Two Column Cashbook

A two column cash book is a book of original entry and also a ledger account where cash transactions are recorded. As the name suggests, a two column cash book is a combined format of single column cash book whereby the cash column and bank column are combined. If an organization opts to use a two column cash book, it will just be a matter of recording all transactions affecting the single column cash book in one ledger account. In the following illustration, it is simply a direct transfer of the information in the one/single column cash book in the previous illustration six to a two column cash book as shown herein;

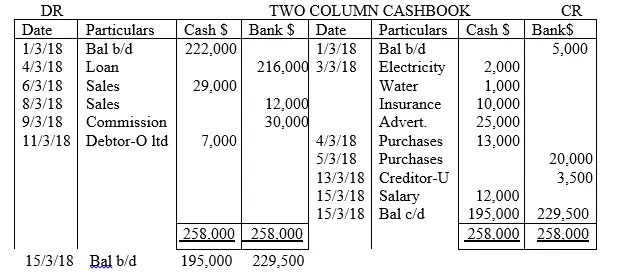

Example of two column cashbook-1

Assume the facts of afore discussed illustration one that; on 2018 March 1st Balance b/d; cash in hand $222,000 and cash at bank $(5,000)-If the monetary value is in brackets, it means it was a case of bank overdraft as discussed in level one tutorials.

3rd Paid the following expenses on cash; electricity $2,000, water bills $1,000, insurance $10,000 and advertisement $25,000

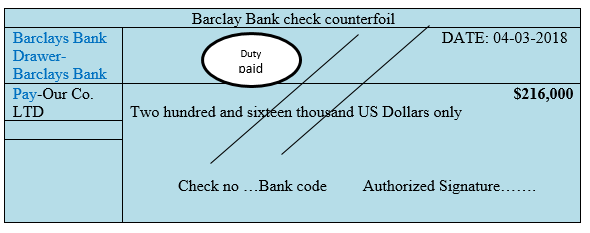

4th Borrowed a loan from Barclays Bank ltd $216,000 in check

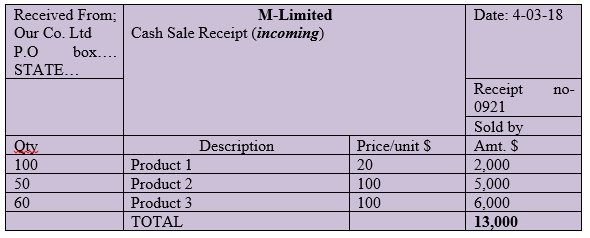

4th Bought goods for $13,000 in cash from M Ltd merchandise

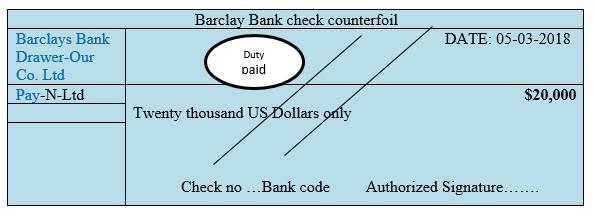

5th Bought goods of $20,000 by check from N Ltd

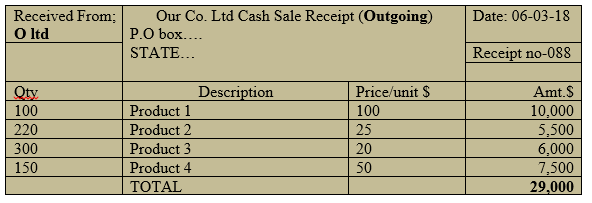

6th Sold goods for $29,000, cash to O ltd

8th Sold goods for $12,000, check to O Ltd

9th Received commission from KK co. holdings of $30,000 in check

11th Received cash from trade debtor, O Ltd, $7,000

13th Paid trade creditor, U Ltd, $3,500 by cash

15th Paid salary $12,000 by cash to one employee

Required;

Record the transactions in the respective source document and transfer them to the corresponding book of cash and bank accounts as the books of the original entry as on 15th/03/2018

