Classification of ledger accounts

1.Personal accounts

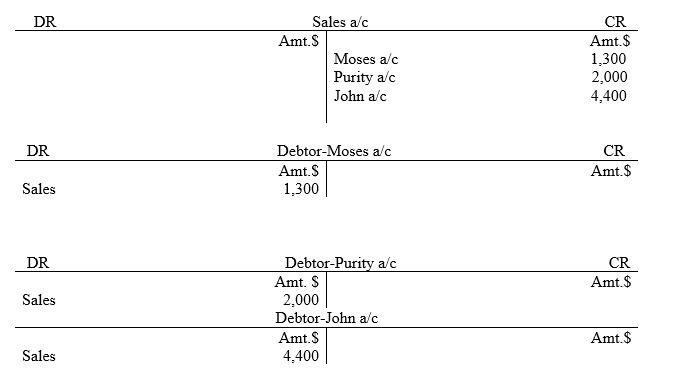

These are accounts which represent a relationship between the firm in question and individual(s) whether natural persons such as Moses, Purity and John or artificial person such a limited company and partnership e.tc.

Personal accounts are further sub-divided into debtors and creditor accounts.

i)Debtor account

Debtors account represents a relationship between the firm selling the products and the person who buys on credit. In this case, the debtor account represents a current asset.

Example

Tip top ltd is a merchandize company dealing with stationeries. On 10th/03/2014, the firm sold goods on credit to the following individual traders

Required

Show the accounting entry in the respective personal debtor accounts

Solution

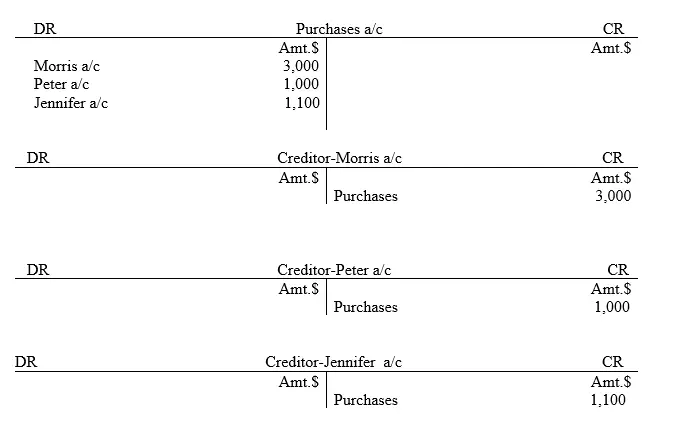

ii)Creditors account

Creditor account represents a relationship between the person buying the products and the person who sell on credit. In this case, the creditor account represents a current liability. Such examples of account are trade creditors and capital accounts.

Example two

TT ltd is a merchandize company dealing with motor vehicle accessories. On 19th/010/2016, the firm purchased spare part goods on credit from individual traders

Required

Show the accounting entry in the respective personal debtors accounts

Solution

2) Impersonal accounts

Impersonal accounts is the opposite of personal account hence the account does not represent a form of debtor–creditor relationship. This account is further classified as real and nominal types.

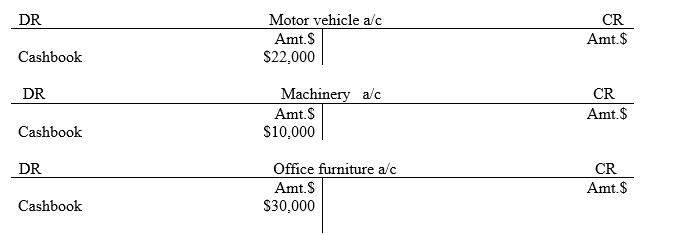

i)Real accounts

This account represent assets or properties or goods that one owns. It is further classified as either tangible or intangible accounts. Tangible accounts entail those items/assets which physically exist such as buildings, land, cash and fixtures and fittings. Intangible category involves assets which are invisible such as patent right, copyright and franchise or investment in securities such as bonds, shares e.t.c.

