Accounts Payable

Any time you hear of a PAYABLE, no matter what is being referred to, you should know that we are referring to a debt/liability. For example if we are talking of Z payable, X payable Y payable, then it implies that there is a debt of Z,X, and Y nature to be paid in the future respectively.

Accounts Payable is the amount of unpaid debt originating from goods bought on credit for re-selling purposes by the business in question. It applies when the business acquires goods for re-selling purposes from the supplier on credit basis. It is also referred to as trade creditors.

Accounts Payable arise when the business in question is not in a position to purchase inventory on cash basis hence borrow from the supplier through credit purchasing. It is a way of financing a business for a short period. Sometimes the instrument use is referred to as trade creditors.

Example

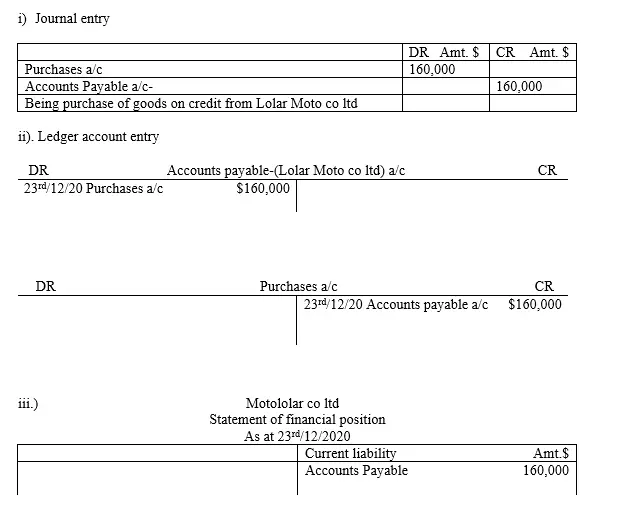

23rd/12/2020, Motololar co ltd purchased goods for reselling purpose worth $160,000 from Lolar Moto co ltd on credit. Terms of repayment is in two months.

Required

- Show the journal entry for the aforementioned transaction

- Show the ledger account entry thereof

- Extract a statement of financial position to show how this transaction was treated

Solution

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.