Balance sheet format

Balance sheet format is the design used to present assets, capital and liabilities of an organization. Balance sheet format can be classified in to different categories based on the criteria used. The criteria used is subjective in the sense that it may be designed to suit a particular purpose or it can be the orthodox way of presenting assets and liabilities of the business. Each format used has its advantages and disadvantages.

a) Classification of balance sheet under balance sheet item presentation criteria

Under this classification, Balance sheet can be presented in two ways;

- Vertical format(“T” format)

- Horizontal format

Vertical format(“T” format)

The vertical format is also commonly referred to as T format for the structure of the financial statement looks like capital letter “T”. That is, the format has two sides, namely the right hand side and the left hand side. When recording the balance sheet items, there is no law on which side to record assets and the liabilities. But mostly, all assets are recorded on the left hand side be it non-current assets (also known as fixed assets), intangible assets, and current assets. Capital and liabilities are recorded on the right hand side. It should then be noted that the reversal entry is also o key as long as no mixing of items.

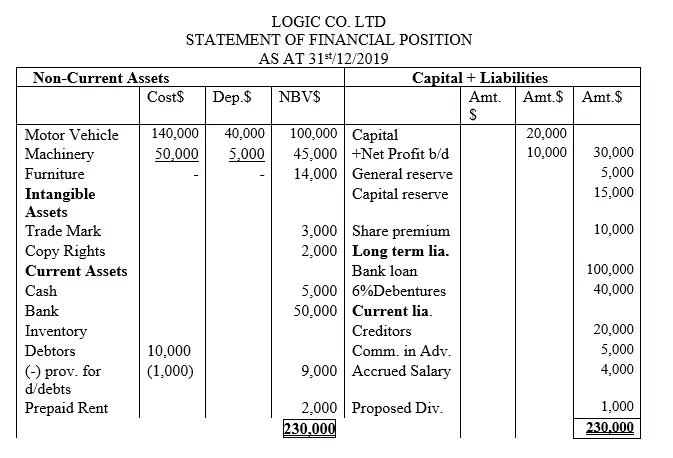

Example one

Logic co ltd presents its financial position at the end of every year as follows;

The above is a vertical format. Also referred to as T format

Advantages of Vertical format

- Simple to understand-this is because all the balance sheet items are straightaway indicated in the financial statement.

- Appropriate for small businesses-the T format is suitable especially when the business is small and not dominated by many transactions.

- Simple to prepare-one who has basic bookkeeping skills can prepare this type of balance sheet for it is self-guiding that if assets are to be recorded on the left hand side then the rest of the items will be recorded on the right hand side

Disadvantages of vertical format

- Fails to meet the International Financial Reporting Standards (IFRS)-Previously, the International Accounting Standards (IAS) were allowing use of T format. But of recent, the IFRS requires the firm to prepare balance sheet using the horizontal format. This disqualifies the T format

- Not accommodative-The way the format is, it does not flex to accommodate some point of detail that need to be presented in a proper manner. For example, according to IFRS balance sheet should be in a summarized manner with notes indicated for further explanation. This cannot work with T format.

Horizontal format

This is the opposite of vertical format for the recording of the balance sheet items is done horizontally without taking sides. In other words, prose format is adopted.

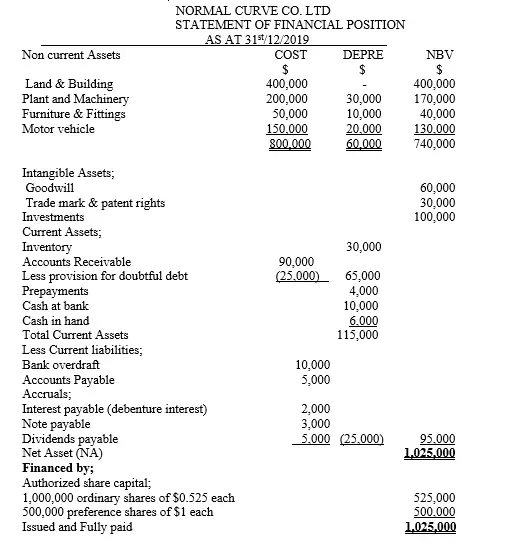

Example two

Normal curve co ltd presented to you the balance sheet below.