Example

Power P ltd started a business on 1st/02/2020. The firm purchased the following assets on cash

Motor vehicle $22,000

Machinery $10,000

Office furniture $30,000

Required

Make accounting entries for the above non-current assets in the respective real accounts

Solution

ii)Nominal accounts

Nominal account are accounts for recording non-touchable or non-physical items. This classification of account is further sub-divided into income and expense items.

Income account

Income account is an account where gains generated in the course of doing business is recorded.

Income account is further sub-divided into trading, capital gain and operating income account.

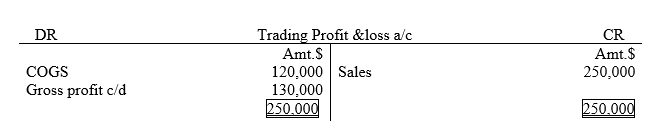

Trading income account

This is an account where returns or gain generated as a result of undertaking the normal or ordinary trading activities of the organization such as gross profit is concerned.

Example

The following information was extracted from the books of Peacock ltd

Sales $ 250,000

COGS $120,000

Required

Prepare a trading account and determine the trading income (gross profit).

Solution

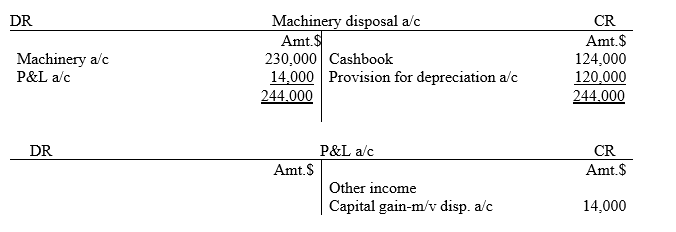

Capital gain account

This is an account established represent capital gain of the business due to disposal of a fixed asset or sell of an invisible investment such as shares or common stock. The following simple example will give you an hint…

Example one

Beware co ltd disposed its machinery assets. On sale, the cash received was deposited in the bank

Amt. $

Cash proceedings 124,000

Machinery-at cost 230,000

Cumulated depreciation 100,000

Required

Prepare machinery disposal account to establish the capital gain generated

Solution

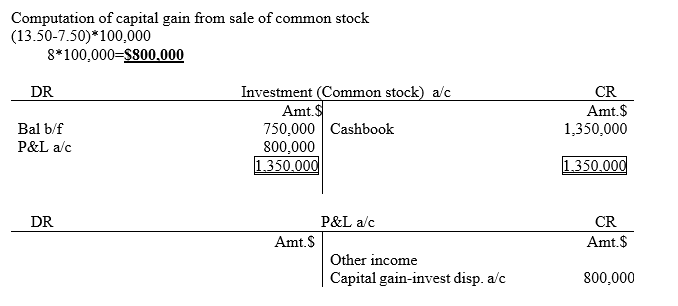

Example two

Walk over co ltd had bought 100,000 Standard Chartered Bank common stock in 2018 at a market price of $7.50. In January 2021, the company identified a new lucrative project that required immediate financing. The company then sold the 100,000 ordinary shares whose current market price was $13.50. The sales proceeds was received through a check

Required

Show the capital income account to record the capital gain realized

Solution

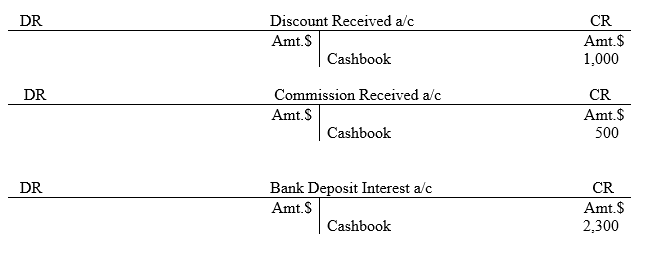

Operating income

The other category of income is referred to as operating income. This category entails incidental income generated in the normal business activities. A good example is net profit of a business, commission received, discount received and bank deposit interest.

