Revenue expense

Revenue expense also known as operating expense is the cash outflow paid by the business to a third party as a result of the former (the business) receiving some services during the ordinary way of doing business.

Key Words

- Cash outflow-for a business expense to be classified as so, there must be an actual cash outflow involved. In other words, the business uses its cash or non-cash resources to pay out for the services provided.

- Third Party-the payment is made to a third party means somebody or persons being paid does not own the business in anyway. In other words, he is an outsider to the business. For example employees or a contractor/supplier. This is the reason why dividends paid to common shareholders are not business expense although there is actual cash outflow from the business for the common shareholders are insiders. They are the owners of the business and that again is why such payment of dividends is referred to as profit and loss appropriations but not business expense.

- Provision of services-the rationale behind the payment is in exchange of services provided to the business by the third party such as employee related services such accountant services, human resource services and security services. Also other services may include transport, airtime, insurance, advertisement, rent and rates and electricity. Just to mention but a few

- Normal operations of the business-the expense being paid should be in the course of the normal or ordinary operations of the business. What is normal or ordinary business activities for a particular business is guided by the main objective of the business as stated in the memorandum of association as discussed in out tutorial notes in intermediate level under the sub-topic on accounting treatment of sales and purchases (final accounts-scenario 1).

So for an expense to qualify as one, the four aforementioned criteria must be met.

Business expense is further categorized in to 4 classes based on the approach used to prepare profit and loss account, now commonly referred to as comprehensive income statement. That is;

Operating Expenses

Administration Expenses

Selling and Distribution Expenses

Financing Expenses or Charges

Operating Expenses

Operating expenses is a type of cash outflow paid by the business in the ordinary way of business to ensure that the business is continuing in its operations. These type of expenses are somehow general and they are paid to ensure activities associated with generation of ordinary income (operating income) are moving on well. Examples of such operating expenses are, salary expense, electricity, rent and rates, transport, taxes, air time, discount allowed, bad debts written off.

Administration Expenses

Administration expenses as the name suggests, are cash outflows that the business pays to a third party offering administrative services. Such as salary of personal assistant to the director, directors remuneration, accountant’s salary, administrator salary, supervisor and managers’ salaries.

Selling and Distribution Expenses

Selling and distribution expenses are business expenses that are affiliated to selling/distribution of goods and services of the business. They are expenses paid to ensure the products offered by the business reaches the market. These expenses include and not limited to salary to salesmen, all expenses related to maintenance of delivery van/vehicles, advertisement or sales promotion related expenses e.t.c

Financing Expenses or Charges

Financing expenses are associated to the aspect of costs linked to financing of the business especially for a longer period of more than one year. Apart from the principle amount a business gets from financial institutions, there are those costs associated with borrowing. They include, loan interest, debenture interest, mortgage interest, interest on bond e.t.c

Classification of Revenue Expenses and EBIT

EBIT stands for Earnings before Interest and Tax and the classification of revenue expenses in that manner of four categories is paramount when preparing comprehensive income statement (Profit and loss account).

Illustration

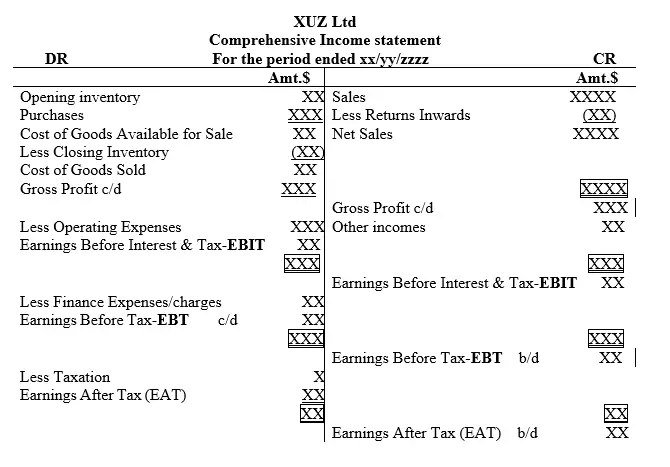

Comprehensive Income Statement Format-EBIT Approach

Considering the business classification we have discussed, the format of profit and loss account using the “T” FORMAT can be modified as follows;

Example

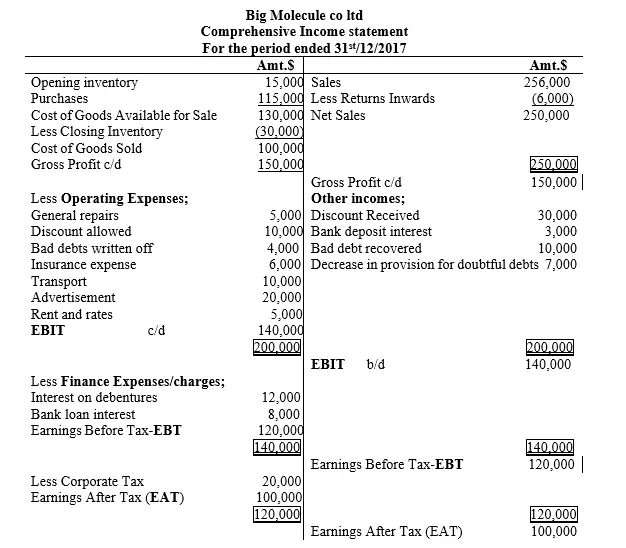

Big Molecule co Ltd management has incorporated the classification of business expenses in the company’s books of accounts. The following is an extract of comprehensive income statement from the company’s accounts at the end of 31st/12/2017

