Determining the closing inventory value using FIFO Method,LIFO Method and Weighted Average Method

The following inventory related transactions took place in the month of January 2019 for PPP Co. ltd

2019 January 1st Bal of inventory b/f 250 units @$10 totaling to $2,500

2nd Purchased 500 units @$12

4th Sold 450 units @$25

6th Sold 120 units @$25

9th Purchased 1,000 units @$10

11th Sold 230 units @$22

13th Purchased 400 units @$12

17th Sold 200 units @$25

18th Sold 150 units @$27

22nd Sold 50 units @$26

25th Purchased 350 units @$15

27th Purchased 1,200 units @$18

31st Sold 1,700 units @$30

Required

Determine the closing inventory value as at 31st January using

- FIFO Method

- LIFO Method

- Weighted Average Method

SOLUTION

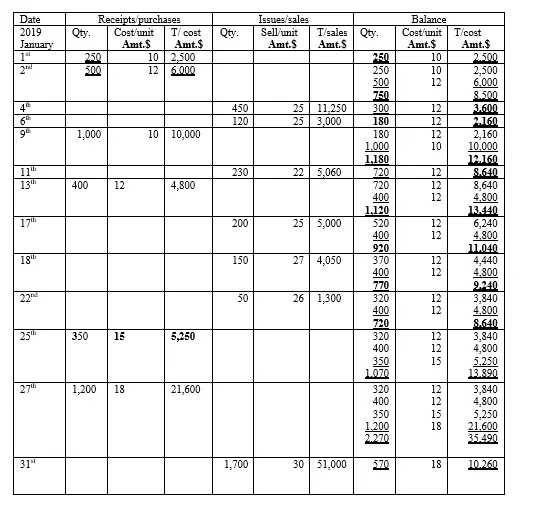

1.FIFO Method

According to FIFO approach, the closing inventory value is $10,260

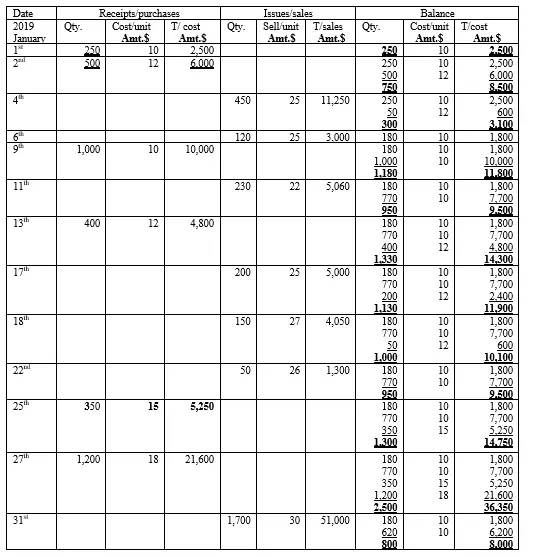

2.LIFO METHOD

According to LIFO Method, the closing inventory value is $8,000

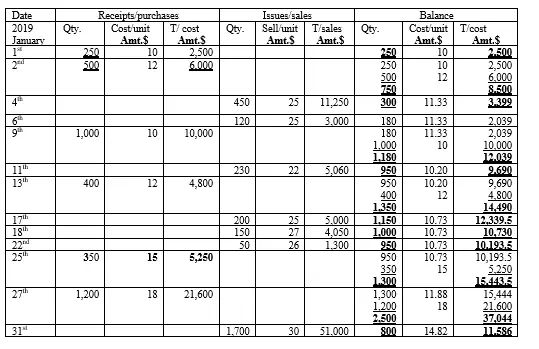

3.Weighted Average Method

According to Weighted Average Method, the closing inventory value is $11,586

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.