Example

KK co ltd is a company which provide general services. The following are the revenues generated at the end of 31st/12/2020

Amt.$

Discount receivables 1,000

Commission received 500

Bank deposit interest 2,300

Required

Record the above items in their respective operating income accounts

Solution

Expenses

Expenses are consumed asset. They are further demarcated into, one; trading expenses such as purchases and carriage inwards, which is also referred to as transport expense on goods purchased and two, operating expenses.

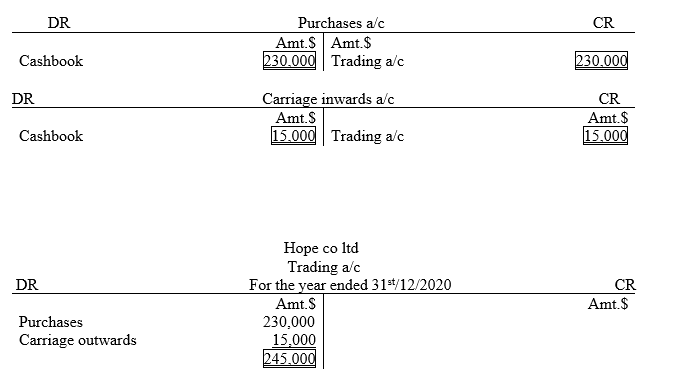

Trading expenses

These are expenses paid or incurred by the business when carrying on the ordinary/normal business activities. Normal business activities refers to the activities undertaken by an organization as stated in the object clause in the memorandum of association document. Example of such trading expenses are purchases and carriage inwards or transport on purchases.

Example

The following transactions were extracted from the books of Hope ltd for the year ended 31st/12/2020. They were all paid for by cash

Amt. $

Purchases 230,000

Carriage inwards 15,000

Required

- Record the above transactions in the respective trading expense account of Hope co ltd

- Close the accounts to the respective financial statement as it would appear at the end of the financial period

Solution

NB: Total trading expense was $245,000 and such expenses of trading nature are charged to trading account

Operating expenses

These are expenses paid or incurred by the business in exchange of service provision from the suppliers and such expenses enable the firm in the daily running needed to generate income. Example of such operating expenses is electricity, carriage outwards, insurance and salaries just to mention but a few.

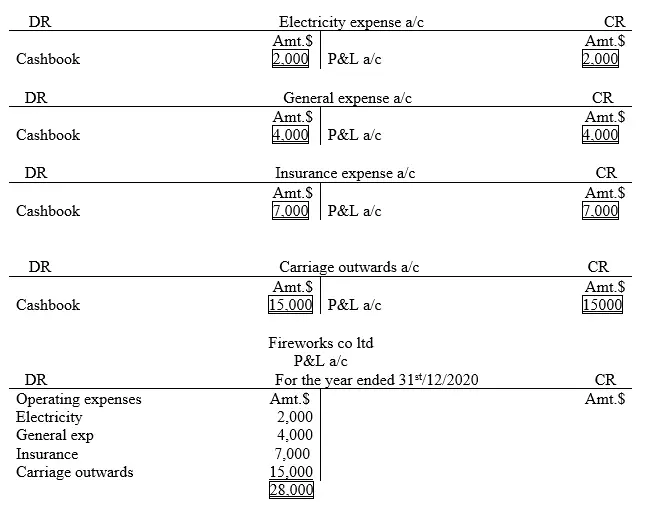

Example

Fireworks co ltd paid the following expenses in cash in the year ended 31st/09/2019

Amt.$

Electricity 2,000

General expenses 4,000

Insurance 7,000

Carriage outwards 15,000

Required

- Record the above transactions in the respective operating expense account of Hope co ltd

- Close the accounts to the respective financial statement as it would appear at the end of the financial period

Solution

NB: Total operating expense was $28,000 and such expenses of operating nature are charged to profit & loss account

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.