Dividend Payout Ratio

Definition

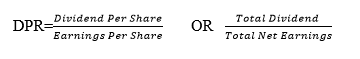

Dividend Payout Ratio is the rate at which dividends are paid to owners of the company compared to earnings gotten per share.

Or

Dividend payout ratio is the quotient of the total amount of dividends paid out to stockholders as compared to the net profits of the company. It is the proportion of earnings paid to shareholders via dividends.

Computation of Dividend Payout Ratio (DPR)

How do we determine the DPR?

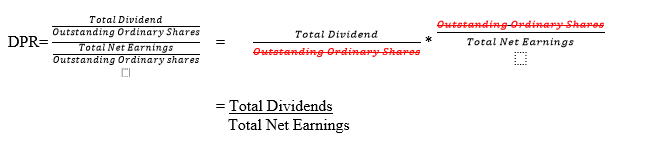

First the formula is expressed as;

Remember that total Net Earnings is the Net profit after taxation and preference dividends. In other words, the profits attributable to the ordinary shareholders/owners of the company.

Steps of determining DPR

There are 5 steps to follow when computing DP ratio

Step 1: Establish the total cash dividends paid to ordinary shareholders. That is amount of net profit that was distributed to the owners of the firm. This can be all the amount of net profit after tax or a less than 100% distribution.

That is Net profit after taxation-preference dividend-retained profits

Step 2: Determine the outstanding weighted number of ordinary shares

Step 3: Determine the dividend per share value

Step 4: Determine the total earnings after tax and preference dividends and divide the amount with the outstanding weighted number of ordinary shares established in step 2 above.

Step 5: Determine DPR by dividing the outcome of step 3 and step 4

Example 1

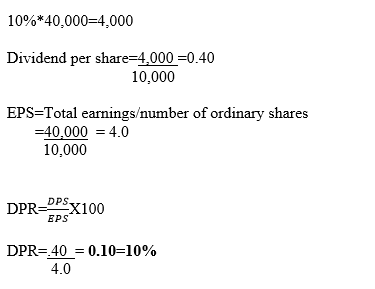

31st/12/2020, A Ltd realized a net profit of $40,000 within one financial period. The management declared 10% of the net profit to be distributed to the ordinary shareholders. If the total ordinary shares at this time was 10,000.

Required

Determine the DPR

SOLUTION

Dividend declared

Therefore, a 10% dividend payout ratio implies that A Ltd will pay 10% of its net profit to shareholders. The remaining 90% of net profit is ploughed back as retained earnings for further development. So we can conclude that the retention ratio is 90%.

Importance of Dividend Payout Ratio

1. Frequency of dividend payment (DPR) indicates the level of growth a firm is experiencing. Either at maturity level or startups or introduction stage. For growing firms, the DPR is very low for most of the profits are ploughed back to build the capital base. For mature firms, they pay more dividends so the DPR is high.

2. Mega investment-Reinvestment Opportunities may arise forcing the firm to invest more in a profitable project hence the DPR is low.

3. Nature of dividend policy used – sometimes, the type of dividend policy that guide the management on how to distribute dividends matters. Such that sometimes even when the firm has made low profits or losses, still the rate remain the same.

4. Signals of future share price variations. Either to appreciate or decline

5. Signals of future increased profitability. When the management increases or starts to pay more dividends, it is a sign of future prospects of the company.

6. Applicability of signaling theory-the distribution of dividend is an indication of how firms adhere to signaling theory which advocates that if you see a firm distribute more dividends, future prospects are sure

7. Retention ratio implications-For companies that do not offer dividends at all, the retention ratio is 100% and for companies that pay all of their net income as dividends, it will be 0% retention ratio.

Advantages of Dividend Payout Ratio

1. Used in payment of dividends-the ratio is usually predetermined for dividend payments. So it is a yardstick

2. Minimize conflict of interest-the DPR guides on how to distribute profits in a uniform manner to avoid conflicts between the management and the shareholders

3. Help investors in decision making-when investing, the investors are able to know which firms have stable DPR hence a stable dividend policy which can be relied upon

4. Easy to compute-it is not a complicated metric to determine or establish

Disadvantages of Dividend Payout Ratio

1. Does not apply in small firms-for small organizations such as small and medium enterprises may not be of any use so the owners of such business may not incorporate it.

2. Dividend payout ratio may not give the right picture of the performance of the firm for some times companies borrow to pay dividends so as to maintain a certain ratio stated earlier to the investors.

3. Low dividend payout ratio may not imply poor financial performance for may be the bigger portion of the net profit has been ploughed back for re-investment purposes.