Cash discount

Cash discount, also referred to as early payment discount, and it is a financial/fiscal relief or an incentive that a seller offers to a buyer when the latter pays his /her debt before the arranged due date. The main intention of cash discount to a customer is to prompt quick payment of the debt owning. Cash discount is further divided in to two;

1.Discount Allowed

2.Discount received

Characteristics of Cash Discount

Cash discount, just like any other fiscal relieve to the buyer by the seller, has its unique attributes which distinguish it. They include:-

1. Time based recognition

Cash discount is realized in books of accounts at the time when the customer/buyer is making actual cash payment. So the amount suggested by the seller remains not activated until the customer pays as per set discount schedule

2. Accelerator of Cash Conversion Cycle

Cash discount shortens the CCC for the quick recovery of debts through immediate cash payment by debtors is of paramount importance. This is common especially on the side of discount allowed.

3. Cash Discount is a dual cash relief

Cash discount is dual relief for both parties. That is cash discount is a relief to the seller when on the other hand he/she is purchasing goods instead of selling and it is a relief to the buyer when the buyer is buying on credit.

4. Cash discount is both a cash inflow and cash outflow

From the point of the buyer, cash discount (ie discount allowed) is a cash inflow to the business for it is an amount saved. Whereas, on the side of the seller, it is a cash out flow for it involves a decrease in the amount of cash to be received by the seller.

More specifically to discount allowed;

a)It is given to clients or the business in question.

b)It is a business expense.

c)It improves the cash conversion cycle.

d)It is dissimilar to trade discount.

Applicability of Cash Discount

1. Applies where there is need of prompting quick payment of debt arising from sale of goods on credit

2. Applies where the cash discount policy is in existence. The cash discount only works were it is tolerated. So some businesses such as chain stores, hypermarkets and supermarkets does not accommodate such

3. Applies at the point of payment unlike other types of discount which is impacted before the buy or sale transaction take place. The buyer can only exercise that privilege, iff he/she complies to the cash discount terms set.

4. Applies within the grace period set after which it becomes null and void. That is, the cash discount applies within the time limits given. Such that once the credit period expires, also the privilege follow suit.

5. Applies if the customer is paying the whole amount with no balances left behind. That is the buyer must be willing to pay total amount of net cash required to fill up the gap thereof.

Computation of Cash Discount

How do we compute cash discount? Whether it is a case of discount allowed or discount received, the procedure is just one and the same

It is very simple. Consider the following steps

Step 1: Identify the wholesaler/supplier cash discount schedule

At this stage, it is obvious to establish the set cash discount schedule for the goods. Either it is in the public domain so you can either google or can find out from the seller himself.

Step 2: Familiarize yourself with the cash discount terms

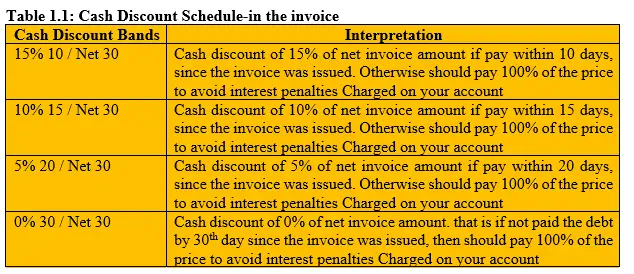

Cash discount goes with terms and conditions which are technical to the user and you as a learner need to acquaint yourself with. The Table 1.1 below summarizes that perspective as follows;

Note: That the cash discount terms used are usually set by the management using either of the following methodologies

- Ordinary dating method

- End of the month method (E.O.M )

- Receipt of goods dating method (R.O.M)

This three methods have been well articulated in this article after the 4th step-just have a look at it

Step 3: Compute the net invoice value of the seller

Before you incorporate the cash discount terms, determine the net invoice value to be sent to the buyer. Net invoice is the gross sales value amount net of any trade discount. (ie Net invoice value=gross outgoing invoice-trade discount).

Step 4; Compute cash discount Amount

Based on the band the customer fits or qualifies, determine the cash discount thereof. This is achieved by getting the product of the relevant/corresponding cash discount rate and the net invoice value.

