What is solvency ratio?

Unlike liquidity ratio, solvency proportion is a main gauge utilized to estimate a business's capabilities to meet its long-term debt obligations as and when they fall due. The concern here is if the business cash flow is sufficient to meet its long-term obligations. The overall health of the business can be approximated using solvency ratio. Those ratios vary and some of those ratios include;

- Debt-to-Equity (D/E) Ratio

- Debt-to-Assets Ratio

- Interest Coverage Ratio

- Debt-to-Capital Ratio

1.Debt-to-Equity (D/E) Ratio

Debt to Equity quotient which is expressed as D/E ratio=Total Debt/Equity is a manifestation to guide the stakeholders of a business such as the management, stockholders and debtholders on the proportions in which the business is financed. It is also referred to as Debt-to-Capital Ratio

So debt-equity most of the times abbreviated as D/E, launches a firm’s overall debts in relation to to its equity.

The ratio portrays the extent/Degree of Financial Leverage (DFL).

Leverage, is from the word lever borrowed from the discipline of Physics which is a science subject and it means a bar used to lift weighty matters. That is a bar is a rigid bar resting on a pivot, used to move a heavy or firmly fixed load with one end when pressure is applied to the other

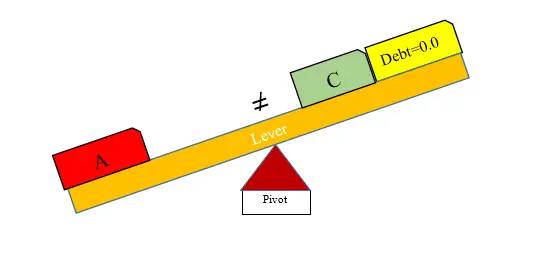

Illustration one

Business before leverage (Debt)

Interpretation one

In illustration one, it shows that capital (ie Equity) is not good enough to finance assets of the business. At this point, the financing of the business is purely from the owners of the business. As a result, there exists disequilibrium between assets and capital and liabilities. This obviously violates the balance sheet equation principle whereby the asset side should always be equal to capital and liability side.

NB: This business is said to be unlevered

business or un-geared business

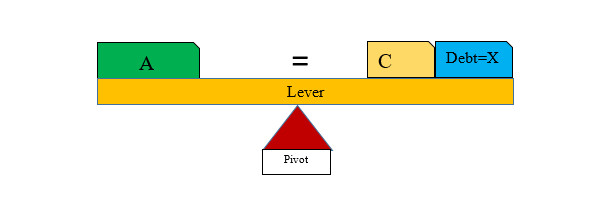

Illustration two

Business after leverage (Debt)

Interpretation two

If the management borrow the right amount of debt (ie balanced leverage), the assets of the business will be efficiently financed and the business will gain its financial health. In illustration two, it shows that capital (i.e Equity) plus total debt is good enough to finance assets of the business. At this point, the financing of the business is both from equity (internal) and debt (external) sources respectively. As a result, there exists an equilibrium state (between assets and capital and liabilities). This obviously complies to the balance sheet equation principle whereby the asset side should always be equal to capital and liability side for the business to thrive.

NB: This business is said to be well levered business or well geared business.

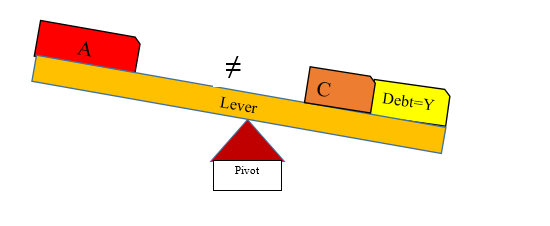

Illustration three

Business after over levarage (Big Debt)

Interpretation three

If the management over borrows debts (ie over-leverage), the assets of the business will be financed normally but then there will arise a scenario of free cash flows (see free cash flow theory) and the management will start rewarding themselves perquisites which will be against the interest of the owners and other stakeholders (see agency theory). This in a way will again affect the financial health of the business in an adverse manner. At this point, the financing of the business is both from equity (internal) and excess debt (external) sources respectively. As a result, there exists disequilibrium state (between assets and capital and liabilities). This obviously violates the balance sheet equation principle whereby the asset side should always be equal to capital and liability side for the business to succeed.

NB: This business is said to be over levered business or highly geared business.

Applicability of Debt/Equity Ratio in Decision Making by Management

Denominator factor; the denominator factor is total equity.

Total equity is a composite value for it entails several aspects such as owner’s contribution in form of

-Ordinary share capital; Owners contribution to start a business.

