What is debtors turnover ratio/debtors velocity ratio?

Debtors arise due to sale of goods or products on credit. Debtors are classified as current assets. Sometimes referred to as trade receivables. The rate at which this current assets are converted in to cash and to debtors again dictate the level of sales of the company.

This quotient estimates the speed (debtor velocity) at which cash is generated by turnover of receivable or debtors. Therefore, this ratio gauges the efficiency with which collection of debts for the goods sold on credit takes place in a business.

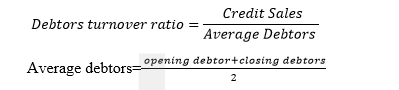

The methodology is expressed as follows;

NB: Cash sales are not incorporated in this computation

Interpretation

For every unit change in debtor value, the credit sales change directly by a certain units which can either be between zero and one or more.

BN: The higher the ratio the better are the debtor activities and the vice versa is true

Example

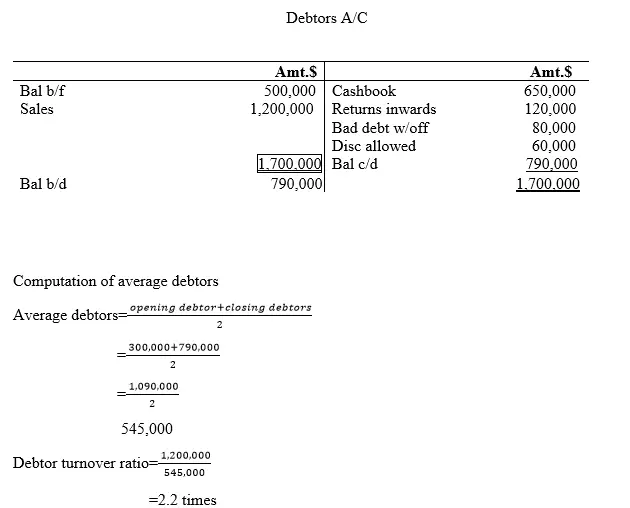

From the following information, establish, debtor’s turnover ratio.

Sundry debtors (opening balance) 500,000

Cash sales 300,000

Credit sales 700,000

Cash collected 650,000

Sales returns 120,000

Bad debts 80,000

Discount allowed 60,000

No. of days in a year – 365

Solution

Preparation of debtors ledger account

Interpretation

Number of times debts are collected in a given period are 2.2 times

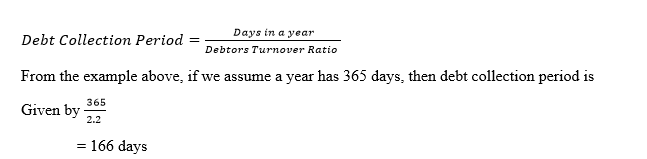

Debt Collection Period

With debtors turnover ratio which measures debtor velocity, it is possible to determine the extent to which debts have been collected in time. This can be established by dividing the days in a year by the debtors’ turnover ratio results as follows;

Conclusion; in this case, the debt collection speed is too slow and chances of losing money through bad debts written off is high.

Applicability of debtors’ turnover Ratio in Decision Making by Management

Debtors turnover ratio is more important in managerial decision making when debt collection period is introduced.

Denominator factor; The management as per debtor turnover ratio need to set credit policies to govern monitoring of excessive past due payments, repetitive and large bad-debt write-offs, identification of credit controls and reputation of credit checking and credit information to awarding of credit. The management need to rely on debtors turnover ratio to set procedures that should be adhered by the corporate once credit is extended include. This should include the timing of the initial notice, the timing of different types of reminders and the timing of the engagement of a professional collection agency in case need be.

Numerator factor; The numerator is composed of net sales for debtors turnover ratio and number of days in a year which are all of uncontrollable perspective for the management may not be in a position of controlling them.