Trades Note Payable

This is a current liability. However, trades note payable is an extension of accounts payable whereby the business enter in to an official agreement (i.e promissory note) that the business in question is committed to pay the debt owing.

Example

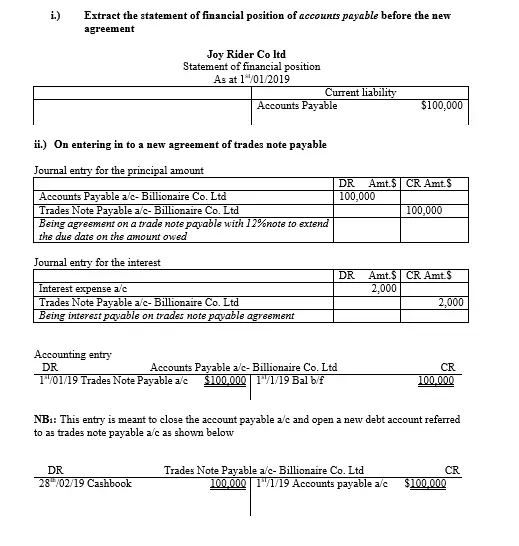

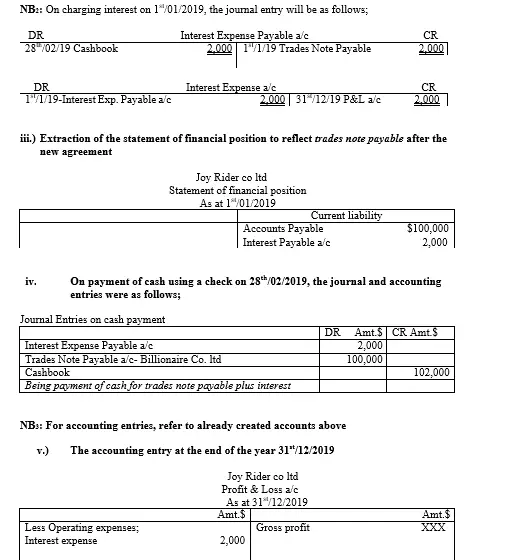

1st/01/2019, Joy Rider Co Ltd realized that the set deadline of paying its dues of $100,000 account with Billionaire Co. Ltd could not be met as agreed earlier. As an accommodation, Billionaire Co. Ltd agrees to accept Joy Rider Co Ltd’s 60-day, 12% per annum (i.e 12 months), $100,000 note payable in granting an extension on the due date of the debt.

If this new agreement is effected for the next 60 days and after that period, Joy Rider Co Ltd paid the cash amount by 28th/02/2019;

Required

- Extract the statement of financial position of accounts payable before the new agreement

- Make journal entries and accounting entries for the two distinct transactions

- Extract the statement of financial position of trades note payable after the new agreement

- Show the journal and accounting entries on payment of cash using a check

- Show the accounting entry at the end of the year 31st/12/2019

Solution

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.