Investors Risk Profiles

The position that an investor finds himself at the end of the investment period is determined by the risk attitude of that investor. An investor falls under either risk seeking, risk neutral or risk averse.

The point here is that at the end of the investment period, one either is richer, poor or maintains the same status quo as it was before investing in any particular asset or portfolio.

An investor who is risk seeking is also said to be a risk lover for he/she is desiring the best outcome or returns of any investment he chooses. This attitude is so propelling, so pushing, so thriving, so proactive such that an investor will pay a premium to acquire or enjoy more expected returns in the future.

This investor can borrow from the market to invest in a risky venture due to the attractive high return/premium tight to that asset or portfolio.

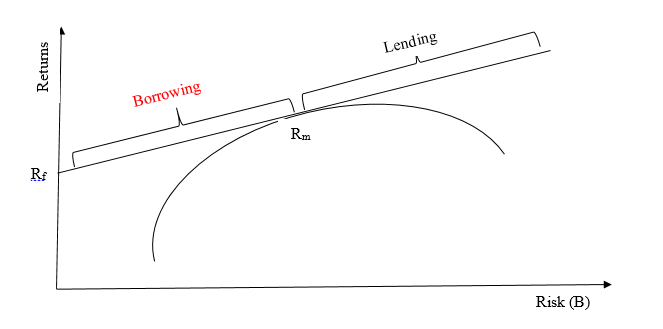

Capital Asset Pricing Model (CAMP) and Risk Seeking Investor

CAPM is an investment model that was developed by Harry Markowitz in 1952. This model applies in the case of a risk seeking investor for he/she will borrow from risk free market and lend in a risky market. What do we mean by borrowing from risk free market to lend in a risky market portfolio? Look at the below CAPM illustration.

Explanation:

Assume that an investor has $100,000 to invest in the market.

If he is a risk seeker, he will borrow from the risk free market and invest in the risky market. That is the risk seeker will not spend his $100,000 on buying risk free asset (this is as good as borrowing), instead, he will invest in the risky assets (i.e lending).

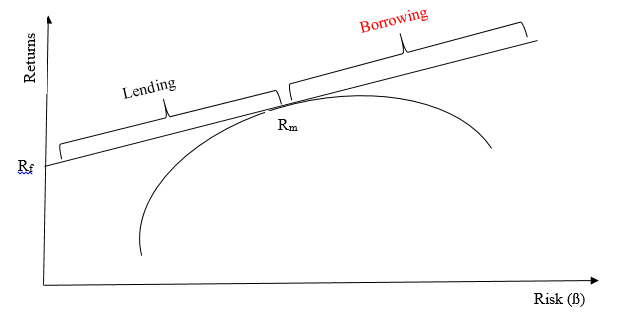

Capital Asset Pricing Model (CAPM) And Risk Averse Investor

CAPM model also applies in the case of a risk averse investor for he/she will borrow from risky market and lend in a risk free market. What do we mean by borrowing from risky market to lend in a risky market portfolio? Look at the below CAPM illustration.

Explanation:

Assume that an investor has $150,000 to invest in the market.

If he is a risk averse, he will borrow from the risky market and invest in the risk free market. That is the risk averse investor will not spend his $150,000 on buying risky asset (this is as good as borrowing), instead, he will invest in the risk free assets (ie lending).

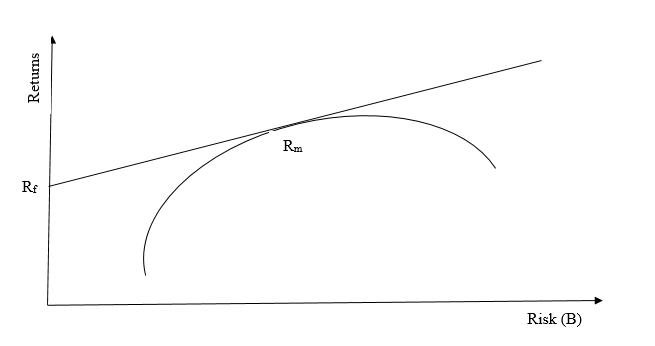

Capital Asset Pricing Model (CAPM) And Risk Neutral Investor

CAPM model also applies in the case of a risk neutral investor for he/she adopts a “do nothing strategy”. Look at the below CAPM illustration.

Explanation:

Assume that an investor has $150,000 to invest in the market.

If he is a risk neutral, he will not take a lead in borrowing or lending from either the risky market or the risk free market. Instead, he will wait for the risk seekers and risk neutral actions in the market and then he/she will follow suit. That is, he will wait for the risk seekers to invest first and he/her will follow that action. Or if he/she is following a risk averse investor, he/she will follow the same suit and invest the $150,000 accordingly or fail to do so.