-Net Profit; the profits generated by the business is based on the capital contributed by the owner(s). Therefore, any profits made is part of owners’ equity or owners wealth’

-Retained profits; is the whole or part of net profit of the year that is ploughed back to the business by the management. The decision on the proportion of net profit to be ploughed back (retained) and to be distributed to the owners of the business (dividend) is at the discretion of the management.

-General reserve; is net profit that is set aside for general purposes. This is an extension of net profit of the year that is retained for general purposes.

-Capital Redemption Reserve Fund (CRRF); is net profit that is set aside for redeeming or purchasing back shares already issued to the public especially preference shares

-Share premium; is gain gotten when capital is raised through issue of ordinary shares at a price more than the nominal price (at a premium). If the nominal price is $10 and shares are issued at $12, then the $2 (ie 12-10) is share premium and it is also owners’ equity. It is a gain associated with the capital contribution by the promoters of the organization.

In conclusion, all the aspects of capital highlighted in lesson one to six in this part is generally called owners’ equity or claim and the sum of all those aspects of equity explain the total assets of the business.

Therefore, the management need to consider decision points such as;

How profits to be retained each financial period

How much dividends to be distributed

Whether to redeem preference shares or not and so on and so on. All those managerial decisions will affect the Debt/Equity ratio hence the gearing ratio.

Numerator factor;

The numerator factor is also controllable for the management are at their discretion to determine whether to use external financing or not. If the management goes for more external debts, this leads to high gearing of the business which may be a little bit dangerous.

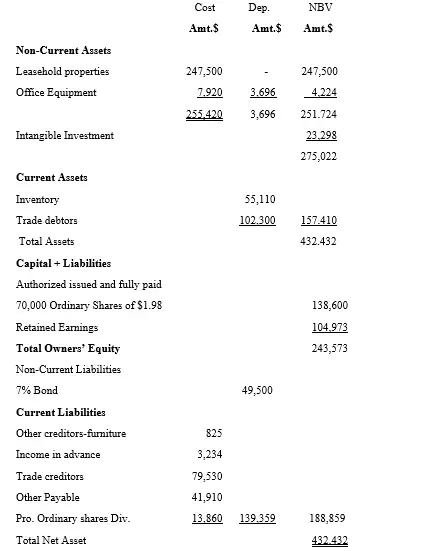

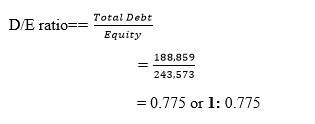

Example one

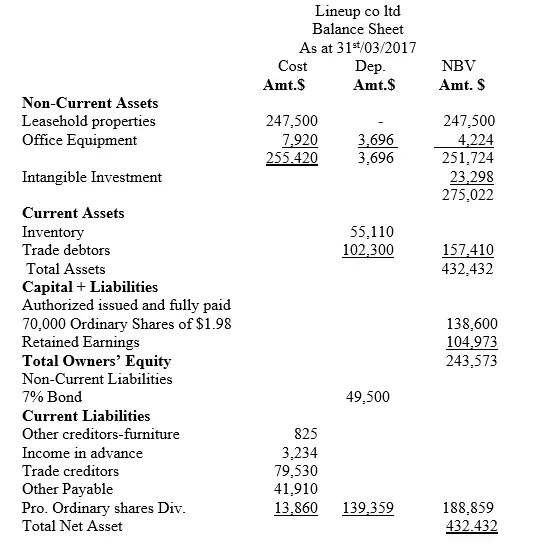

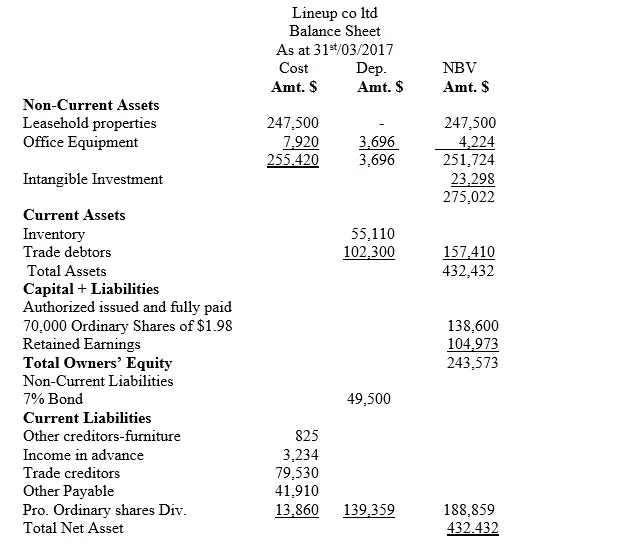

The following balance sheet was extracted from the books of accounts of Lineup co ltd for the period ended 31st/03/2017

Lineup co ltd

Balance Sheet

As at 31st/03/2017

Required

Determine

Debt-Equity ratio and interpret the results

Solution

Interpretation

For every one unit of $ of Equity used in financing the business, there is a corresponding $0.775 from external debt. In other words, the business is highly levered or geared for $0.775 of external debt.

