

Transport $ 16,000

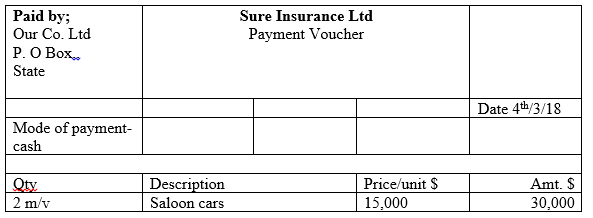

Insurance $ 30,000

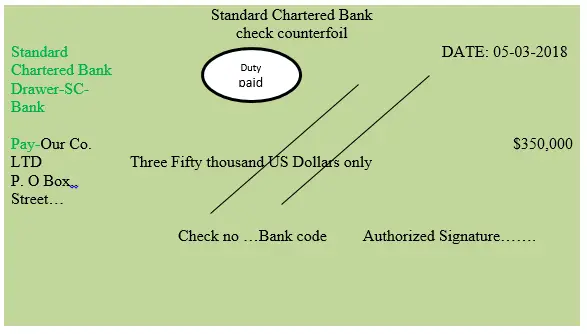

5th Borrowed loan from Standard Chartered Bank $ 350,000

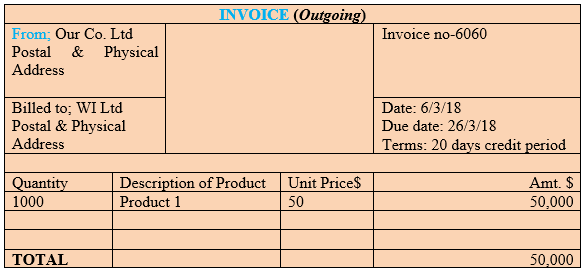

6th sold goods on credit to WI ltd of $50,000; 20 days credit period; discount terms; 10/5%; 15/1% ; 20/0%

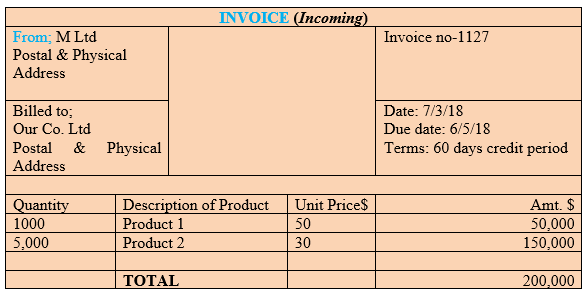

7th bought goods from M ltd on credit for $200,000; 60 days credit period; discount terms;20/15%; 40/7.5%; 50/1%

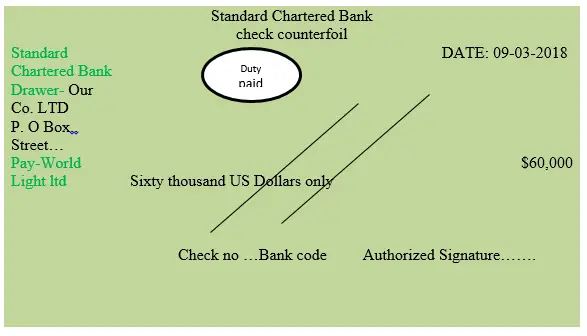

9th paid advertisement expenses to World Light ltd $ 60,000 by check

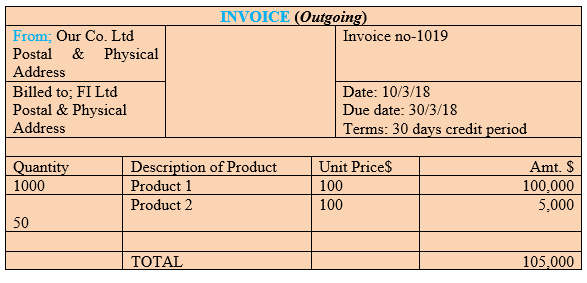

10th sold goods to FI ltd on credit, $105,000;30 days credit period; discount terms; 15/5%;20/1%

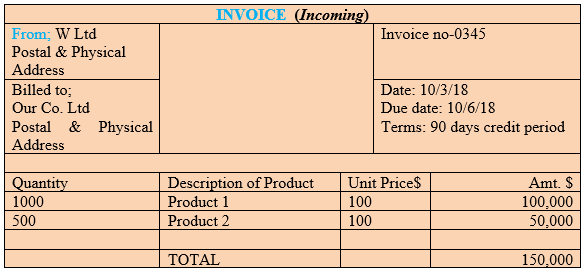

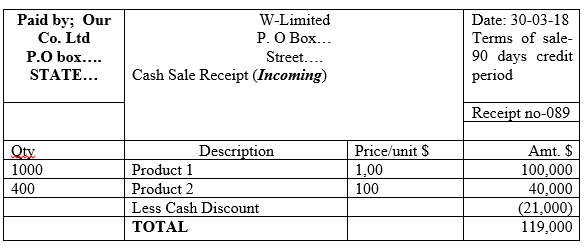

10th bought goods from W ltd on credit, $150,000; 90 days credit period; discount terms; 20/15%; 40/10%; 60/5%

