Market To Book Value Ratio

Market to Book Value Ratio is the quotient that portrays the market value of a firm as compared to its book value as per the financial statement at a particular period of time. It is a ratio that was used to compare the monetary value of a firm as determined by the market forces and as per the books of accounts.

Computation of Market to Book Value Ratio

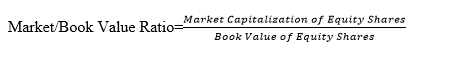

It is expressed as follows;

Further Substantiation

One: What do we mean by market capitalization of equity shares?

Market capitalization of equity shares means valuing of all outstanding ordinary shares of a firm at a particular time using the prevailing market price of those shares.

For example

If at the end of the financial period, the market price per ordinary share of the company was $30 and the total number of outstanding or weighted ordinary shares were 100,000. Then the market value of all those shares is $3,000,000 (i.e. 100,000*30). This the market capitalization of the ordinary shares of the firm.

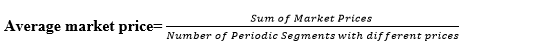

NB: If the market price over the period under consideration was NOT stable, then an average market price is computed as follows

You see, in other words, we want to know how much the market forces of demand and supply value the shares of that company. So, if one ordinary share of that company is exchanging at $30, then it means if we are to sell the company, we will consider the total number of ordinary shares issued and fully paid and sell them to the buyers at the prevailing price. Hence we will get 3 USD million.

But we know that the book value of the same shares may be or may be lower or higher than the market value

Two: What do we mean by Book Value of equity shares?

As the name suggests, book value means the monetary value of the ordinary shares of the company.

Somebody will wonder how we arrive at this book value. But remember this, from accounting equation,

A=C+L. Assume no external borrowing. Then the equation changes to A=C

Where

A=Assets

C=Capital or Equity.

Let us assume equity here is represented by pure ordinary shares. Then it means that the monetary value of assets will always be equal to monetary value of equity. And since assets (especially the non-current assets) keep on depreciating while land and buildings keep on appreciating, then it means the original value will keep on decreasing or increasing which make the market value and book value be different

Therefore, the ratio of market and book value will differ.

Example

Suppose CPP ltd statement of financial position was as follows for the year ended 2018

CPP ltd

Statement of financial Position

CPP ltd is a public limited company listed at New York security exchange market and the average market price it has been trading at was $33

Required

Determine the Market/Book Value Ratio of the company and interpret the outcome

SOLUTION

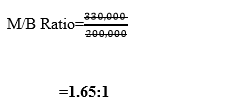

Market capitalization=10,000*33=$330,000

Book value is given as per balance sheet (i.e. statement of financial position)=200,000

Therefore,

Interpretation-for every one USD book value of equity, there is a corresponding 1.65 USD Market value of equity.

Importance of Market to Book Value Ratio

1. Helpful when disposing a business-this ratio act as guide to estimate the market price of the business in case the owners want to sell/dispose it

2. Guide investors to make the right choice-investors can know whether the firm to invest in is either over or under valued in case of buying of shares of that company

3. Yardstick to measure the management efficiency-the higher the ratio the more efficient the management is in its decision making for it shows that the market is in high confidence in its existence

Advantages of Market to Book Value Ratio

1. To investors, they can make use of this ratio to speculate the market-that is the investors will be guided by the ratio to know when to buy the company shares and when to sell. Is avoids capital losses

2. Valuation method for a business-if the owners of the company want to sell the firm on piecemeal basis, they can make use of this ratio to avoid undervaluing the business

3. Indicator of the financial performance of the business-the higher the ratio, the better the performance of the business in the market

4. Competitiveness of a business-M/B value ratio is an indicator to measure whether a firm is competitive in the market or not-the higher the ratio the more competitive it is and the vice versa is true

Disadvantages of Market to Book Value Ratio

1. Inflation factor-this ratio does not factor in the issue of inflation. Such that high market/book value ratio due to unnecessary increase in price levels may not imply increased financial performance

2. Controversial formula-some authors prefer average market price while others prefer one period market price. As a result, the M/B value ratio of different firms in the same industry differ hence not possible to compare performances.

3. Book value for firms in the same industry is dissimilar-book value is determined differently because of the different depreciation methods use. This hinders comparison of performance of different firms in the same industry.