Advantages of Classification of Revenue Expense

1. Help in computation of financial ratios - the demarcation of business expenses in to the four categories, namely; Operating Expenses, Administration Expenses, Selling and Distribution Expenses and Financing Expenses or Charges makes it easy to establish well known ratios such as ROCE, ROI, ROE, and ROA

2. Aid in management decision making - the management have clear focus to interpret financial report for decision making purposes. For example, with determination of ROCE or returns on capital employed, the formula involves the numerator being EBIT or earnings before interest and tax which is key for countries with tax profile that is disadvantageous to businesses such as high taxation rate for this indicator of financial performance considers the power of income generation of a firm excluding the tax aspect which has distorting effect.

3. Easy for the stakeholders to understand the financial performance of the business - the presentation of the financial statement in this manner makes it easy for both the literate and illiterate stakeholders to interpret the financial reports of the business. This ensures that there is no conflicts due to wrong interpretations which is common amongst stakeholders.

4. Reduce probability of being over taxed - when accounts have mixed information like expenses it is possible to wrongly categorize some expenses such as increase of provision for doubtful debts. This expense may be assumed to be of no use hence not included in the computation of tax, then this will result in to higher taxation

Disadvantages of Classification of Revenue Expense

1. Tedious to prepare-it takes the accountant some time sort out and classify the expenses accordingly where by reasonable care is highly needed and therefore it is a cumbersome exercise as compared to where you just prepare a comprehensive statement.

2. Not common in practice- classification of Revenue Expense is not universally accepted by all the stakeholders of a business

Accounting Treatment of Revenue Expenses

Revenue expenses are cash outflows from the business paid to a third party during the normal or ordinary operations of the business. The accounting treatment of revenue expense which is also commonly referred to as operating expense is threefold.

a).If the cash for the expense is paid in a timely manner

b).If the cash is paid in advance

c).If the cash is paid in arrears

a) If the cash for the expense is paid in a timely manner

If the business pays its revenue/operating expense in time, it implies that in one financial period, the total expense paid will be exact. That is, no excess, no shortage. In this case the matching principle as discussed in our beginner’s level tutorial applies very well.

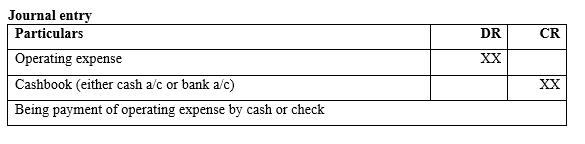

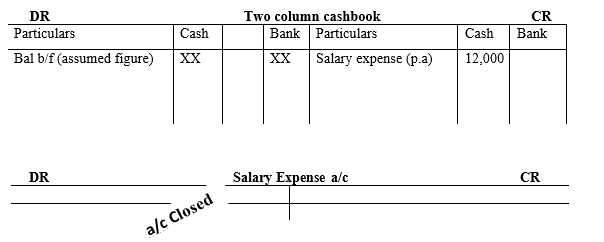

Accounting treatment

On payment of cash for the full year

Example 1

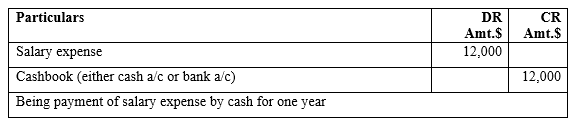

31st/12/2018, HIJ co ltd had paid salary expense for its employees for one whole financial period amounting to $12,000 in cash.

Required

i)Journalize that transaction as on 31st/12/2018

ii)Post the transaction in the respective ledger accounts

iii)Show the accounting treatment of this transaction in the final accounts of HIJ co ltd as on 31st/12/2018

SOLUTION

i) Journal entry

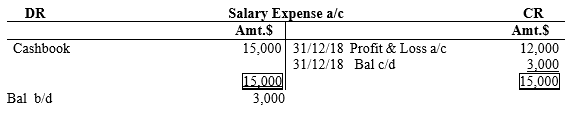

ii) Posting to respective ledger accounts

So after one year’s period, the entries will be summarized as follows.

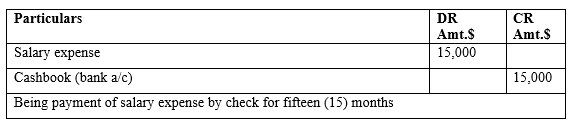

iii) When the books are closed at the end of the financial period

b) If the cash is paid in advance-Prepaid Expense

When expense is paid in advance, it implies that the amount paid exceeds the one year’s period expense. Therefore the total amount paid is divided into two

One; the expense amount for the year according to the matching principle

This amount is charged to p&l account for it is the expense of the year.

