The accounting information extracted from the books of XYZ Co ltd for the year ended 2018 showed a credit shortage of $405,900 in trial balance.

Immediately an investigation was undertaken and the following accounting facts were discovered. That;

a) The total of one page of book of original entry to record sales was understated by $123,000

b) The account of Taurus was debited with $307,500 by mistake for sales made to Titus

c) Salary account was under cast by $86,100

d) Discount received had been understated by $369,000

e) A machinery that was disposed at net realizable value of $442,800 was recorded as sales.

f) The net profit before the adjustment was $9,717,000

Required

i) Correct the aforementioned errors

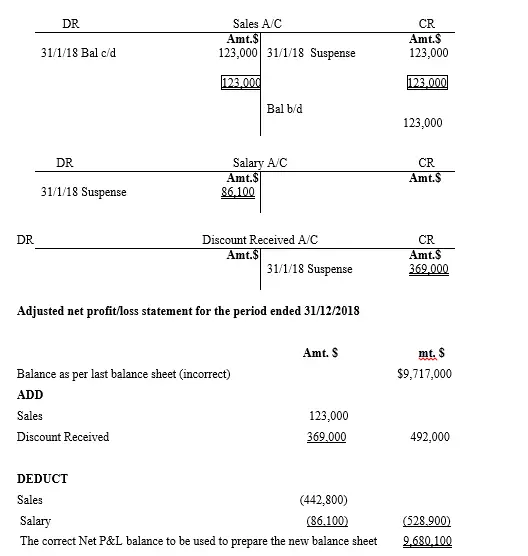

ii) Show the corrected profit and loss account balance brought down on 31/12/2018

SOLUTION

Step one involves identification of the origin of the error. In other words, one has to trace at what point the error occurred. For instance, is it at the point of recording the transaction in the respective source document or at the point of posting the information to the ledger account. After that;

Step two, you classify or assess the type of error that has occurred strategize how to correct the error for they have different ways of rectifying. Then in step three, you go ahead and assess the nature of effect the error has caused on the identified item that is if it caused an increasing or a decreasing effect.

The next step four involves preparation of the respective affected ledger accounts to first of all show the financial status of such accounting items before doing the actual corrections using journal entries as guided in step five.

Here we go!!

STEP FOUR; Extract the respective affected ledger account(s)

Interpretation to the entrepreneur/learner;

For the entrepreneur to have full understanding of how and why the corrections were done, let us consider each case given and interpret it so as to give a justification for such adjustments.

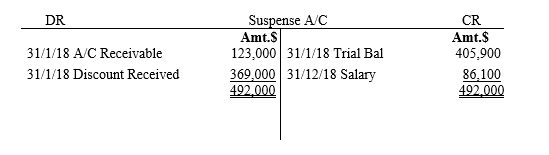

First, is the case of the suspense account which had a credit balance. The question to ask ourselves is, why credit balance and what could have caused such an entry? The answer is simple. Remember that in level two of this accounting tutorial series, we realized that errors are of two types, namely; errors that does not affect the trial balance and two, errors that affect the trial balance. In a case where the trial balance fails to balance, the problem is usually errors that are arithmetical, such as understating or overstating of account figures due to wrong subtractions, addition, multiplication, or division during computation. In such a case, the trial balance cannot have equal DR and CR sides.

Now, with that in mind, let us further interpret the error issues raised.

The first one is

(a) Whereby the total of one page of book of original entry to record sales was understated by $123,000

This means that the case was of a sales day book which is a subsidiary book. So it implies that correct entry was made in the source document that is the outgoing invoice. Again, transferring (ie, note that this was not a posting) of the individual debtor accounts to the sales day book was also ok and no error was committed. Also, it should be noted that, the corresponding posting of the specific/individual debtor values in the general ledger was correctly done. Only that the totals in that document was recorded as a certain value such as XXX, which was less by $123,000 of the actual total amount. This error made the trial balance to have unequal amounts. Hence, suspense account is introduced to tentatively correct the error. This is the reason why a reverted entry is made in the suspense account against the affected respective account.

Therefore, the respective debtor accounts were carrying the correct entries while the corresponding sales account was understated by $123,000. This contributed to trial balance failing to balance and also decreased the net profit by an equal amount.

- The account of Taurus was debited with $307,500 by mistake for sales made to Titus

This is an error of commission where by an account of the same class is wrongly debited or credited. In this case of Titus and Taurus, both are debtors hence in the class of personal accounts. The error does not affect the trial balance. So the trial balance will still balance after occurrence of this mistake. The correction simply involves reversing the entries. This error could not affect the net profit in any way for the two affected accounts are of the same class. This error did not result to the trial balance failing to balance. Hence, suspense account is not introduced to correct the error. This is the reason why the directly affected accounts were used to revert the mistake.

c) Salary account was under cast by $86,100

This is an error arising due to arithmetic problems hence the trial balance detected its occurrence. That is, the trial balance did failed to balance. Remember, that when the business paid the salary amount, the correct posting of a credit entry was made in the cashbook but on the side of the salary ledger account, a mistake of recording the figure less by $86,100 was done. This implies that the net profit was on the other hand boosted for the aforementioned amount should have been deducted but is was not the case. This error made the trial balance to have unequal amounts. Hence, suspense account is introduced to tentatively correct the error. This is the reason why a reverted entry is made in the suspense account against the affected respective account.

d.) Discount received had been understated by $369,000

Discount received transaction boosted the net profit of the business for if provided by the seller, the cost of purchases made decreases. Therefore, any understating means that profits were decreased by the same amount as indicated. This error made the trial balance to have unequal amounts. Hence, suspense account was introduced to tentatively correct the error. This is the reason why a reverted entry is made in the suspense account against the affected respective account.

e.) A machinery that was disposed at net realizable value of $442,800 was recorded as sales.

This is an error of principle whereby the entry was made in an account wrongly which is in a different class of account to the one that could have been considered for the posting. In this case, the two accounts directly affected are used to correct the error. This is because the sales proceeds were equal to net realizable value of the machinery which means there was no capital gain or loss on disposal. In fact, if there was such a scenario, then machinery disposal account which is equivalent to P&L account would be introduced to determine the profit or loss on disposal. So in this case, we leave it at that.

Having interpreted the error implications, we go to the next step of journal entries

Step five entails journal entries to initiate the process of correcting the errors as follows;

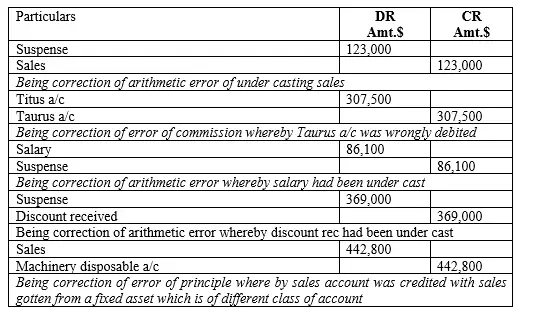

Journal entries