Methods of setting cash discount terms

As aforementioned, cash discount terms used are set by the management using either of the following methodologies, namely; Ordinary dating method; End of the month method (E.O.M ) and Receipt of goods dating method (R.O.M)

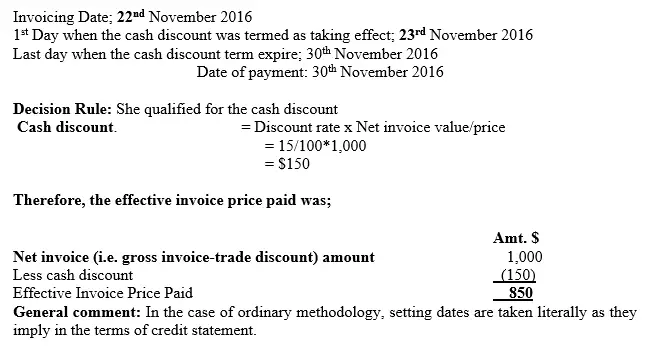

Ordinary Date Setting Method

As the name suggests, the terms are just normal. No unique approach as such but what we obviously know and practice. Such that, if a seller sets credit term of (15/10, N/30).then it implies that the buyer will get a discount of 15% if he/she clear the account within 10 days. In other words, if he makes payment within 10 days from the date of the invoice, he/she will be entitled to a 15% cash discount. Otherwise he will have to pay full price within 30 days to avoid interest charges.

Example

On 22nd November 2016 Mrs. Racheal received an invoice for $1,000 /-. On its face, it was indicated 15/10, N/30) terms of credit. Racheal worked hard and ensured on 30th November 2016 she paid everything.

Required

Compute cash discount

Solution

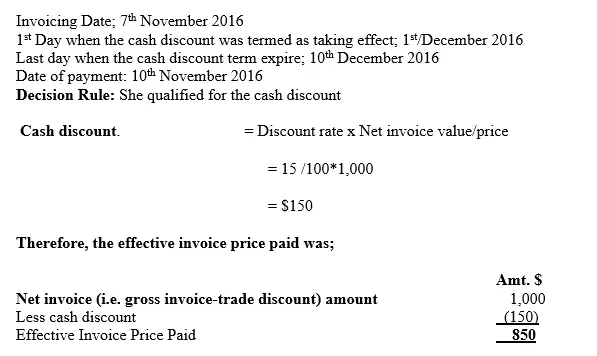

End of the Month Date Setting Method (E.O.M)

This terms of cash discount implies that a buyer qualifies for a cash discount N% if he/she pays within the first “X” number of days of next month/period. That is, if he pays within the first X days of next month from the date of the invoice. Otherwise failure to do so within the limited set time will mean attraction of interest charges.

Let me use the same example of Racheal as discussed earlier. So assume that;

On 7th November 2016 Mrs. Racheal received an invoice for $1,000 /-On its face, it was indicated 15/10, N/30) (EOM), terms of credit.

Racheal worked hard and ensured on 9th December 2016 she cleared her bills.

Required

Compute cash discount

Solution

General comment: In the case of EOM methodology, setting dates are taken with leniency such that the month/period of invoicing the customer is ignored when determining the 1st Day when the cash discount is termed as taking effect to benchmark for the other important dates. So it means that in a nutshell, means that the buyer will get a discount of N% if he/she pay within the first 10 days of following/proceeding month. In other words, if he made the payment within the first 10 days of next month from the date of the invoice, he will be entitled for a cash discount. Otherwise, he attracts interest charges.

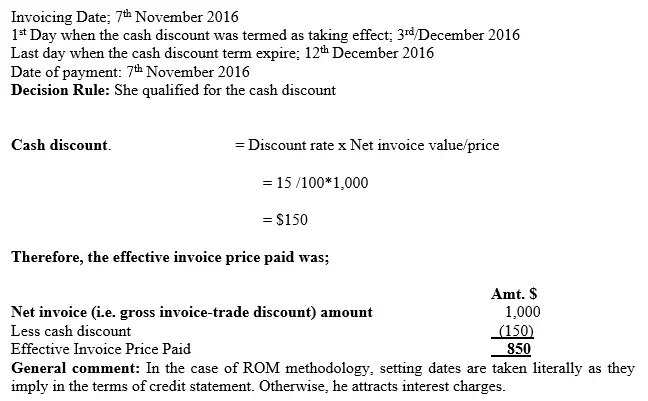

Receipt of Goods Date Setting Method (R.O.M)

This terms of cash discount implies that a buyer qualifies for a cash discount N% if he/she pays within the first “X” number of days after the goods are received. That is, if he pays within the first X days of next month from the date of receipt of the goods. Otherwise failure to do so within the limited set time will mean attraction of interest charges.

Let me use the same example of Racheal as discussed earlier. So assume that;

On 7th November 2016 Mrs. Racheal received an invoice for $1,000 /-On its face, it was indicated 15/10, N/30) (ROM), terms of credit. The shipment being waited for arrived on 2nd of December 2016

Racheal worked hard and ensured on 7th December 2016 she cleared her bills.

