Contextual research gaps: background definitions, steps of identifying contextual gaps, examples

What is contextual Research gap?

1.1 Definition

Contextual research/knowledge gap is the missing gap of knowledge on the definition and measurement method used to describe a particular variable from contextual point of view to make it more appropriate in a certain study or research. The contextual knowledge gap gives the researcher an opportunity to critically consider the appropriate method used to measure a variable or defining the variable as per the prevailing context. Therefore, a researcher should consider using a variable as defined or measured in a particular context for this approach is always more logical than otherwise. The context may vary from global, regional, local, industry or nature of the firm under investigation.

The following scenarios will help demonstrate how a study variable may be contextually defined and or measured to add logical weight to it.

1.2 Physical Location Context

As stated earlier, physical location may be of global, regional, local perspective. So in this set up, a variable may assume different definition or measurement method based on the location. For example, a variable such as firm size (fz)

1.2.1 Japan

In Japan, Small and Medium Enterprises (SMEs) is defined as businesses which employ 4-299 employees

As a researcher, if you are carrying an investigation on SMEs in Japan, then you need to consider the definition of SME in terms of number of employees. More specifically the right definition entails employees ranging between 4-299. This means that businesses with less than 4 or more than 299 is not an SME business in the Japan. This is the contextual definition which is logical in this global region

1.2.2 USA

In America, SMEs is defined as firms with less than 500 employees. Therefore, in USA, Unlike in Japan, businesses with less than 4 and or more than 299 up to a maximum of 500 still fall under SME classification. For a research pertaining to SMEs, data can be collected from those businesses which have employed 500 or less than that number for this is what is contextually logical in USA.

1.2.3 United Kingdom (UK)

In UK, SME business is defined from two dimensions, namely; number of employees and the annual sales. That is, on the basis of number of employees, a business with less than 50 employees and on sales level per annum an annual turnover under €10 million) and medium-sized (less than 250 employees and an annual turnover under €50 million) businesses.

1.2.4 South Africa

In South Africa, SME is defined as a business with either the following attributes, namely; Less than 200 employees, Annual turnover of less than R64 million, Capital assets of less than R10 million and Direct managerial involvement by owners. This implies that anything less than this indicators means a business of a different class. So the researcher need to put a threshold based on the locale of the users of a particular study variable.

NB: That in research, a variable is of significance as a predictor, dependent or otherwise if defined and/or measured as per the locational perspective. This is because such an approach is what makes logic to that particular location or as per users in that physical locale.

1.3 Nature of the Firms

The contextual aspect of industry or business nature help in identifying the appropriate definition and measurement of a study variable. A study variable will assume different definition and measurement based on how a particular NATURE of the firm practically utilizes that variable.

1.3.1 Firms Listed at the Securities Exchange Market

Firms listed at the securities exchange market are firms whose securities are traded in the secondary market and operate under set rules and regulations by the constitution and the watchdog body supervising them. One of its requirement is to publish their final books of accounts such that the financial report become a public document and anybody interested can access the details therein unlike the private limited companies. So definition and measurement of variables commonly describing these firms’ activities are peculiar in that context.

Illustration 1: Financial Performance

In a scenario where we are considering profitability of those firms, you will realize that this variable is measured in diverse ways which are universally accepted. For instance, profitability just mentioned is a variable to measure financial performance which may be gauged in diverse ways which normally make logic such as; Return on Equity (ROE), Return on Assets (ROA) and Return on Investment (ROI) to measure profitability. This is contextually logical because firms in this sub-sector commonly practice this approach in this setting. Secondly, you should note that it is easier to access data for there exists sufficient data in the public domain due to the constitutional requirement to have such firms publishing their accounts.

Now, contrary, for small businesses, they define financial performance using indicators such as market share, sales turnover rate and or market retention rate etc. You see, this is also equally what is the most logical way to assess the financial performance of SME business. These firms cannot use ROE, ROA and ROI as it is in the case of listed firms because they don’t keep proper books of accounts and even if they do, they don’t make it public for that is not a law requirement. So the researcher need to be careful to establish the nature of the firm he/she is dealing with so as to use the appropriate variable with its correct or fitting measurements.

Illustration 2: Distribution of Profits to Owners

When distributing the profits of the company, again the firms listed in the security market will consider dividends which are measured using Dividend Payout Ratio (DPR). Whereas, the owners of small businesses, have no universally accepted approach of distributing profits at the end of the financial period as it is in the case of large firms listed at the securities exchange market. Therefore, as a researcher, you cannot use dividend payout ratio to gauge the level of sharing firm profits amongst owners of SMEs for it does not apply.

