Return on Investment (ROI)

Definition; It is a gauge of measuring financial performance of an investment, be it an organization or an investment project such as acquisition of securities or real estate as compared to the total investment a firm has undertaken. In this scenario, we are concerned with the monetary cost of investment done to be able to generate income.

The formula can be twofold;

Scenario one: If one establishes a business, the returns are from the business operations and the formula will be as follows;

Before looking an example, let me clarify a few issues investors and students of finance and accountancy have in common

Clarification

One; we use EBIT profitability perspective and not Profit after Taxation (PAT) when computing ROI. Why, this is because;

-Interest on loans and other types of debts are part of income generated and since our concern is efficiency which involves comparing output (earnings) and cost of investment (input), this element is not excluded.

Taxation Another point is that tax is not excluded for it is an external charge by the government in question and it cannot be affiliated to efficiency. In addition, it will be unfair to subtract taxation amount from the organization’s earnings/profits for taxation regimes vary from one country to another. Hence one cannot benchmark efficiency of returns generation of one company with other companies in the same classification.

In short, that is why we talk of EBIT that is earnings before we subtract interest and tax

To be on the safe side, average investment is incorporated to smoothen cases of unnecessary fluctuations of the market price of those projects.

Example 1

Zealot ltd had the following financial details in his statement of financial position

Earnings before Interest and Tax (EBIT) for the year ended 31st/Dec/2020 $75,000

Required

i). Determine Return on investment

ii) Interpret the results

Solution

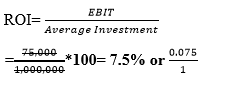

i)Determine Return on investment

ii)Interpretation; for every one unit of USD invested in fruit processing machine, it results to 0.075 USD generated. It should further be noted that the higher the ROI the more efficient the investment is. Therefore, the management or the owner of the business need to be careful when deciding the investment assets to acquire.

OR

A 100% investment in processing machine results to 7,5% increase in the returns.

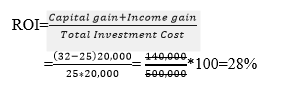

Scenario two: If one acquires an investment such as purchase of securities, the returns are from the capital gain and income gain over time and the formula will be as follows;

Example 2

1st/01/2020, Peterson purchased 20,000 ordinary shares of Total ltd at $25 per share. After one month, the market price increased to $32 per share. He disposed the shares at the securities exchange.

Required

Determine the returns on investment (ROI) in that venture

Solution

Interpretation; for every $1 currency invested in securities, $0.28 units of currency are generated.

Applicability of ROI in Decision Making by Management

The ratio is made up of the numerator and the denominator. That is;

Denominator Factor

The management has to focus in cheap investment opportunity where by it has to choose out of spectra of opportunities the less costly and at the same time have its eyes on the ball of ensuring that the efficiency of income generation is not compromised.

It should be noted that the denominator factor is a controllable factor and the management has a say over it. This implies that the management should ensure that they do their best is selection of the best investment opportunity.

Numerator Factor

On the other hand, the numerator factor limits the management in decision-making for it either fully or partially entails macro-economic factors which management has no control over. This is because net profits are dictated by the market price of the goods in supply. Such that if there is bad weather or the demand is too low, this adversely affect the returns.