Required

Compute cash discount

Solution

Accounting treatment of cash discount

Accounting for cash discount is twofold, whether referring to the side of discount allowed or discount received. That is transfer of discount amount to cashbook and posting of cash discount amount to the respective ledger account.

1.Transfer of Cash Discount to Three Column Cashbook

When transactions involving cash discount takes place, the first step is to transfer the amount of cash discount to the three column cashbook as stated in our intermediate level.

We say to “transfer” because in this step we simply put the amounts of discount as computed to the respective sides of the three column cashbook without following the double entry principles of DR and CR respectively. Therefore, for all discount allowed amounts, they are recorded on the debit side of the three column cashbook.

NOTE1: That, the discount allowed account has DR totals for it is an operating expense account but this coincidence of recording the amount on the debit side of the three column cashbook has not relationship with application of double entry.

Similarly, for all discount received amounts, they are recorded on the credit side of the three column cashbook.

NOTE2: That, the discount received account has CR totals for it is an operating income account but this coincident of recording the amount on the credit side of the three column cashbook has not relationship with application of double entry.

2.Posting of Cash Discount to Three Column Cashbook

At this level or step, the cash discounts in the respective prime books or books of original entry are posted to the respective ledger accounts. We talk of posting for it is at this point that we record the cash discounts to the respective ledger accounts following the double entry principles.

Remember that now, we again post the individual cash discounts to the respective ledger accounts and the total amounts appearing in the three cashbook is posted to the respective discount allowed and discount received accounts respectively.

NB: That it is at the end of the financial year that the totals in the discount allowed and discount received accounts are closed down to profit and loss account.

Illustration

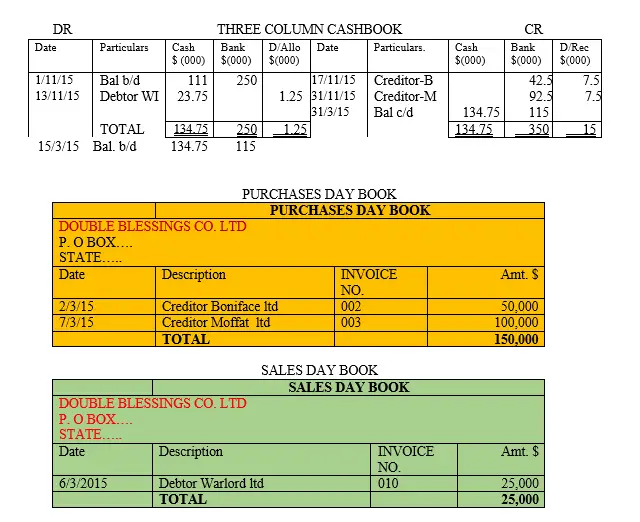

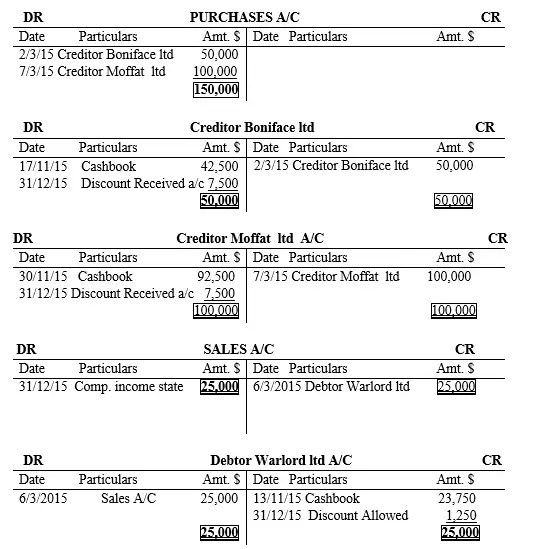

The following transactions took place in Double Blessings Co. ltd in the month of November 2015

2015, November 1st Balance b/d; cash in hand $111,000 and cash at bank $ 250,000

2nd bought goods on credit from Boniface ltd $ 50,000; 30 days credit period; discount terms;10/15%; 0/30

6th sold goods on credit to Warlord ltd of $25,000 with 30 days credit period; discount terms; 10/5%; 15/1%

7th bought goods from Moffat ltd on credit for $100,000; 30 days credit period; discount terms;10/15%; 20/7.5%

13th received cash, $23,750 from Warlord ltd (ie received cash in 8 days)

17th paid Boniface ltd by check (ie paid in 10 days) and cleared the debt

30th paid Moffat ltd by check, clearing the debt thereof (ie paid in 19 days)

