Allocation and apportionment of overhead cost (departmentalization process).

1.1 Introduction

Since overhead costs are not directly associated to a particular cost object, they are subjected to cost allocation and apportionment or what is commonly referred to as departmentalization process. Then the question that follows here is that “what do we mean by these two terms?” The following two definitions has clarified this meaning.

1.1.1 Definition 1

Cost allocation is the process of assigning overhead cost to specific cost object or cost Centre where it is logical to do so especially when there exists a traceable cost object or Centre. The cost object can be a product, project, or batch of a product, a customer job or a production process. Or it can be a cost Centre such as department, section or region etc.

1.1.2 Definition 2

Cost apportionment is the process of proportionately assigning overhead cost to specific cost object or cost Centre especially where cost object or Centre is not traceable against the overhead cost paid or incurred. The cost object can be a product, project, or batch of a product, a customer job or a production process. Or it can be a cost Centre such as department, section or region etc.

Terms used in overhead allocation & apportionment

2.1 Cost Centre

Definition: A cost Centre is a part or segment which can be in form of a department, a section or session, person or item of equipment which consumes economic resources (cost) of the organization under which it is domiciled and it does not generate revenue. In other words, it is a segment which carry a cost responsibility or incur costs.

NB: Cost Centre may take the form of one or more cost objects which consume economic resources.

2.2 Cost Object

Definition: Cost Object is a product or service which is being manufactured or produced and various costs of production can be ascertained through it. For example,

Physical good: A cup, a ruler, a text book, batch of bananas, a piece of cake, a car, ball, and laptop etc.

Service provision: Treatment for malaria; teaching service per a semester; Consultancy services in tax compliance requirements; night watchman services; car wash services etc.

2.3 Direct Cost

Definition: Direct cost is the economic resources forgone by the organization to directly produce or manufacture a particular product.

2.4 Cost Unit

Definition: Cost unit is the indicator or measurement gauge used to define a unit of the cost object so as to make it possible to allocate/apportion cost elements or ascertain costs. For example, a cost object can be expressed in terms of kilograms, litres, newtons, kilometers, and kilowatts.

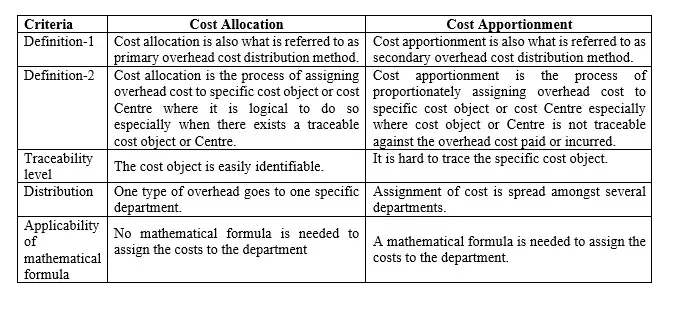

Difference between allocation and apportionment of overhead cost

3.1 Introduction

The aspect of overhead cost is always confusing to the learner when distinguishing the activities of allocation and apportionment. The following demarcation gives a clarity of the difference between the two aspects as follows;

Critical differences arising from overhead allocation and apportionments

4.1 Introduction

There is always a lot of confusion amongst learners when addressing the afore mentioned two concepts. There is also further confusion on other similar but different terms as used in Cost Accounting. The following tables briefly portrays further differences as indicated below;

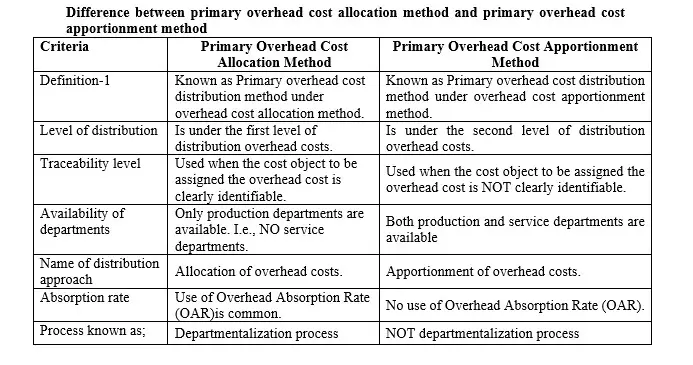

4.1.1 Primary Overhead Cost Allocation Method and Primary Overhead Cost Apportionment Method.

The aspect of primary overhead cost allocation method is always confusing to the learner, even some times the tutors and users of cost accounting information for in some cases the term primary overhead cost apportionment method is used in place. But do they mean the same? No, they are not similar. So, where is the difference? The following table portrays the differences;

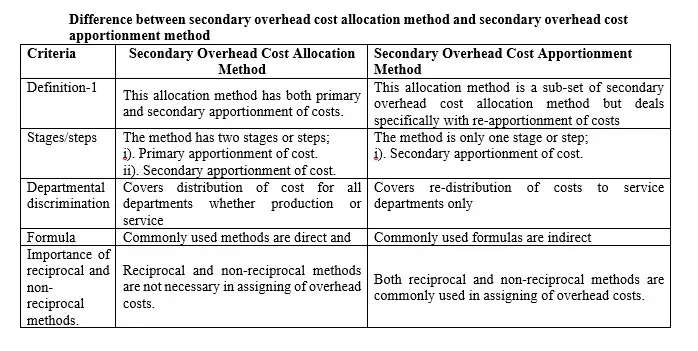

4.1.2 Secondary Overhead Cost Allocation Method and Secondary Overhead Cost Apportionment Method.

The aspect of secondary overhead cost allocation method is always confusing to the learner, even some times the trainers themselves for in some cases the term secondary overhead cost apportionment method is used in place. For your information, the two terms are quite different. The following table portrays the differences;

Classification of overhead cost distribution

The in-depth discussion on how overhead costs is distributed, this activity is divided in to two categories which are distinct from one another. These classes are;

5.1 Primary Overhead Cost Distribution Methods.

5.2 Secondary Overhead Cost Distribution Methods.