1.4 Nature of the Industry

The nature or the type of industry where a certain firm operate under has a contextual definition and measurement of the commonly used variables which may differ from one industry to another. Let us consider a few cases below

1.4.1 Manufacturing Industry

In this sector, variables are defined and measured contextually in a different approach. For instance, the internal factors that influence the performance of firms under manufacturing will be different as compared to those of other industries

Illustration 1: Internal factors affecting performance of manufacturing firms in the manufacturing sector

Such factors can be such as;

|

Internal factor/variable

|

Measurement

|

|

Raw Materials Cost

|

Raw Material Purchase Price per Unit

|

|

Labor Cost

|

Labor Rate

|

|

Overheads Cost

|

Overhead Absorption Rate

|

|

Management Efficiency

|

Management Efficiency Index

|

So you see, all these factors are inputs for productivity to take place which in turn influence the level of performance and the corresponding measurement indicators are unique to those organizations.

Centrally, firms in other industry such as banking or financing sector have unique internal factors that affect firms in that industry. For example, the internal factors affecting bank performance can be such as;

|

Internal factor/variable

|

Measurement

|

|

Bank Deposits From Customers

|

Bank Deposit Interest Rates

|

|

External Borrowings

|

Cost of Borrowing (Debt Interest)

|

|

Agency And Advisory Services

|

Agency Fees

|

|

Investment In Securities

|

Cost Per Unit of Security

|

Therefore as a researcher you realize that even for predictor variables, for firms in each specific industry are unique and specific based on the industry the firm operates under and this in a contextual matter. So one need to be careful to ensure that he or she gets the contextual definition and method of measurement of the variable in a correct way. This will help in putting more weight or significance on the role the variable plays in a model.

Illustration 2: Profitability of the firms

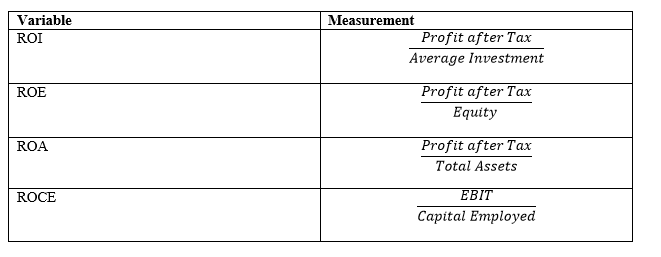

If we take an example of profitability of firms in the manufacturing industry, you realize that the common way of defining and measuring this variable are proxies such as ROI, ROE, ROA and ROCE whose approaches of measuring are summarized as follows;

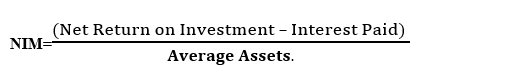

For banking firms, such as banks and microfinances, the same variable of profitability is measured using Net Interest Margin (NIIM). The formula used is as follows;

So you see, as a researcher, you need to be careful for although the variable may be commonly used in different industry, the contextual definition and measurement vary. Like in this case of profitability, the formulas are dissimilar and we need to appreciate that.

Advantages of contextual knowledge gaps

- Add the level of significance on a study variable-when the correct contextual measurement or definition is identified by the researcher for the study variable, this makes it have the right weight and the chances of portraying a significant role in a model is high.

- Logic-when the researcher ensures that he/she gets the right contextual definition or measurement, this adds logic and the corresponding empirical model is valid.

- Theoretical foundation-the right contextual definition or measurement of a variable by the researcher is a way of building a theory that can be of use in the future.

- Creation of new knowledge-identification of correct contextual knowledge gap helps in creating new knowledge to the already existing one which is one of the mainstream objectives of research endeavors.

- Make it possible to identify the right methods to use during the research processes-there are several types of methods used in research and contextual knowledge gaps help in identifying the right method.

Disadvantages of contextual knowledge gaps

- Controversy amongst researchers-the term contextual knowledge gap is confusing amongst researchers and scholars hence misused in research resulting to wrong data analysis and research findings

- Not universally considered-the aspects of knowledge gaps are not commonly applied across the board and this makes its usefulness not to benefit research users.

- Difficulty to differentiate between contextual knowledge gap and other types of gaps. This problem results to having more and more types of knowledge gaps which may be of no value addition to the study.