Preparing a trial balance, comprehensive income statement and a statement of financial position

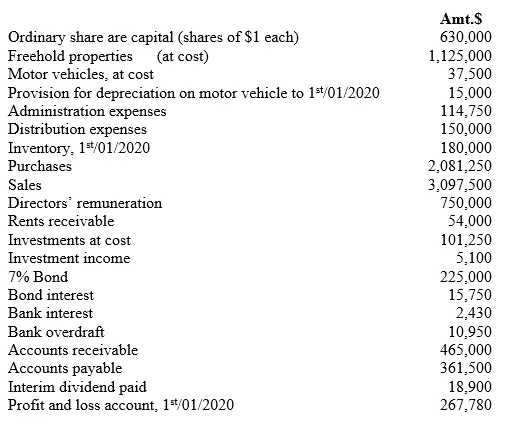

The following is a list of account balances of Your co. Ltd at 31 December 2020.

Additional information;

- All the motor vans were purchased on 1st/01/2017

- Depreciation has been, and is to be, provided at the rate of 20% per annum on cost from the date of purchase to the date of sale.

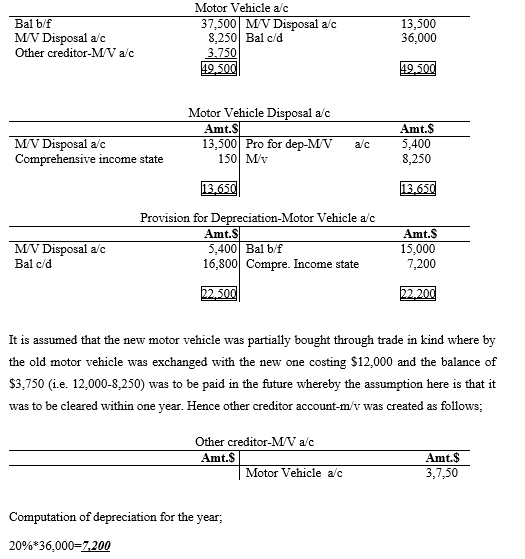

- On 31st/12/2020 a motor vehicle, which had cost $13,500, was sold for $8,250, as part settlement of the price of $12,000 of a new van, but no entries with regard to these transactions were made in the books.

- The estimated corporation tax liability for the year to 31st/12/2020 was $190,500.

- It is proposed to pay a final dividend of 10% for the year to 31st/12/2020.

- Closing inventory was valued at $250,500.

Required:

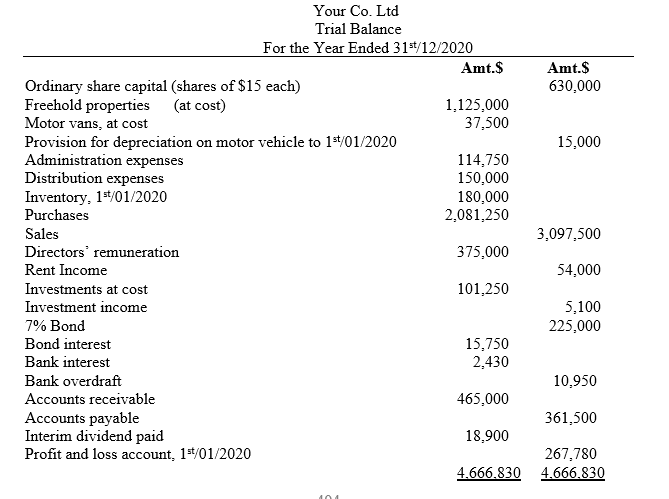

- Prepare a trial balance for the year ended 31st/12/2020

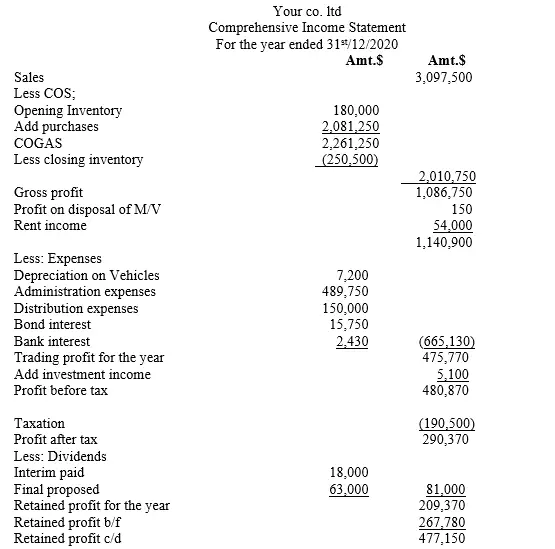

- Prepare a comprehensive income statement for the year ended 31st/12/2020

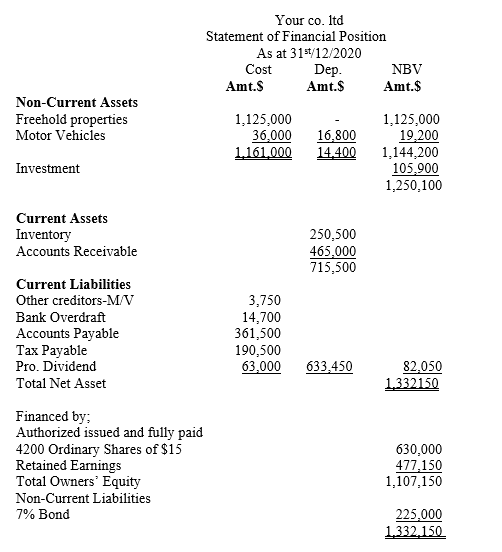

- Prepare a statement of financial position as at 31st/12/2020

ANSWER -trial balance for the year ended 31st/12/2020

ANSWER -A comprehensive income statement for the year ended 31st/12/2020

ANSWER -A statement of financial position as at 31st/12/2020

Workings

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.