Two: the amount that is in excess is NOT an expense, it is a current asset and therefore, it does not form part of the revenue expense. So it is not charged to P&L account instead it is recorded in the statement of financial position under current asset. This excess expense paid is referred to as prepaid expenses as discussed in intermediate level tutorial.

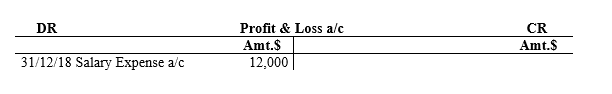

Example 2

Let us re-consider example 1 above whereby by 31st/12 2018, HIJ co ltd had paid salary expense for its employees for fifteen months (15) amounting to $15,000 by check. Assume that per annum salary is $12,000.

Required

i) Journalize that transaction as on 31st/12/2018

ii) Post the transaction in the respective ledger accounts

iii)Show the accounting treatment of this transaction in the final accounts of HIJ co ltd as on 31st/12/2018

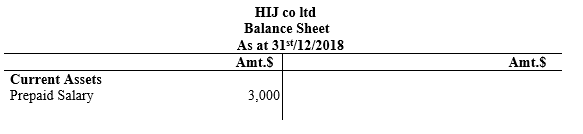

iv) Extract a balance sheet

SOLUTION

Journal entry

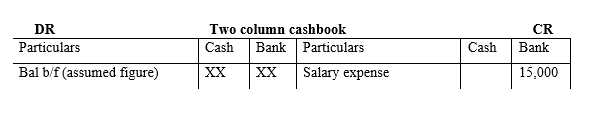

Posting to respective ledger accounts

So after one year’s period, the entries will be summarized as follows

When the books are closed at the end of the financial period

NB: Generally, if an expense account has debit balance brought down (bal b/d), then this represents a current asset. Even a corresponding prepaid expense account can be opened to post such a transaction as discussed in our intermediate level

c) If the cash is paid in Arrears-Accrued Expense

When expense is paid in arrears, it implies that the amount paid is less than the one year’s period expense. Therefore the total expense is divided into two

One; the expense amount actually paid which is less than a one year’s amount

This amount is adjusted upwards to determine the charged to p&l account for it is the expense of the year.

Two: the part of the total expense for the year that has not yet been paid.

Now, with the accrual principle, this amount not yet paid in the course of the year is referred to as incurred expense. This expense is referred so because the business has been provided with services but has not paid yet. According to this principle, the already paid expense is adjusted upwards to total to a one year’s expense amount. After adjusting to a full years expense, it is now charged to p&l account. However, the amount in shortage (i.e incurred expense) is recorded in the statement of financial position as a current liability. This shortage of expense incurred is referred to as accrued expense as discussed in intermediate level tutorial.

Example 3

Once again, let us re-consider example 1 whereby this time round we assume that by 31st/12/2018, HIJ co ltd had paid salary expense for its employees for eight months (8) amounting to $8,000 by check. Assume that per annum salary was $12,000 .

Required

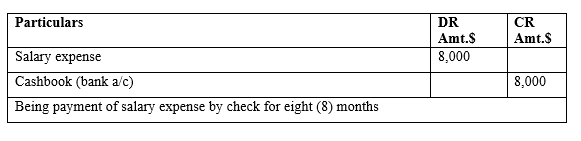

i) Journalize that transaction as on 31st/12/2018

ii) Post the transaction in the respective ledger accounts

iii) Show the accounting treatment of this transaction in the final accounts of HIJ co ltd as on 31st/12/2018

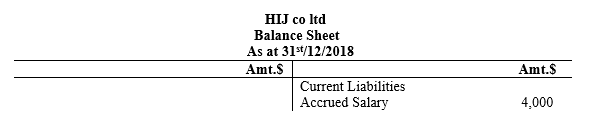

iv) Extract a balance sheet

SOLUTION

Journal entry

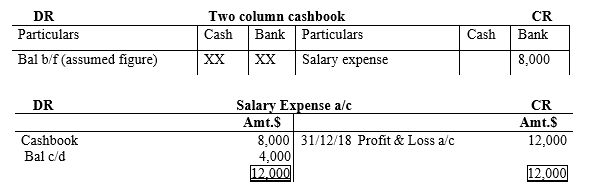

Posting to respective ledger accounts

So after one year’s period, the entries will be summarized as follows

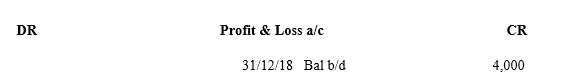

When the books are closed at the end of the financial period

NB: Generally, if an expense account has credit balance brought down (bal b/d), then this represents a current liability. Even a corresponding accrued expense account can be opened to post such a transaction as discussed in our intermediate level

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.