Costing methods: definition; classification; characteristics; difference and advantages

1.1 Introduction

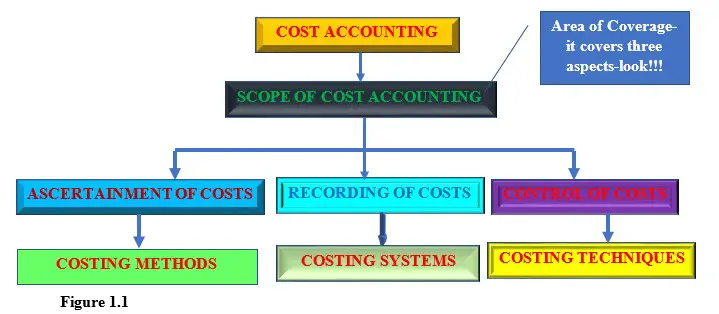

The concept of costing methods is a very confusing topic to many scholars such as learners, researchers and tutors. This is because there are other similar terms used in cost accounting such as costing systems and costing techniques which have not yet been made clear to the users of this information. This makes many readers get lost over this key concept which is paramount in cost accounting. Now, in this article, we have simplified the concept by introducing Figure 1.1 on the scope of cost accounting which is in our article Introduction to cost accounting-Definition, Theory and Practice, Scope, Difference Between Cost Accounting and Financial Accounting . So, before we give the point of detail below, familiarize yourself with this generic Figure 1.1 borrowed from the aforementioned sub-title as follows;

Definition and classification of costing methods

Definition-1; Costing method is the approach or style or tactic adopted by an organization to collect cost data in a more appropriate manner so as to establish the total cost and cost per unit of the final product produced or manufactured. The final product can either be physical goods or services.

So, you see, costing method is an approach of cost data collection which is under “Ascertainment of Cost” umbrella and you know that Ascertainment of Cost aspect is a thematic sub-topic of scope of cost accounting as shown in Figure 1.1 above.

There are several methodologies utilized by different organizations, which is determined by the nature of products being manufactured. This viewpoint of the diverse needs of different organizations necessitates consideration of the criteria used in classifying the costing methods.

2.1 Classification Criteria: Unit Costing

This criterion involves use of a single or unit (i.e., output) of a product so as to accumulate and analyze the diverse cost elements used in production. The criteria advocates accumulation of all relevant costs incurred or paid to completely produce either a single product which is large through a manufacturing process which is continuous. Under this classification criteria, there are two main types of costing methods, namely; Specific order or job costing and Continuous operation or process costing. This criterion leads us to two mainstream costing methods;

2.1.1 Job Costing

This is a costing method which entails job numbers as the final products during production process. Each job number is dissimilar to the others being undertaken by the firm.

2.1.2 Operation Costing

This is costing method which entails production of mass number of units in a process which may be one or two processes. The products are usually many at the end of the final process and are uniform in nature.

Characteristics of costing method

3.1 Introduction

In this section, the discussion is on features that differentiate costing method from costing system and costing techniques. So, the characteristics are as follows;

- The methodology used is appropriate such that the main objective of ascertaining the total and per unit cost is achievable.

- The method is applicable to products which have commonality characteristics.

- The ascertainment of cost is most of the times involves some repeated activities or repetitive processes.

- The process of cost ascertainment is within a specific period of time usually a year.

- Costing method entails both the determination of the overall cost and the per unit profitability of the product.

- The activity of costing method is periodical in the sense that the aspect of cost ascertainment is limited to a specific accounting period.

- In addition to economic costs, the costing method incorporates other costs inform of normal and abnormal losses.

