Balance Sheet And Profit And Loss Account

Balance sheet is one of the financial statement requirements as per International Accounting Standards. This statement is derived from the accounting equation which is expressed as A=C+L. However, by extension, the balance sheet is correlated with the trading and profit and loss account which is also another financial statement used in business.

The big question is: Is there any correlation between balance sheet and profit and loss account of a business? The answer is YES!

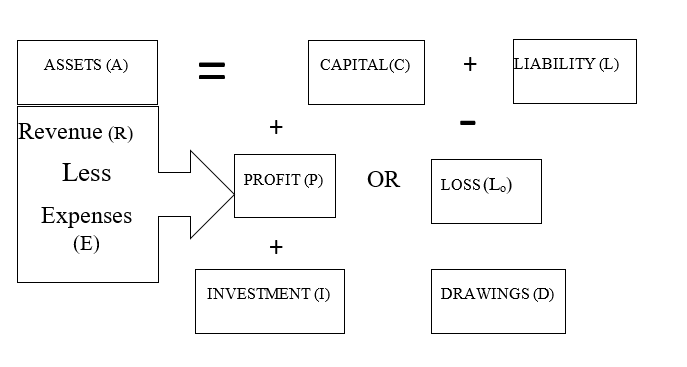

The following flow chart demonstration represents the link between the two financial statements

A=C+L

Figure 1

The revised accounting equation starts with the;

ORIGINAL EQUATION

A=C+L

Scenario 1

If the company made profits (P) revised accounting equation will be;

A=C+P+L; where A=Assets, C=Capital, P=Profits and L=Liability

This implies that with increase in profitability of the company, the capital base or owners’ equity will increase with a corresponding increase on the asset side, which either can be additional cash or increased physical assets.

Scenario 2

If the company made loss (LO) revised accounting equation will be;

A=C-L0+L; where A=Assets, C=Capital, L0=Loss and L=Liability

This implies that with occurrence of loss to the company, the capital base or owners’ equity will decrease with a corresponding decrease on the value of the asset, which either can be reduced cash amount or decreased physical assets.

Scenario 3

If the company made an additional capital (ie Investment) revised accounting equation will be;

A=C+I+L; where A=Assets, C=Capital, I=Investment and L=Liability

This implies that with additional capital of the company, the capital base or owners’ equity will increase with a corresponding increase on the asset side, which either can be additional cash or increased physical assets.

Scenario 4

If the company directors withdrew cash or non-cash resources from the business (D) revised accounting equation will be;

A=C-D+L; where A=Assets, C=Capital, D=Drawings and L=Liability

This implies that withdrawing business resources, whether of cash or non-cash form results to reduction of the capital base or owners’ equity with a corresponding decrease on the value of the asset, which either can be reduced cash amount or decreased physical assets.

Illustration

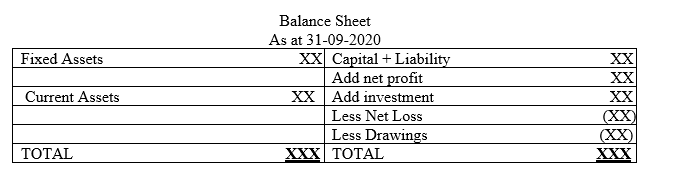

According to Figure 1, the intertwined balance sheet/and profit and loss account is as shown below;

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.