Trade discount

Trade discount is the monetary/fiscal relief that the seller who can be either a supplier, manufacturer or a dealer of a particular product extends to another trader in mind that the buyer is purchasing for re-selling purposes. So the relief is in form of reduced retail price such that the profit that the buyer will make will be pegged on the difference between the prevailing market price and the selling (catalogue selling price) set by the wholesaler/manufacturer. In this deal, the goods are not sold to the end users such as final consumers.

Characteristics of Trade Discount

1. The relief by the wholesaler is purposed to encourage re-sellers to make a bigger profit margin as compared to their competitors in the market

2. The discount is either expressed in terms of percentage of the list selling price or in absolute terms such as a certain amount off the retail price. Such as list price=$30-$3=$27

3. Trade discount does not reflect in the sales invoice of the reseller or purchases invoice of the buyer

4. Trade discount is not part of double entry system- that is there is no entry made in the books of accounts of the buyer and seller. That is, when it comes to recording in the journals or invoice, the amount representing sale is net of trade discount.

Applicability of Trade Discount

1.Applies where the intention of sale is to create some extra profits to the buyer apart from the ordinary profits from market

2.Applies where the buyer is purchasing to re-sale but not to single buyers who purchase for final consumption

3.Applies for buyers who pay in cash (i.e immediately) and also on credit transactions

4.It works on local arrangement between the seller and buyer for it is not formally recorded in the books of accounts of either parties

Computation of Trade Discount

How do we compute trade discount? It is very simple. Consider the following steps

Step 1: Identify the wholesaler/supplier catalogue selling price

At this stage, it is obvious to establish the set selling price for the goods. Either it is in the public domain so you can either google or can find out from the manufacturer himself.

Step 2: Discounted Prices

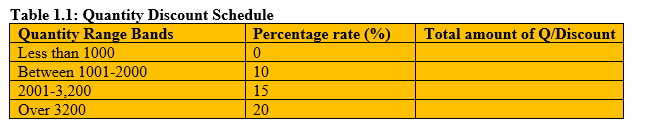

Consider the agreed reduced selling price the wholesaler/manufacturer has set for those re-sellers who are intending to purchase in large quantities for re-selling purposes. Table 1.1 below summarizes that perspective as follows;

Step 3: Sum up the individual Trade Discounts in each band

This step entails adding up all the bits of trade discounts from all the bands provided by the wholesaler/manufacturer.

Step 4; Determine the amount payable by the buyer (optional)

It involves considering the gross amount payable with the assumption that there was not trade discount at all and less the total trade discount.

Accounting Treatment of Trade Discount

Accounting for trade discount can be well understood by use of the following example

Example

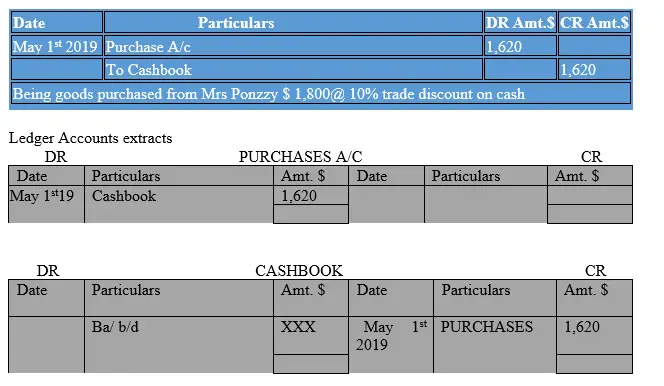

May 1st, 2019 Mr. Mackenzie purchased goods from Mrs Ponzzy of list price $1,800 on cash. Mrs. Ponzzy allowed a 10% trade discount to Mr. Mackenzie on the list price for purchasing goods in bulk quantity.

Required

Show the journal entries in the books of Mr. Mackenzie and the corresponding ledger accounts for the same transaction

Solution

Journal Entries

NB: Remember that trade discount does not appear in the books of account of both seller and the buyer.

Advantages of Trade Discount

1)Increased Sales volumes -the seller is in a position to make more sales hence the volumes increase.

2)Good Reputation-if a firm is cheap through offering trade discounts, then its reputation advances. The consumers even those who purchase to re-sale will be saying good about the company such as the company that cares the people-this increases market share.

3)Decrease in Operating cost -small businesses enjoy reduced cost of operations when trade discount is extended to them. Trade discounts, especially for smaller businesses, can lower operational business costs.

