Balance Sheet Restructuring Under Covid-19 Environment

In the early days of 2020 around the month of March, the outbreak of the COVID-19 pandemic in most parts of the world had devastating impact on most organization’s balance sheet. This requires restructuring of their financing and investing perspectives respectively for continuity assurance.

How can this debt and investment restructuring be achieved?

The following scenarios represent diverse ways of re-organizing the balance sheet of the business during and after the current Covid-19 pandemic.

Option 1-Restructuring Investment

Due to Covid-19 pandemic, most to the productivity levels of non-current assets has gone down due to less demand and laying off of workers who used to run such machinery. If this be the case, the following steps can be adopted to correct the menace

Step one

Dispose all the underutilized non-current assets

Step two

Replace the old non-current assets with new Covid-19 affiliated activities. This makes your business more relevant to the market activities. For instance, one may dispose a machinery for fertilizer manufacturing and substitute with machinery for manufacture of sanitizers

Example one

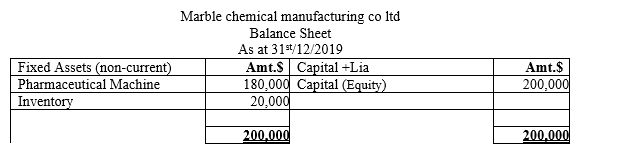

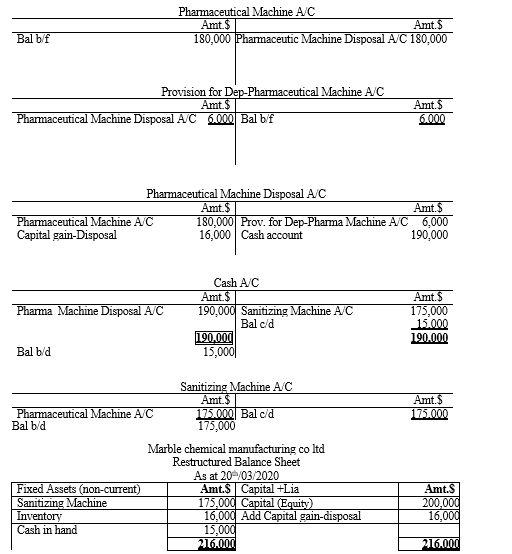

Marble chemical manufacturing co ltd has been a successful business for many years since its inception in 2010. Its balance sheet as per 31st/12/20219 was as shown below;

Additional information

In the month of March 2020 20th, Covid-19 pandemic struck the organization financially. Hence, the management was forced to restructure its investment from general pharmaceutical products to manufacturing of sanitizers. This resulted to the management of Marble chemical manufacturers displace the existing machinery with a new one which was slightly cheaper.

The following were the additional transactions, which took place to achieve this objective

(i) Disposed the old pharmaceutical machine at a price of $190,000 in cash

(ii) The cumulated depreciation up to the time of disposal was $6,000

(iii) Purchased a new sanitizing machine at $175,000 on cash basis

(iv) Closing inventory was valued at $16,000

Required

Prepare the restructured balance sheet to show the new financial position

Solution

Option 2-Restructure Financing

Covid-19 pandemic made many firm land into financial distress and unable to meet their debt obligations as and when they fall due. This calls for restructuring of the sources of finance to ensure that the repayment covenants are user friendly. To achieve this objective, a review of the prevailing terms and conditions of the debt is done and the right strategy is adhered to.

Step one

Consider adjusting the principle amount or the cost of borrowing perspective

Step two

Approach the existing or a new debt financier and discuss the way forward. And the way forward should create some breathing space for your company

Step three

Restructure the debt

Example two

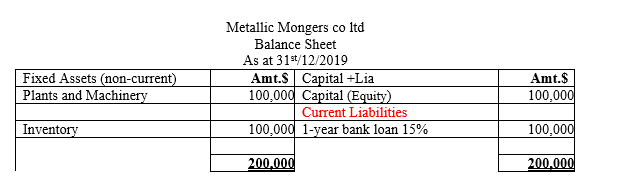

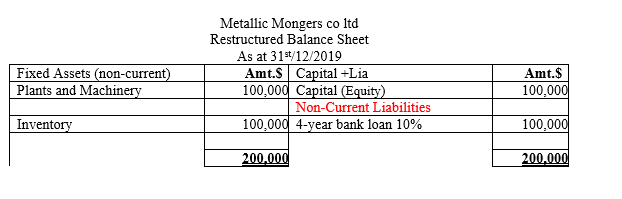

Metallic mongers co ltd has been meeting its debt obligation as expected by the loan lender up to the time Covid-19 pandemic caught up many companies unawares. Metallic mongers co ltd was one of the victim but it had only one years principle and interest amount to be off the hook. The management decided to restructure the short-term loan to a long term loan so as to reduce the amount of principle to pay on yearly basis. The following balance sheet was presented to you as a consultant to restructure it as per the new debt terms.

Additional information

In March 2020 the management of agreed with Standard Chartered Bank to re-structure the loan to two four years repayment period at interest rate of 10% using reducing balance approach.

The following were the additional transactions, which took place to achieve this objective

Required

Prepare the restructured balance sheet to show the new financial position

Solution

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.