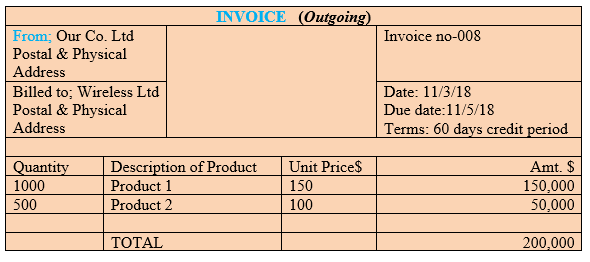

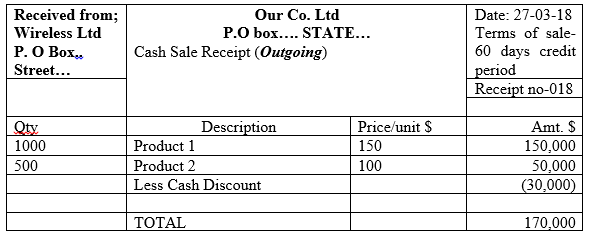

11th sold goods to Wireless Ltd on credit, $200,000; 60 days credit period; discount terms;45/15%

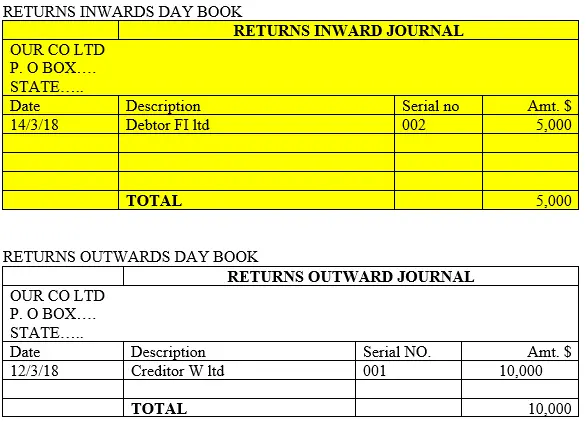

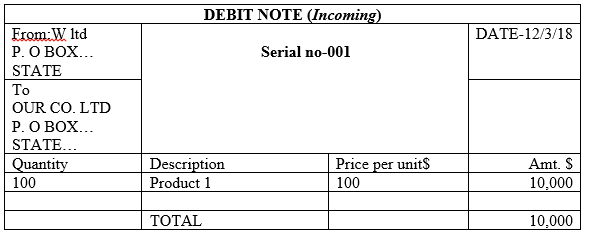

12th returned goods of $10,000 to W ltd due to failure of quality specifications

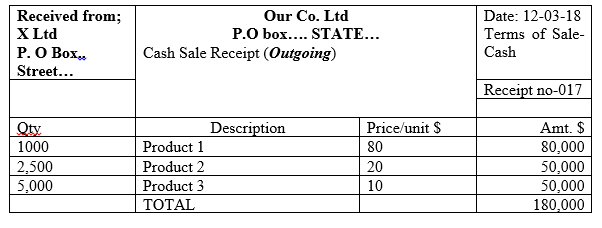

12th sold goods on cash, $180,000 to X ltd

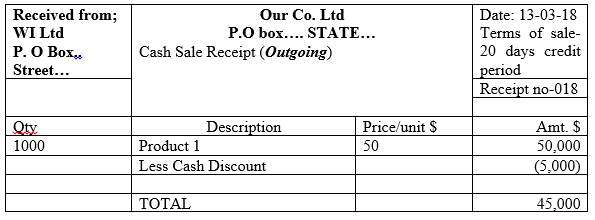

13th received cash, $45,000 from WI ltd (ie received cash in 7 days)

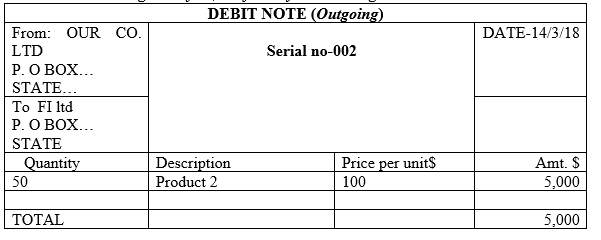

14th FI ltd returned goods of $5,000 for they were damaged

17th paid B ltd by check (ie paid in 15 days) and cleared the debt

20th received a check from FI ltd clearing the debt due (ie received a check in 10 days)