4)Increasing competitive edge of businesses -when businesses are given trade discounts, they also extent the same leave to their final customers which result to retention of most of them. This assures the business the power to compete in the market hence cannot be thrown out of business.

5)Increased profitability-when business get this relief, they make more profits and hence increase their purchasing power. This further enables them to continue being in business by assuring their customers continuous supply without breakdowns

6)Reduced chances of bankruptcy

Trade discounts prompts the business to continue generating more cash which makes it possible to meet debts as and when they fall due. This minimizes chances of being put under liquidation by third parties.

Disadvantages of Trade Discount

1)Costly Creditworthiness assessment of Customers-to be sure of progress in extending trade discounts, the suppliers need to carry out some customer screening to know their credit position and this is costly for financial and time resources are needed to achieve that.

2)Close Monitoring and evaluation of Accounts Receivable -additional responsibility arises on the side of the suppliers for in case they sell on credit to the buyers they need to ensure that the accounts are in good standing and this means a new role that may deny another section some services so as to monitor the customers.

3)Negative Effect on Cash Flow-the mismatch between sell on credit and purchasing of goods on cash may create a loophole of cash shortages especially on the side of the supplier. This can happen on extreme cases especially when the credit terms are very lenient. Therefore cash can be in shortage.

4)Financial losses through bad debts written off-the extension of trade credit will lead to some buyers defaulting their debt obligation which may translate in to cash lost through bad debts written off.

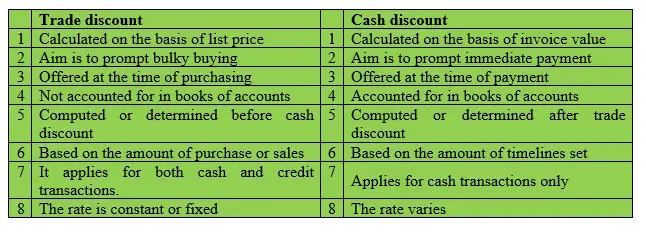

Differences between trade discount and cash discount

Table 1,2 below portrays the distinguishing features or attributes between trade discount and cash discount

Table 1.2: Difference between Trade discount and Cash discount

Simultaneous accounting treatment of both trade & cash discount

Most of the times a buyer will simultaneously be offered with both trade discount and cash discount. Then the big question that arises is;

If a firm is privileged to enjoy the two types of discounts, namely trade discount and cash discount, then the accounting treatment is as detailed in the example below.

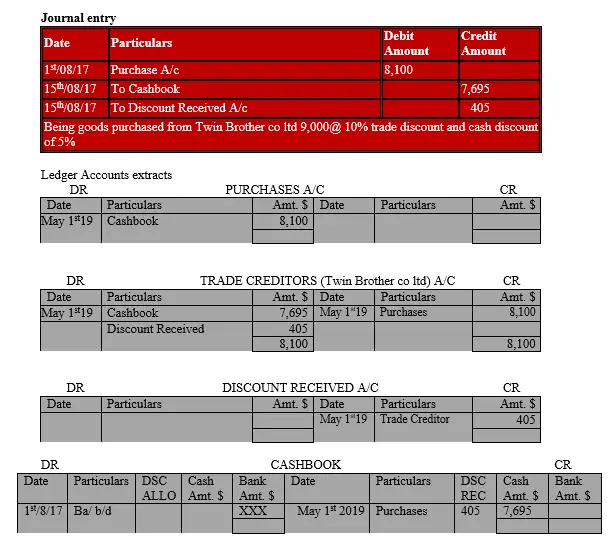

Example

August 1st, 2017 Pauline purchased goods from Twin Brother co ltd of list price $9000 on credit. The terms of repayment were as follows;

If pay within 10 days cash discount is 15%

If pay within 20 days, cash discount is 5%

If pay after 20 days, no cash discount

Twin Brother co ltd gave Pauline a trade discount of 10% for she is a business woman and had bought goods in large quantities.

Pauline managed to pay her debt on 15th August 2017 on cash.

Required

Accounting entries-journals to record the above transactions

Accounting entries-corresponding ledger accounts to record the above transactions.

Solution

NB: There are two types of discounts that Pauline benefitted; trade and cash discount

Workings

1. Trade discount was 10%*9,000=$900

Cash discount of 5% for she complied on the 15th day. That is before 20 days were over but after ten days. Therefore,

2. Cash discount 5%*(9000-trade discount of 900)

5%*8,100=$405

NB: Remember that trade discount does not appear in the books of account of both seller and the buyer. While, for cash discount, it is incorporated in the respective ledger accounts.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.