2.Debt-to-Assets ratio

Debt to Assets percentage is another leverage quota expressed as D/TA ratio =Total Debt/Total Asets and is an indicator

to guide the stakeholders of a business on the total debt proportions which sponsor total assets. A higher ratio indicates a greater degree of leverage, and consequently, financial risk.

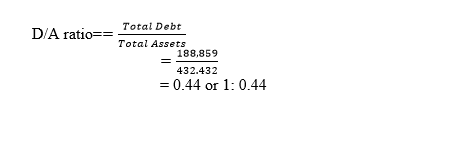

Example two

From the balance sheet of Lineup co ltd previously discussed for the period ended 31st/03/2017 compute debt/total asset ratio

Required

Determine

Debt-Total Asset ratio and interpret the results

Solution

Interpretation

For every one unit of $ used in financing total assets of the business, $0.44 is from external debt.

Applicability of Debt to asset ratio in Decision Making by Management

Denominator factor; the denominator factor is the total asset which entail both fixed and current asset of the business. The management need to consider whether investment in both fixed and current asset is efficient enough to ensure that the income generated (EBIT) can cover the debt principle and debt interest costs.

Numerator factor- the numerator factor is the summation of both current and non-current liabilities/debt. The management need to consider the level of external debt to ensure that the business in not over-levered or highly geared. This will help in instilling discipline amongst the management team for if the assets are debt financed, then good corporate governance which entails transparency and accountability is necessary.

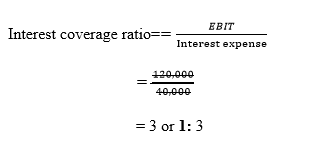

3.Interest Coverage Ratio

Theinterest coverage ratio expressed as EBIT/Interest Expenses aims at establishing the number of times the business profits can be used to meet debt interest obligation with ease to avoid insolvency, this is determined empirically by dividing the firm’s profits (before subtracting any interests and taxes) by its interest payments. The higher the value, the more solvent the company. In other words, it means the day-to-day operations are yielding enough profit to meet its interest payments.

Example

Bosnia co ltd realized profits of $120,000 before interest and tax in the year ended 3oth/Sept 2016

The total debt interest charges for the same period was $40,000

Required

Determine

Interest Coverage Ratio and interpret

Solution

Interpretation

The per annum profits before interest profits covers per annum interest expense three times.

Applicability of Interest Coverage Ratio in Decision Making by Management

Denominator factor; the interest expense is a tax allowable item and therefore it attracts tax shield benefits. The management has to balance between the coverage of this cost by the earnings generated by the business.

Numerator factor: the numerator is determined by the power of income generation by the business. This aspect is independent of the interest. Therefore, the management need to ensure that they identify business opportunities to generate more income otherwise if EBIT reduces, it will result to insolvency problems, which can lead to closure.

4.Debt-to-Capital Ratio

The debt-to-capital ratio is a quotient representing the total debt whether of long or short term to total capital employed. It is organization’s financial leverage.

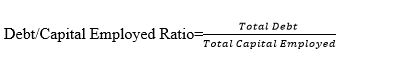

Formula

Where

Total Debt= long and short term debts (whether interest bearing or not)

Total capital employed= summation of all debts plus all manner of equity used to finance the business

Example

In the previous example of Lineup co ltd, determine the Debt/Capital Employed Ratio. Use the balance sheet as provided below;

Required

Determine

Debt-Total Capital Employed ratio and interpret the results

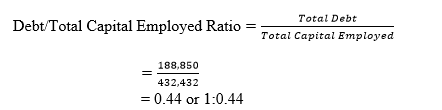

Solution

Interpretation

For every one $ of capital employed in the business, $0.44 is financing from total debts whether of interest or non-interest bearing nature.

Applicability of total debt to total capital employed ratio in decision making by management

Denominator factor; the denominator factor is the total capital employed and it is a summation of both external and internal financiers of the business. The management need to consider its structure to ensure that the total sources of financing is not dominated by external parties although there is need to consider taking the advantage of tax shield benefits associated with debt interest.

Numerator factor- the numerator factor is composed of all debts whether with fixed interest or not. The management need to consider the level of external debt to ensure that the business in not over-levered or highly geared.