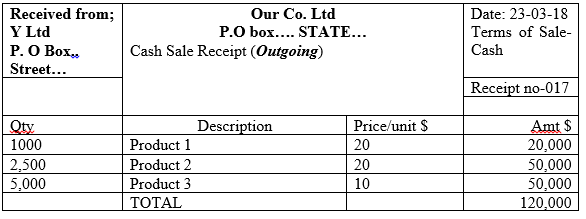

23rd sold goods on cash, $120,000 to Y ltd

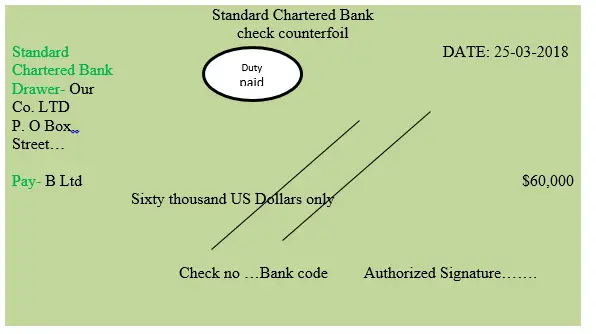

25th bought goods from B ltd of $60,000 and paid by check

27th Received cash from Wireless ltd (ie received cash in 16 days)

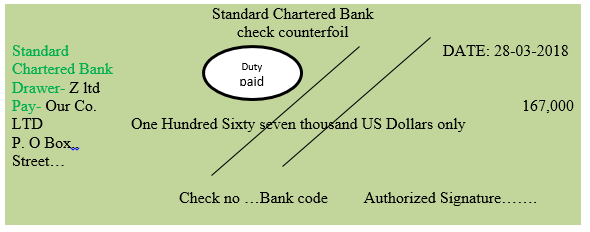

28th sold goods to Z ltd of $167,000, received payment by check

30th paid W ltd the amount due on cash. The respective discount allowance applied (ie paid in 20 days)

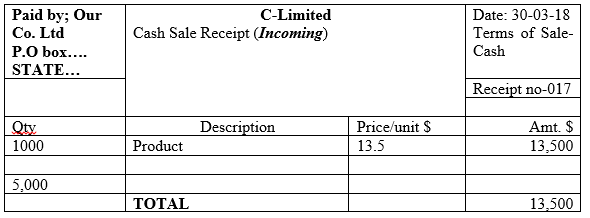

30th bought goods from C ltd of $13,500 in cash

31st paid M ltd by check, clearing the debt thereof (ie paid in 24 days)

Required;

Record the above transactions which took place between Our Co ltd and B,M,W; WI,FI, Wireless, A,B,C and X,Y,Z in the respective source documents and transfer the same in the corresponding books of original entry

Solution

Step One; Recording the transactions in the respective source documents

2nd bought goods on credit from B ltd $ 100,000; 30 days credit period; discount terms;10/15%; 20/10% and 30/0%

