Balance sheet and circulating capital-a new look

“Why do Small and Medium Enterprises (SMEs) fail in their early stages?” Janet asked me this question in a locally organized SME summit, whose main objective was interrogating the challenges faced by SMEs in the world.

In answering this question, I introduced the matter of balance sheet and circulating capital of SMEs. In this discussion, I highlighted the aspect of fixed and circulating capital components in the balance sheet.

What is Circulating Capital?

Circulating capital that part of total capital that is used in the day to day running of the business. It is the capital used to purchase trading inventory, acquisition of raw materials especially if the business is of manufacturing nature and payment of operating expenses.

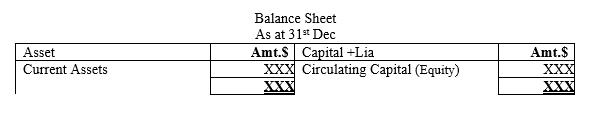

This aspect can be represented by a balance sheet as follows;

NB: Circulating capital is always converted to current assets such as inventory and again back to cash in hand within a period of one year.

What is Fixed Capital?

Fixed capital is part of total capital that is used to finance fixed assets that are used for income generation such as production plants or service provision machinery. These assets are associated with return on investment (ROI).

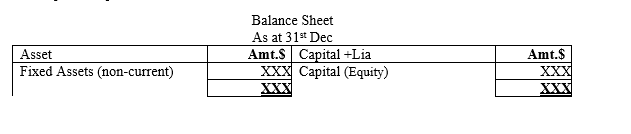

This aspect is represented in the balance sheet as follows;

NB: Fixed capital is converted to Fixed assets such as plants, properties and equipment for a period of more than one year.

Circulating Capital and Misappropriation of Cash resources by SME owners

Owners of SMEs fail to interpret the implications of circulating capital. As a result, capital in circulation converted in to cash in the cash box is assumed to be profits made by the business. hence, it is prone to misappropriation. That is, at this point, the cash generated may be used to finance personal needs. As a result the capital base of the business reduces

Example

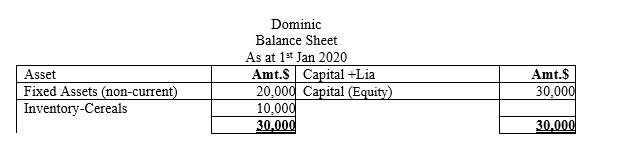

Dominic is a business man dealing with cereals. On 1st/01/2020, his balance sheet was as follows;

Additional information

- During the year, he made sales amounting to $12,000 in cash.

- Out of the $12,000 cash generated, he spend $4,000 to pay his daughter’s college fees

Required

Demonstrate how cash resources were misappropriated and the financial position implications

NB: Assume that the organization’s markup is 20%

Solution

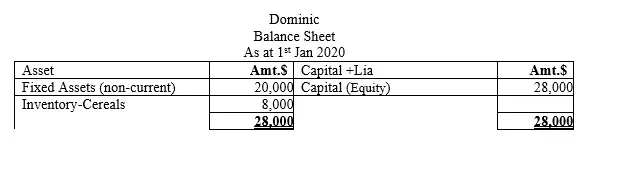

Profit made was sales-cos

12,000-10,000=$2,000

Amount used for personal use was $4,000, which was in excess by $2,000. This means over and above the profit generated of $2,000, the owner wen a head and chopped the circulating capital by another $2,000. This implies that overall capital base was shocked. The affected balance sheet will be as follows

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.