Joint product cost apportionment using sales value method: introduction; steps; advantages and disadvantages and examples

1.1 Introduction

There are THREE main methods which can be used to apportion the costs. These methods are, namely;

i). Physical unit Basis.

ii). Sales Value Basis.

iii). Sales Value Less Post Separation Cost Basis.

This article only focuses on the sales value basis or method.

NB: This method is applicable where at the split off point, the different products are saleable.

1.2 General Step by Step Guidelines for Apportioning cost using sales value method.

The following 4 steps will guide you in apportionment of costs and also in the determination of final profits if these circumstances exist.

STEPS 1: Identification of the separation parameter.

Identify the most suitable SALES metric or measuring indicator which can easily be used to demarcate the two or “n” number of the joint products. In this case is only sales value basis.

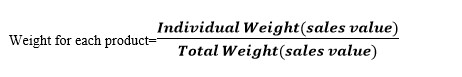

STEP 2: Compute the total cost for each product using the sales basis model/formula.

This goal can be achieved by

STEP 3: Determination of sales value.

Since the aim of the whole process of separation of those products is to determine the profits associated with that particular product, then sales value is computed at this stage. With the specific selling price for each product, determine the sales value.

STEP 4: Determine the profit for each product.

After determining the sales value for each product, subtract the apportioned cost for that particular product from the corresponding sales value for each product. Do the same for all products.

Formula: Profit=Sales-Apportioned Cost for each product. This objective can be achieved by use of profit statement.

1.2.1 Example

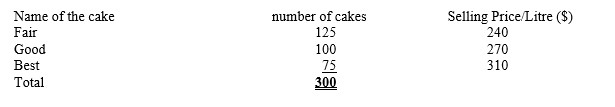

Egg York cake bakers co. ltd deals with the production of THREE types of cakes, namely, Fair, Good and Best. In the month of December, the company incurred a total cost of $60,000 to produce 300 pieces of cakes.

Required

Using sales value Basis methods of cost apportionment;

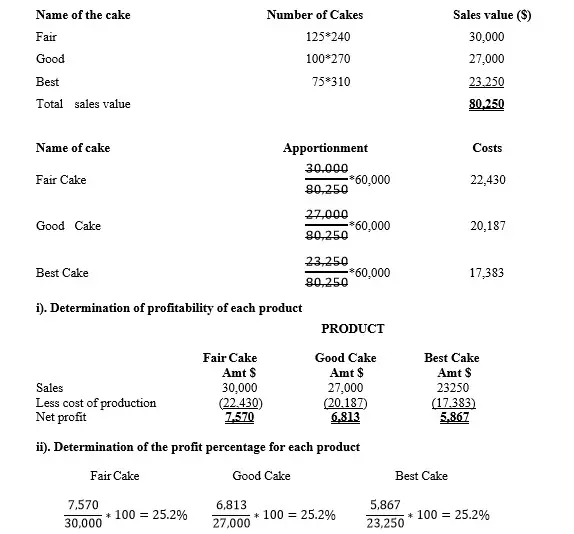

i). Determine the profitability level of each type of cake.

ii). Determine the profit percentage for each product.

Solution

Metric used to separate is sales value

Advantages of sales value method in joint product costing

The following are some of the advantages of using sales value method of valuing joint products;

- Suitable where the market price in the economy is stable. This method considers market value of products as basis for allocating joint cost. This is okay where the market is not turbulent.

- Suitable where it is possible to determine the market value of a product at split-off point. That is, if the joint products can be sold at the split-off point, then it is okay to utilize this method.

- It is a useful method when the market prices for the product is predictable due to its stability.

- Uniformity in profit margin-the common practice of most firms is adoption of pricing policy where by the margin is pre-determined. So, this approach fits well.

- Logical in pricing- use of sales value approach is plausible or practical for the main objective of production is to generate sales. So, sales value is a suitable indicator in valuation of joint product.

Disadvantages of sales value method in joint product costing

The following are some of the disadvantages of using sales value method of valuing joint products;

- Uses selling price at the time of split-off and if the market price is volatile, this may result in to variations in valuation of the final products at different periods.

- Unavailability of selling price at the time of split-off point. This may result to no basis of valuing the final product produced.

- Not suitable for decision making by the management. You see, the issue of market price has to do with external forces which may not be controlled by the management. So, the method turns to be redundant.

- Time-consuming-the method is cumbersome to apply and therefore it takes a lot of time to establish the value of the joint product at the point of split-off.