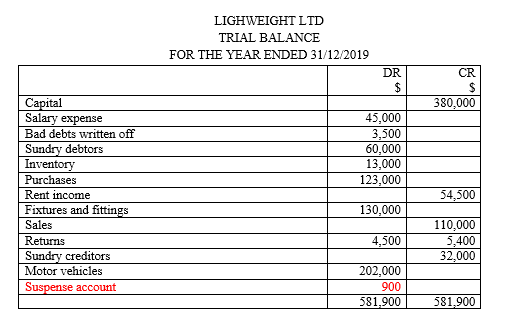

The following trial balance was extracted from the books of Light weight ltd for the period ended

The following trial balance was extracted from the books of Light weight ltd for the period ended 31/12/2019. The totals on both sides of debit and credit sides did not balance as shown below hence a suspense account was used to balance the two sides.

- Motor vehicle bought was originally recorded in the general journal as $202,000

- Both returns inwards and outwards accounts were inversely recorded in the respective ledger accounts otherwise their correct values were $5,400 and $4,500 in that order

- Sales value was exclusive of goods sold in the last day of the month of December which were valued at $15,000 and not yet recorded

- Bad debts written off was recorded as $3,500 by mistake. The correct amount was $4,500

- There was additional capital of $84,900 that was added in to the business before the year ended but was not incorporated

Required;

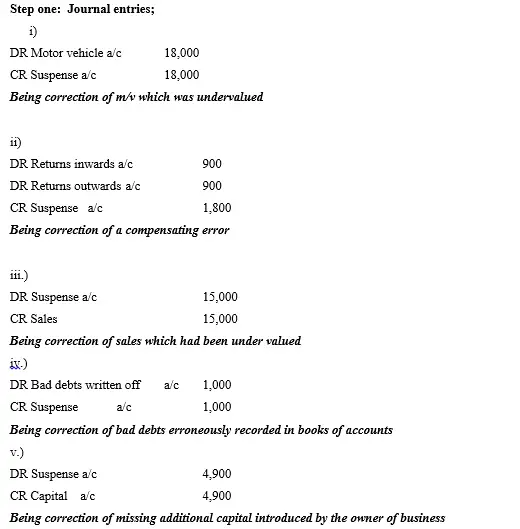

- Use journal entries to correct the trial balance for the year ended 31/12/2019

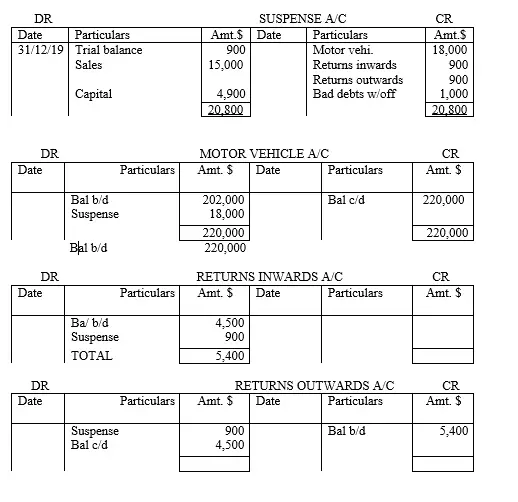

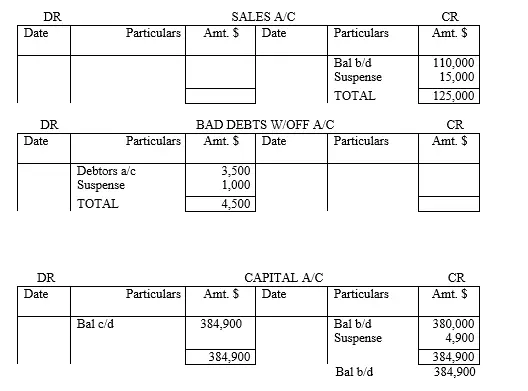

- Post the journal entry in the respective ledger accounts and determine the new balances brought down

- Open a suspense account and adjust it accordingly

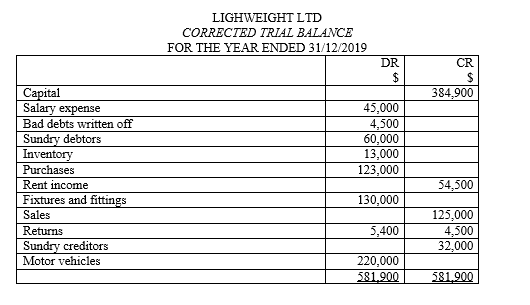

- Extract the correct trial balance for the year ended 31/12/2019

SOLUTION

Step one: Journal entries;

Step two: adjusting the respective ledger accounts;

Step four: Corrected Trial Balance

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.