Advantages

- Looks more presentable than the T format

- Flexible to indicate details such as notes for further explanations

- More detailed for the presentation can aid one to show working capital component by arranging the current assets and the current liabilities in certain manner which is more understandable

Disadvantages

- Not appropriate for decision making by the management for it does not allow for comparison of figures

- Difficulty to prepare as compared to T format which guides one better for there are two sides to focus on when recording

- Chances of errors such as mixing of the item is high especially for unexperienced accountant or bookkeeper

b)Classification of balance sheet under management reporting requirement criteria

Balance sheet is a tool for decision making by the management. So its format is key in unearthing the issues to be focused on by the board. So the format can either be in two forms

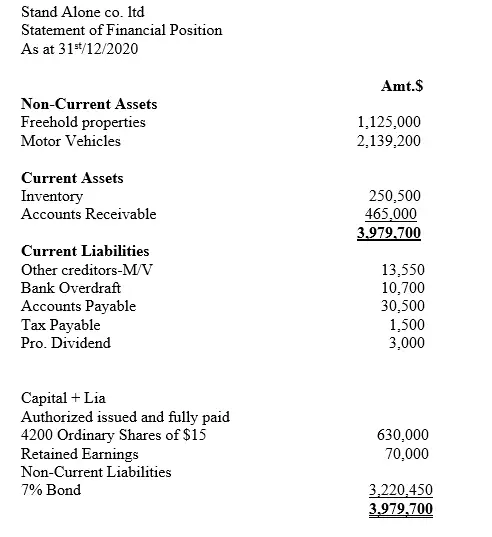

i). Standalone balance sheet format

ii). Comparative balance sheet

Standalone balance sheet format

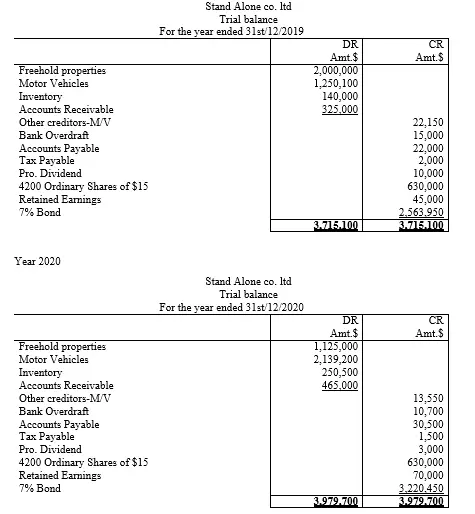

Stand Alone co ltd provided you with the following trial balance information for two financial periods of 2019 and 2020 as follows;

Example one

Stand Alone co ltd provided you with the following trial balance information for two financial periods of 2019 and 2020 as follows;

Year 2019

Required

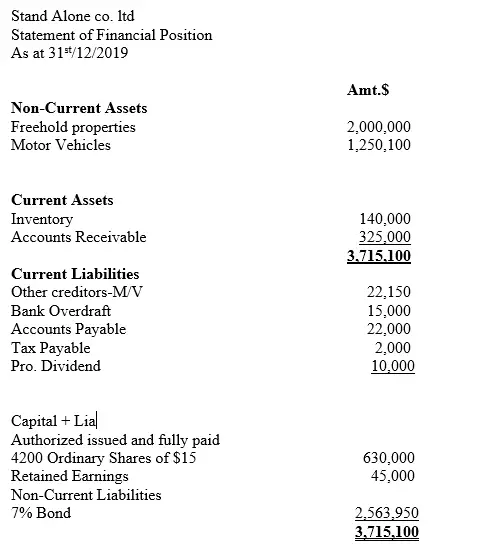

Demonstrate the financial position of 2019 and 2020 for each year separately (ie using standalone approach)

Solution

Year 2019

Year 2020

Advantages

- Simple to prepare-in other words, it is not complicated to lay it down

- Suitable for small organizations

- Not costly to prepare

- Not time consuming

- Does not require an accounting expert

Disadvantages

- Not appropriate for decision making by the management for it lacks comparability element

- Not suitable for firms with many transactions for it fails to capture all the details at once

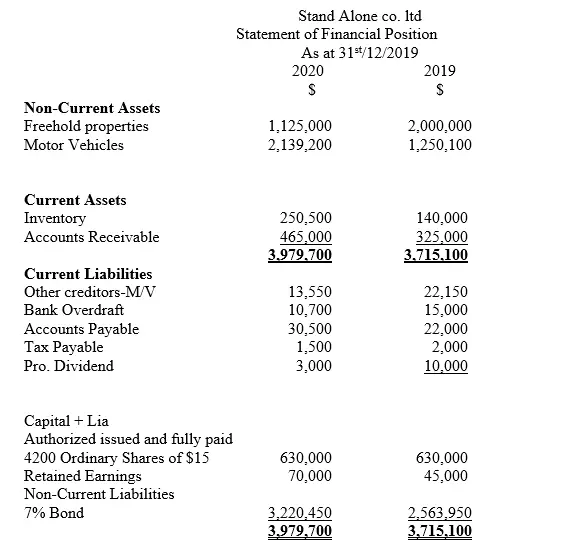

Comparative balance sheet

A comparative balance sheet as the name suggests is prepared in a manner to enable the management and even other stakeholders to unearth detailed information especially pertaining to financial performance of the business. As a result, the comparability constituent is incorporated by considering the balance sheet for two consecutive financial periods.

