Earnings Per Share (EPS) and how to compute EPS ratio

Earnings Per Share is the income earned by the ordinary shareholder for every common stock (ordinary share) they own in the firm.

It is required at the end of the financial period when net profit of the firm is determined.

Earnings Per Share is logical for it is used to assess whether the returns expected by the investors is high or low as compared to their expectations or the foregone opportunity cost.

It is used by management to assess their efficiency in performance as far as generating income for the shareholders is concerned.

Steps of Computing EPS Ratio

STEP ONE

Determine the gross profit of the business using trading account

STEP TWO

Determine the net profit by using Profit& Loss account

STEP THREE

From step two, less tax liability from the net profit

STEP FOUR

From the net profit, less preference dividends paid to preference shareholders

STEP FIVE

Establish the outstanding number of common stock-this are the total number of ordinary shares which are issued and fully paid at the end of the financial period

STEP SIX

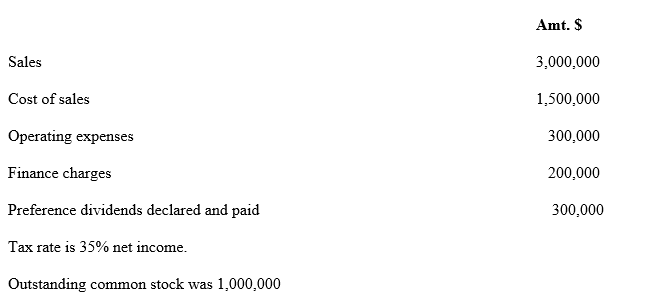

Example

CCC Company had the following end of the year accounting information

Required

Determine the EPS value

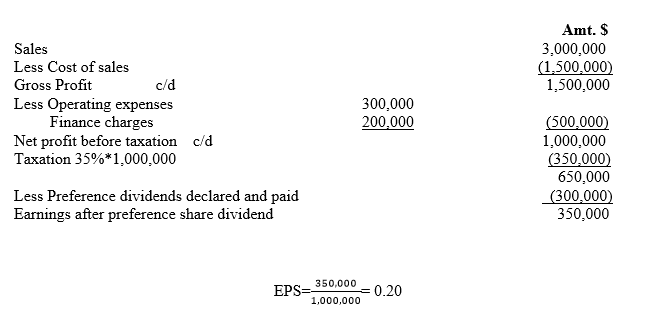

Solution

For more on EPS, please check here.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.