Amortization in debt repayment

Amortization is the process of writing off the economic value of intangible assets such as royalties, copyrights, and trademark and patent rights. This term is also used to imply spreading of repayment amounts of debt across a specific period. According to IFRS, it is referred to as intangible asset impairment.

Amortization applies where intangible assets or liabilities lose their economic value-i.e fair value over time.

Amortization is required to show the net book value of the asset or liability after a certain period so as to know the financial position of the business.

Amortization is used by debt lenders to show the schedule of repaying a certain amount of money. It can also be used by the accountant in an organization to know the time duration remaining to expiry of a property right.

Example

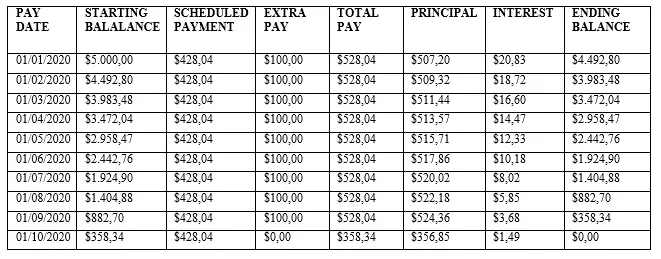

In a case of a debt, an amortization table/schedule is used to help in computation of the amount to be deducted every other period ended, be it a month, or year.

Suppose Molly extended a debt to a certain client whose repayment terms and conditions were as follows

Principle amount of $5,000 at an effective interest rate of 5% per annum for one-year. Then the amortization schedule will appear as follows for the one year

So part of the amortization schedule will be as follows;

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.