Solution

Step one; Recording of information in the respective source documents;

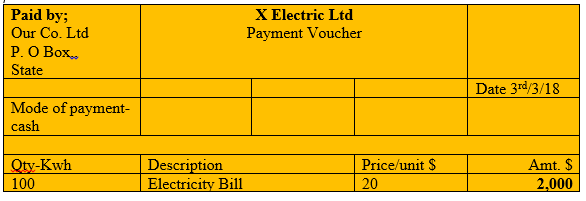

3rd Paid the following expenses on cash; electricity $2,000

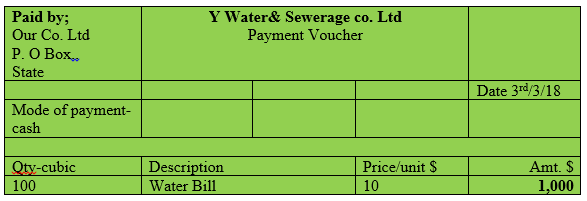

3rd Paid the following expenses on cash; water bills $1,000

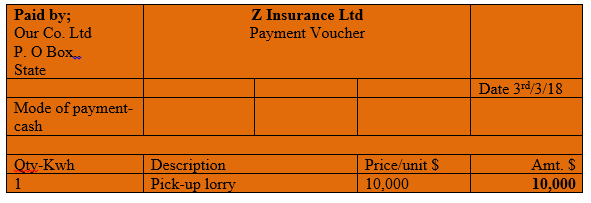

3rd Paid the following expenses on cash; insurance $10,000

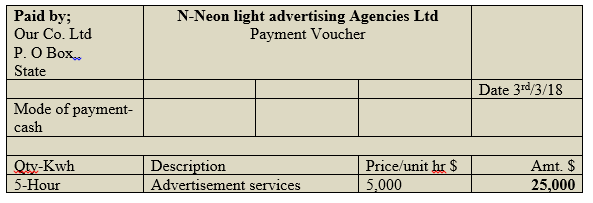

3rd Paid the following expenses on cash; advertisement $25,000

4th Borrowed a loan from Barclays Bank ltd $216,000 in check

4th Bought goods for $13,000 in cash from M Ltd

5th Bought goods of $20,000 by check from N Ltd

6th Sold goods for $29,000, cash to O ltd

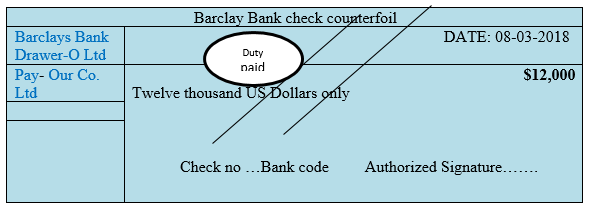

8th Sold goods for $12,000, check to O Ltd

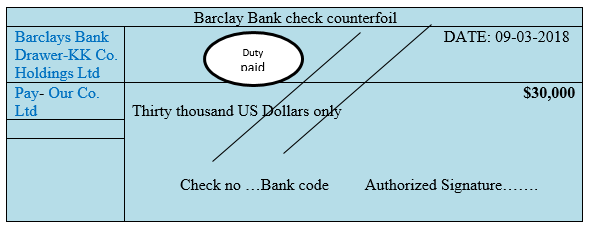

9th Received commission from KK co. holdings of $30,000 in check

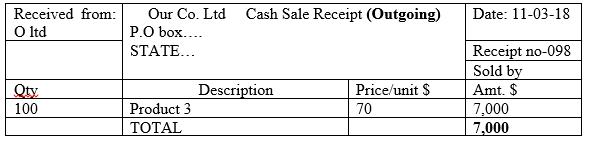

11th Received cash from trade debtor, O Ltd, $7,000

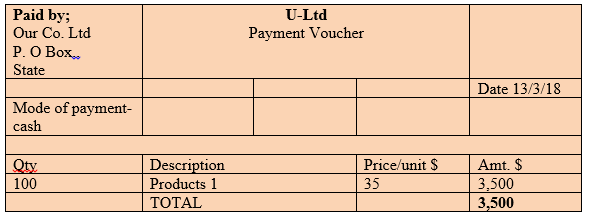

13th Paid trade creditor, U Ltd, $3,500 by cash

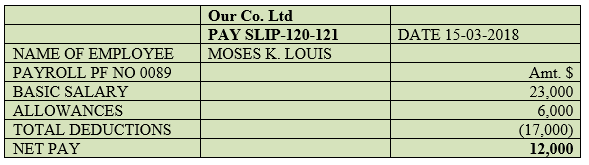

15th Paid salary $12,000 by cash to one employee

Step two: Transfer to books of original entry;

Contra Entries Transactions

Contra entry transaction refers to a transaction whose dual (double entry principle of DR and CR) affect the same parent account. Some cash transactions may apparently be similar to drawings or additional capital transactions. Contra entry transactions does not does not translate into any cash inflow or outflow as it apparently appears. It is a transaction which is recorded to offset or reverse an entry on the debit side or the credit side of the ledger account or the vice versa. The entries of a single transaction is recorded in the same account although in different columns. One entry is termed as the contra entry of the other entry. The word contra refers to opposite or against . NB:As discussed in level one tutorials on transactions related to withdrawals or deposits drawing transactions, contra entry is neither a cash outflow or cash inflow transactions. There are two types of contra entries, namely;

-

Withdrawal of cash for office use