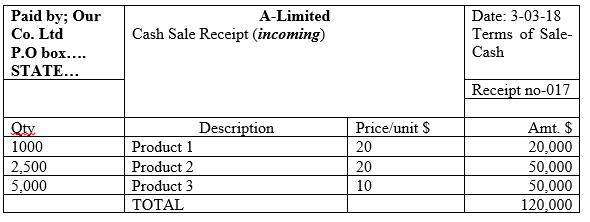

3rd bought goods $120,000 on cash from A ltd

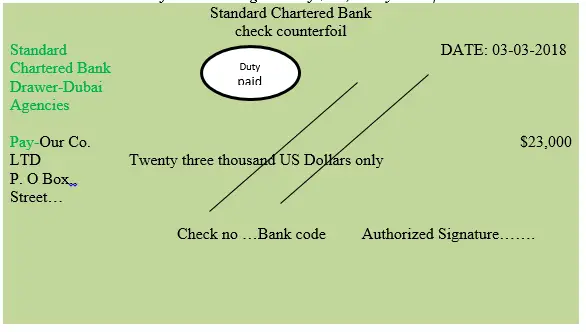

3rd received commission from Dubai Agencies of $ 23,000 by check

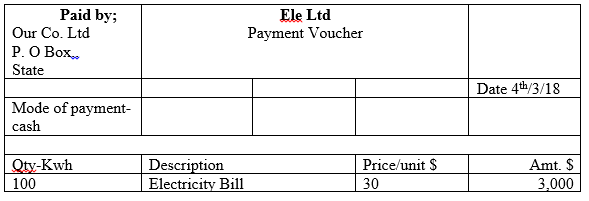

4th paid the following expenses in cash; Electricity $3,000

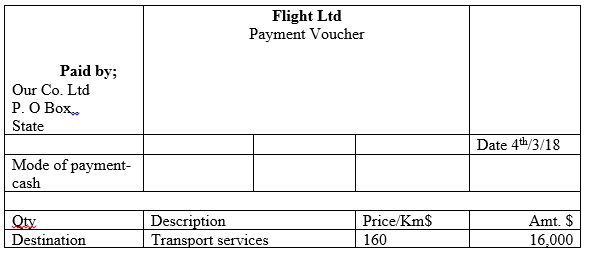

4th paid the following expenses in cash; Transport $ 16,000

4th paid the following expenses in cash; Insurance $ 30,000

5th Borrowed loan from standard Chartered Bank $ 350,000

6th sold goods on credit to WI ltd of $50,000; 20 days credit period; discount terms; 10/5%; 15/1% ; 20/0%

7th bought goods from M ltd on credit for $200,000; 60 days credit period; discount terms;20/15%; 40/7.5%; 50/1%

9th paid advertisement expenses to World Light ltd $ 60,000 by check

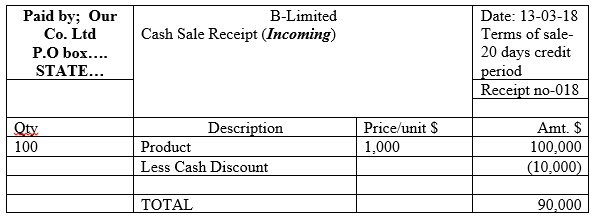

10th sold goods to FI ltd on credit, $105,000;30 days credit period; discount terms; 15/5%;20/1%

10th bought goods from W ltd on credit, $150,000; 90 days credit period; discount terms; 20/15%; 40/10%; 60/5%

11th sold goods to Wireless Ltd on credit, $200,000; 60 days credit period; discount terms;45/15%

12th returned goods of $10,000 to W ltd due to failure of quality specifications

12th sold goods on cash, $180,000 to X ltd

13th received cash, $45,000 from WI ltd (ie received cash in 7 days)

14th FI ltd returned goods of $5,000 for they were damaged

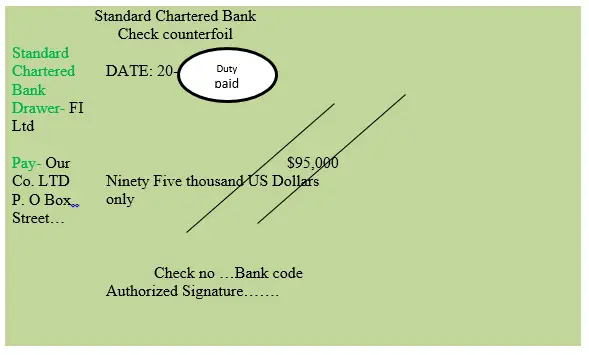

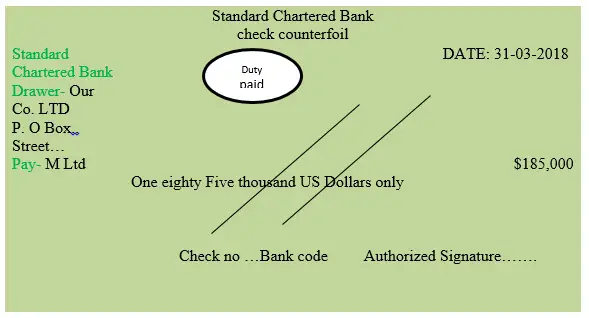

17th paid B ltd by check (ie paid in 15 days) and cleared the debt

20th received a check from FI ltd clearing the debt due (ie received a check in 10 days)

23rd sold goods on cash, $120,000 to Y ltd

25th bought goods from B ltd of $60,000 and paid by check

27th Received cash from Wireless ltd (ie received cash in 16 days)

28th sold goods to Z ltd of $167,000, received payment by check

30th paid W ltd the amount due on cash. The respective discount allowance applied (ie paid in 20 days)

30th bought goods from C ltd of $13,500 in cash

31st paid M ltd by check, clearing the debt thereof (ie paid in 24 days)

Step Two: Transfer of information from source documents to the respective books of original entry

There are four books of original entry that have been affected by the aforementioned transactions. This are; three column cash book, purchases day book, sales day book, returns inwards day book and returns outward day book. The learner need to note three key issues, that; one, it is in the three column cash book where all cash transactions are recorded even if the original transaction was of deferred mode such as credit sale or credit purchase. Two, it should be noted that it is in the three column cash book where the cash discounts (discount allowed and discount received) are recorded on the DR and CR sides respectively and three, the recording of discount allowed (ie an operating expense) and discount received (ie an operating income) on the DR and CR sides respectively is not a double entry principle. Therefore, the transfer of information from the respective source documents to the affected books of original entry is as follows;