Quantity Discount

Quantity discount is part of discount we have discussed in the discount article . It is a relief given by wholesalers, manufacturers or suppliers when they want to pursue the buying of goods in bulky form or in large quantities whether for re-selling or final consumption. To fit in the terms of the seller, one must meet the set thresholds.

For example, a 100,000 unit purchase can carry a 10% discount on the total cost of the units. This makes the overall cost of purchase be a little bit lower than the wholesale price.

Characteristics of Quantity Discount

1) This is how you distinguish this kind of customer relief with those other categories, namely trade discount and cash discount

2) Quantity discount aims at persuading the buyer to purchase in large quantities

3) The sellers who give this relief are mostly manufacturers or producers or dealers of a particular product unlike retailers

4) Cost per unit reduction implication-on providing this relief is reflected in the cost per unit of the seller

5) The purchasing price to the buyer become more favorable than when the relief is not there

6) Quantity discount to some extent adversely influence per unit profits of the seller

7) Discounts can have an adverse impact on profit per unit, also known as the marginal profit.

Applicability of Quantity Discount

1. Quantity discount applies where at the end there is decreased cost per unit of the goods manufactured by the firm.

2. Quantity discount applies where the buyer is able to afford to purchase in large quantities. This means the same privileges do not apply to single buyers who need one or two or so units to finally consume at home.

3. Quantity discount applies where the seller has the goods produced and placed in the warehouse whose storage and handling cost need to be minimized.

4. From the customer’s point of view, the concept of Quantity Discount works for them as they get a favorable and discounted price of the goods working as the pocket-friendly deal for them

5. Quantity discount applies where Buy One Get One Free and Buy Two and Get One Free policy exist in the business.

6. Both delivery terms and payment terms may be set at a particular point in time or can be spread across a certain period of time

7. Quantity discount applies where both parties enjoy a win win situation. That is the seller clears inventory in the warehouse whereas the buyer gets a fair or favorable purchasing price

8. Applicable to Fast Moving Consumer Goods (FMCG)-mostly quantity discount fits well where the goods are produced in large quantities and at the same time they are of fast moving in nature.

Computation of Quantity Discount -Step By Step Approach

How do we determine the amount of quantity discount that the buyer takes home? The following is step by step procedure of determining the quantity discount the buyer expects at the end of the day.

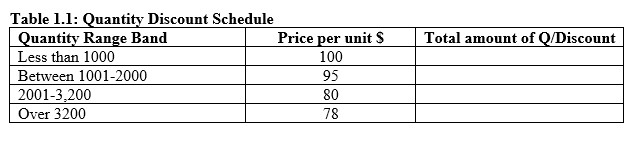

Step 1: Identify the sellers/manufacturer’s discount range or schedule

This is the pre-determined table with the producer or manufacturer breakdown of how the different rates of discount are set.

For instance, Table 1.1 portrays this fact

Step 2: Identify and match the discounted price with the actual quantity purchased

In this stage, match the exact amount of goods bought as per the correct band so as to relate it to the relevant discounted or non-discounted purchasing price

Step 3: Sum up the total discounted amount to pay or to be paid in the future.

Compute the total discounted amount as per each discount band

Step 4: Determine the total cost of all the goods bought without the discounts

With an assumption that there was no discount provided, compute the total cost thereof. This will guide you in determining how much quantity discount was extended to the buyer by the seller

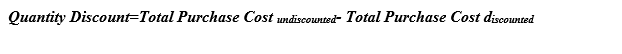

Step 5: Compute quantity discount as per that transaction

From step 3 and step 4 outcome, derive at the exact amount of quantity discount given to the customer by the seller. This is achieved using the following formula

Accounting Treatment of Quantity Discount - IAS-18

Accounting treatment of quantity discount just like in the case of trade discount is governed by the IAS-18. A quantity discount is a decrease in the price of a good if the purchaser selects to get goods in a huge quantity. Alternatively, in a single delivery of goods, quantity discount can be extended to the buyer in which case it is deducted from the invoice sent to the customer. Look at the IAS-18 compliance statement below.

Compliance to IAS-18

Under measurement perspective of the IAS-18, revenue is measured as the fair value of the consideration received or receivable, taking into account any trade discounts or volume rebates allowed etc

Advantages of Quantity Discount

The advantages of quantity discount apply to both counterparties, ie the seller and the buyer as explained below;

To the seller

1. Enjoy economies of scale-because the seller sells the goods in large quantities, him or her benefits in the following perspectives which characterize operations in large scale (economies of scale). That is increased sales volume, reduced cost of storage and production etc.

2. Competitive edge-because of selling in bulky the makes the seller outcompete the other market players

3. Increased profitability-due to increased sales, increased profits are guaranteed

4. Avoid slow-moving inventory-bulky selling due to discount provided ensures that all inventory is on the move and hence no room for idle inventory which can cause problems of opportunity costs

5. Assurance of continuous production-as long as quantity discount is there, there is always assurance of continuous supply of that product

6. Winning of customer loyalty-this win assures the seller of continuous demand of his products and this translates to opening of more branches

To the buyer

1. Enjoy favorable purchase price-because the buyer purchases in large quantities, the acquiring price is fair. i.e. cheap purchases.

2. Reduced cost of per unit encourages the buyer to purchase more and more.

3. Increased profitability-with favorable purchase price and reduced cost of production returns increase.

4. Assured supply by the seller-because the supplier is encouraged to supply more, the buyer on the other side will be assured of no shortages of the same which can lead to loss of customers.

5. Improved terms of credit-as the two parties build good relationship the terms of credit become less stringent for they are familiar with each other.

Disadvantages of Quantity Discount

1) Seller suffer losses because the discounts given chop off the profit margins to some extent.

2) Supply of low quality goods-due to supply in large quantities, the seller may concentrate more on quantity to meet the imminent demand level and in return compromise the quality thereof.

3) Risky level is high-supply in large quantities can be very risky because in case of a calamity as it was in the case of COVID-19 Pandemic, then demand can drastically decline and if the goods were perishable, it will translate to losses and also difficulties in paying the debt by the buyer.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.