This involves withdrawing cash from the bank of the business for the purposes of furthering the business. This is different from the case where cash is withdrawn for personal use. The accounts affected by withdrawals for office use are cash account and bank account where by you

DR Cash Account

CR Bank Account

-

Deposit of cash into the business bank account

This involves depositing cash of the business from the cash box into the business’ bank account. This is different from a case where personal cash resource is deposited into the business bank account by the owner. The accounts affected by depositing cash from the cash box to the business’ bank account are cash account and bank account where by you

DR Bank Account

CR Cash Account

NB: Against each corresponding contra entry in the cash book, the abbreviation “C1” is indicated to imply the first contra entry has occurred. Then for the other contra entries follow up to Cn implying the nth contra entry.

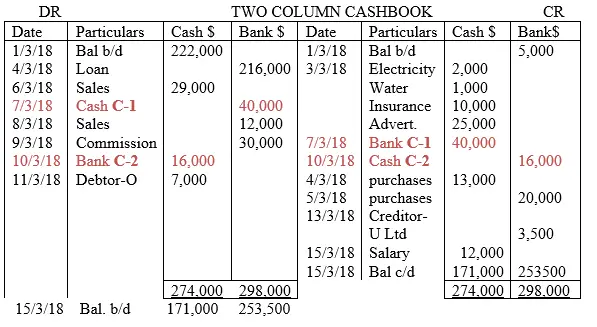

Example of two column cashbook-2

Assume the case of aforementioned illustration involving two column cash book discussion and that the contra entries that took place were as follows (italic);

2018 March 1st Balance b/d; cash in hand $222,000 and cash at bank $(5,000)-If the monetary value is in brackets, it means it was a case of bank overdraft as discussed in level one tutorials.

3rd Paid the following expenses on cash; electricity $2,000, water bills $1,000, insurance $10,000 and advertisement $25,000

4th Borrowed a loan from Barclays Bank ltd $216,000 in check

4th Bought goods for $13,000 in cash from M Ltd

5th Bought goods of $20,000 by check from N Ltd

6th Sold goods for $29,000, cash to O ltd

7th cash of $40,000 from the cash box was deposited in to the bank

8th Sold goods for $12,000, check to O Ltd

9th Received commission from KK co. holdings of $30,000 in check

10th cash amounting to $16,000 was withdrawn for office use

11th Received cash from trade debtor, O Ltd, $7,000

13th Paid trade creditor, U Ltd, $3,500 by cash

15th Paid salary $12,000 by cash to one employee

Required;

Record the above transactions in the two column cash book (direct approach).

Solution

More examples