Cost Allocation

Cost allocation is the process of collecting all relevant costs incurred by a particular cost unit or cost center.

It entails first identifying the cost unit, or cost Centre and then linking the costs thereof. The allocation relies on particular criteria.

So, the cost accountant identifies, accumulates, and assigns costs to costs objects such as divisions, goods, programs, or an outlet of a company.

Applicability

This exercise is applicable when it is easy to link the specific cost elements and the cost objects or departments. As an entrepreneur/learner, you should note that cost allocation is for overhead costs only and not direct costs. This is because direct costs are for specific cost Centre or object.

Cost allocation comes in if it is also possible to specifically identify the cost Centre or object directly associated with a particular cost.

Example

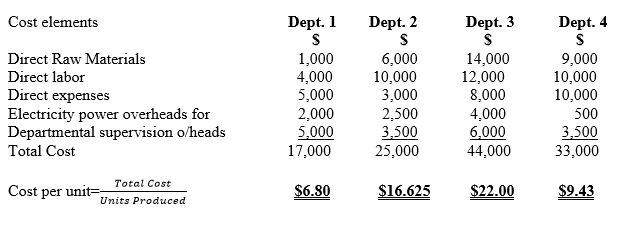

Fig Tree co ltd is a pharmaceutical company that manufacture medicine for small children with bone marrow abnormalities. The company has four departments, which produce medicine for specific bone marrow problems amongst children. The direct costs for each department is as shown below

Required

Allocate the following overheads in the respective departments and determine the cost per unit for each product

Solution

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.