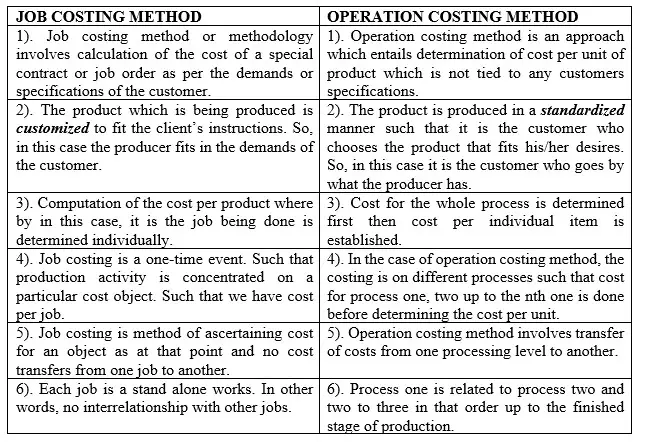

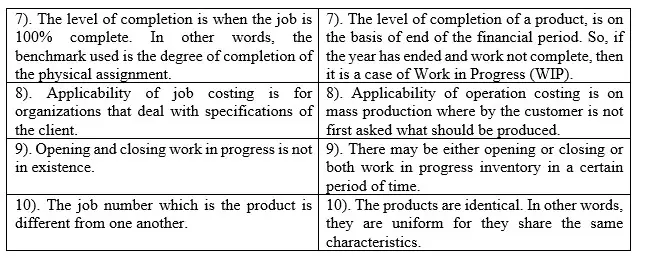

Difference between job costing and process costing

4.1 Introduction

Job costing method and operation costing methods are all approaches of ascertaining the total cost and by extension the cost per unit of an end product. However, the two methods are different as far as the following aspects are concerned;

Advantages and disadvantages of costing methods

5.1 Introduction

The following are some of the advantages and disadvantages of costing methods, be it job or operation costing methods.

5.1.1 Advantages of costing methods

1). Minimization of production cost

By reducing inefficiencies associated with wastes and loses during production overall costs incurred in production are reduced.

2). Help in the process of profitability determination.

Ascertainment of costs guide the producer to know exactly the total cost of the final product so as to set an appropriate profit margin.

3). Basis on purchase or manufacture of a product decision

The cost ascertainment approach is timely in guiding the management on whether it is economical to produce or purchase a certain product.

4). Control of costs

Costing methods help in comparing either previous year’s cost level so as to manage the consumption of the economic resources. This can be achieved by use of budgeting tool.

5). Tax matters

Taxation of firm’s profitability by the government is pegged on the cost of production. This helps the government to ensure that fairness prevails to avoid over or under taxation.

6). Bargaining power

The employee’s or worker’s union may use the cost of production as per cost ascertainment to argue their case. Hence win in court.

7). Delegation of responsibilities to employees

The workers are assigned their duties based on the costing method used. This helps in ensuring that no idle employees who are paid. Hence control labor cost levels.

8). Preparation of Financial statements

Costing method is a tool which is helpful even in financial accounting during preparation of end of the year financial reports. This is because the reports such as closing inventory for finished goods, work in progress and raw materials are associated with this aspect.

9).Avoidance of collusion and fraud by workers

Costing methods are ways of ensuring that materials and other inputs are not misused by corrupted workers who may sell some to make personal gain at the expense of the quality of the goods being produced.

5.1.2. Disadvantages of costing methods

The limitations of the costing methods are as analyzed as follows;

1).Historical data

The data which is always readily available in the books of accounts of the business is the financial data which is historical and not much needed in decision making. While for costing data which is needed for costing methods deals with the future decision making is missing or scanty. This disparity in need gap curtails costing method procedures.

2). Under-utilized capacity

Costing methods works with the assumption that production capacity is fully utilized. If this is not the case, then the results presented at the end of the year will be misleading.

3). Problem of over and under absorption of overheads

Since costing methods is a process which has to do with estimation of the total cost of a product. Some aspects of this endeavors are standardized or pre-determined and so, when actual outcome takes place, it can be a case of over or under absorption of overheads. This brings inconvenience of planning.

4). Lagged costing method information

Most of the times, costing require furnishing of timely information to the costing department which may not be the case for the various departments concerned with this exercise may have individual departmental challenges which can result to failure on timely costing exercise.

5). Non-flexibility of a costing system

Some costing system which are concerned with recording of the costing information may be faulty or rigid and this hiccup may deny the objective of ascertaining of cost on a particular product. Hence adversely affect costing method used.