Example two

Refer to example one of Standalone co ltd aforementioned and now prepare a comparative balance sheet

Advantages

- Appropriate for decision making by the management. This is because it is possible to compare the financial performance of one year to a previous one.

- It suitable for analytical process such as ratio analysis which can provide in depth information of the business such as liquidity.

- It is more acceptable by IFRS of presenting financial statements

- It is suitable in forecasting-it is possible to use the data for the two years to predict future expectations

Disadvantages

- Complex in presentation for it carries a lot of details which may be confusing

- Time consuming especially when prepared manually

- Costly for a qualified accountant need to be engaged by the management

- Not suitable for small organizations for it is costly and technical to prepare

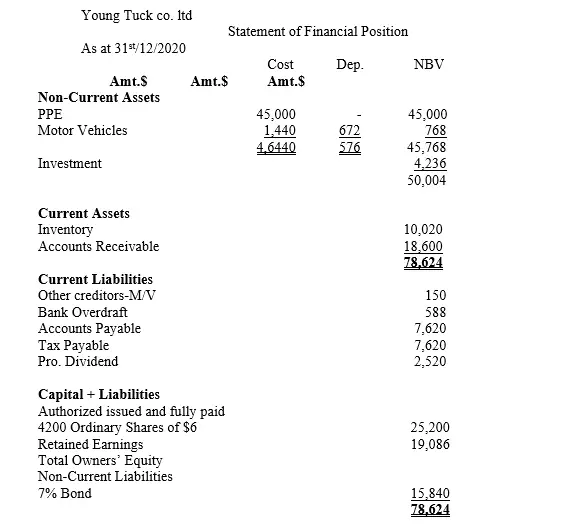

c)Classification of balance sheet under capital employed criteria

The balance sheet has two perspectives, the financing aspect represented by the capital and liabilities and the investment perspective which is depicted by the assets used by the business. Based on the way of financing the business, balance sheet format can either be classified as;

i). Gross capital balance sheet format

ii). Net Asset balance sheet format

As the name suggests, in the case of gross capital balance sheet format, the balance sheet is prepared in such a manner that both the total owners’ equity and total liability used in financing assets is combined (gross).

Example one

Young Tuck co ltd presented to you the following balance sheet. Based on the capital employed criteria, what nature of balance sheet is it?

Answer-gross capital balance sheet and the gross capital employed amounted to $78,624

Advantages

- It shows the total debts the business has in a more straight away manner

- It compares the total sources of finance used to finance all the assets

Disadvantages

- It is not commonly preferred by the owners of the business for it fails to demonstrated the owners wealth in a direct manner

- Difficulty to interpret especially if one is not acquitted with book keeping skills

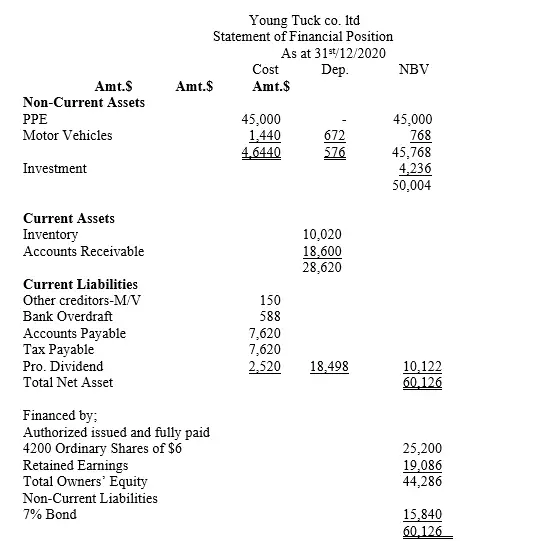

Net Asset balance sheet format

The net asset balance sheet is aimed at portraying the pure capital gotten from the owner’s contribution to finance assets. The assumption is suppose the business closes down, what can be the owner’s claim?

Example two

From the example one above of Young Tuck co. ltd, convert the gross capital balance sheet to net asset balance sheet

Solution

Advantages

- Appropriate when one wants to portray the actual owners’ claim in case the business closes down

- It is more preferred as per IFRS. In fact accounting, when we talk of capital employed we refer to net asset approach or format

- It distinguishes the two sources of financing hence possible to assess whether the firm is highly geared or otherwise

Disadvantages

- Time consuming when preparing

- Not easy to interpret

- Costly for it requires one to be well skilled in accountancy hence the management need to engage accounting guru to prepare such a statement.

For more on balance sheet please see our below articles:

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.