What is Total Asset Turnover Ratio ?

This refers to level of contribution made by total assets towards sales or turnover generation. Total Asset effectiveness in its functionality is the factor that determines sales value will be more or less (holding other factors such as selling price constant). In other words, this proportion displays the proficiency of total assets in the business

Demonstration

Where;

Total Assets is the sum of all the non-current asset and current asset

Our concern in this ratio is to assess the contribution total assets will make towards generation of sales.

Current Assets

Look at inventory which is part of current asset. How does it contribute to nest sales?

There are two ways, one; it is a short term investment for in case one is selling goods, the inventory is readily available and hence sales are possible other than in another case where by the business is out of stock. Two, availability of inventory all the time gives the customers an assurance that they will never lack supply. This in exchange ensures market share/customer retention is high.

Non-current assets

On the other hand, non-current assets contribute towards sales because it participates in actual production of the goods needed in the market if non-current assets were purchased for production purposes.

Still, non-current assets such as warehouses contribute to sales for it provides safe storage such that if the goods were perishable such as horticulture products, they do not go bad and this strategy ensures that sales are maintained.

Example

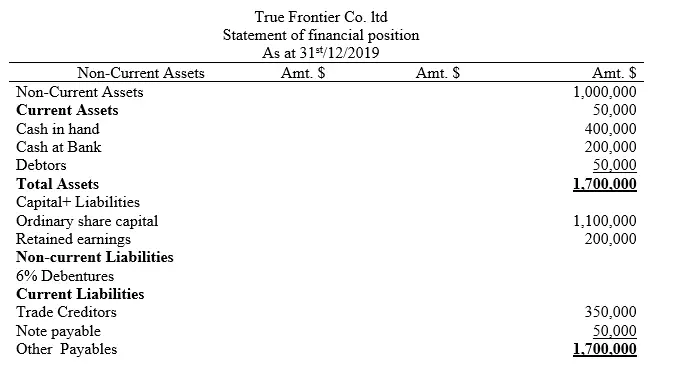

True Frontier Co ltd provided you with the following statement of financial position

Additional information

Gross sales for the year ended 31st/12/2019 was $1,050,000

Returns inwards was $50,000

Required

Determine the total asset turnover ratio and interpret the results

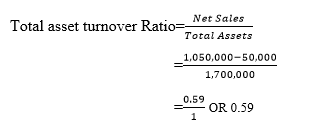

Solution

Interpretation

For every 1.00$ invested in total assets, it generates $0.59 of sales of the business.

Applicability of total asset Turnover Ratio in Decision Making by Management

Total asset turnover ratio is expressed as

Denominator factor; This factor is total asset and it is a controllable factor by the management.

The management has to decide how much total assets will be engaged in sales generation. So the total cost of acquiring these resources are in the hands of the management. Also the quality of the assets used is determined by the management. Therefore, if assets chosen are of high quality, it means that the speed at which conversion of resources in to sales will increase for the betterment of the business. If poor quality assets are utilized, low sales value is realized

Numerator factor; This factor is represented by net sales and the changes that occur in it are majorly from the total asset changes made. So the management do not need to invest its decision making time to chant the way forward for this may result to dismal outcome.