Required;

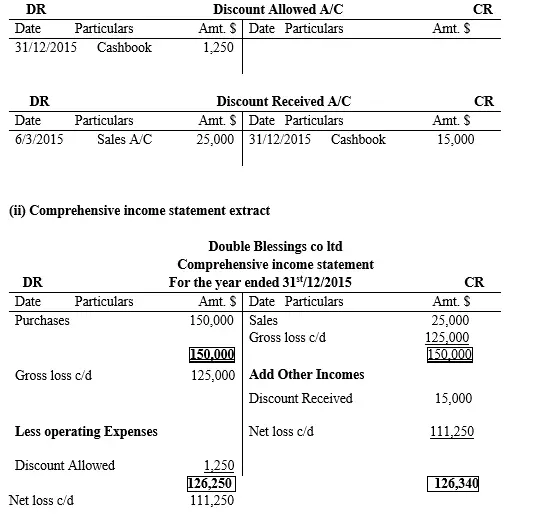

i) Record the above transactions in the respective documents and ledger accounts.

ii) If Double Blessings Co. ltd financial year ended on 31st/12/2015, extract Comprehensive income statement (i.e. initially known as trading and profit& Loss account

Solution

STEP 1: Transfer of Cash Discount to Respective Documents-i.e Books of Original Entry

STEP 2: Posting Cash Discount in the Respective Ledger Accounts

Cash discounts and value added tax (VAT)

When you deal with supply of vatable goods or services, with introduction of cash discount, then the accounting treatment changes to the following format

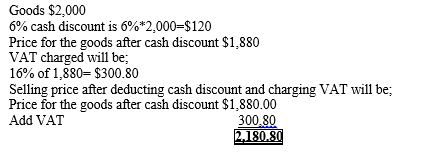

If, you offer a cash discount on goods you are selling, then VAT charged is calculated on the basis of the net invoice amount. That is as you charge VAT, first knock out the cash discount amount from the invoice amount then instill the tax. In other words, the VAT amount will be a percentage of the net amount after discount.

Illustration

Notch Higher co ltd sold goods on credit to Moses of $2,000 with cash discount terms as follows;

On payment within 10 days-12%

On payment within 25 days 6%

After 25th day-no discount

NB: The goods are vatable and the current rate is 16%

Required

i) Determine the amount of cash discount given to Moses if he qualified for 6% category of cash discount rate

ii) Amount of VAT charge on the goods

Solution

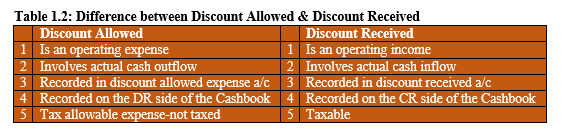

Difference between discount allowed and discount received

Table 1.2 below portrays the distinguishing features or attributes between discount allowed and discount received of which both represent cash discount

Advantages of cash discount

1. Encourage debtors to pay on time hence reduce the chances for the occurrence of bad debts which is a financial loss to the company

2. Improve on the cash conversion cycle hence increasing cash flow level

3. Increased profitability for more sales are witnesses

4. Improved liquidity level which ensures the firm can meet its debt obligation as and when it falls due

5. Competitive edge-with cash discounts, the level of market share increases and this helps in being relevant to the market

6. Enjoy economies of scale-because of selling in large volumes, sales increase and profits too increase and as a result, the cost of operating go down, increased efficiency in operations and better management.

Disadvantages of cash discount

1. Wrong Customers' Price Perceptions

When customers are used to cash discounts of course characterized by low prices, face drastic change in the economy such as Covid-19 economic clutch, attempt by the seller to adjust prices upwards will turn chaotic and may lead to loss of market share as customers will go looking for cheaper alternative.

2. Revenue reduction

Sales at a discount reduced the potential revenue a seller could have realized if he/she sold the goods at full price. This will be a problem to do with economies of scale

3. Reduced cash flows

Sometimes the customer may delay in payment which may result to cash shortages which in turn may adversely affect restocking of the business with new inventory

4. Customer purchase behavior inertia

A customer used to buying goods with cash discount inclusive will face difficulties in convincing him/her otherwise especially when doing product promotion campaigns. For instance, if you stop for a while the cash discounts to promote your product, obviously there will be misunderstandings.

5. Compromise on the quality of the goods

When the mentality of the seller is to distribute goods and a cheaper price in the name of cash discounts, this may lure him to sell more volumes without counterchecking his supplies from other sellers. As a result, goods of low quality may slip in to the market.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.