Salvage value in computing depreciation

Salvage value is also referred to as scrap value or residual value and it is the written net book value that arises when the business is trying to estimate the amount of cash that can be realized on selling/disposing the non-current asset after its useful life or economic life.

The key assumption when a fixed asset, what we also refer to as non-current asset is that a new asset will undergo wear and tear process on its usage such that at some point, the asset is no longer useful.

So the question is, if we decide to dispose it (sell), how much cash can it fetch? This question is subjective to the individual assessment of the management or the technical engineer making the assessment which is pegged on past experience. Therefore, it means that the salvage/scrap value may assume a particular monetary value depending on the assessment or the estimation made. This value then can range between zero value, meaning that the fixed asset item is worthless and just need to be dumped after usage or it can be X value which is more than zero (X>0).

Implications of Salvage Value on;

i) Depreciation amount

The higher the salvage value, the lower the depreciation amount t be charged in profit and loss account at the end of each financial year.

Example one

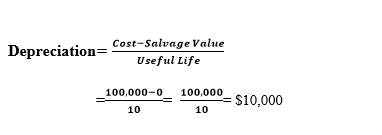

1st/01/2015, Rolly co ltd bought a machinery at $100,000 in cash with a useful life of 10 years and with salvage value of zero (0). Depreciation per annum is on straight line method.

Required

Compute depreciation amount to be charged for each year for the next ten years.

Solution

Example Two

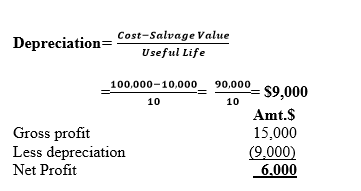

Assume that 1st/01/2015, the same Rolly co ltd bought a machinery at $100,000 in cash with a useful life of 10 years. Assume that the salvage value was ten thousand USD(10,000). Depreciation per annum is on straight line method.

Required

Compute depreciation amount to be charged for each year for the next ten years.

Solution

Conclusion: You can see that the lower the estimated salvage value, the higher the depreciation amount to be charged per annum and the vice versa is true.

ii)Net profit of the company

The overall net profit of the business will be influenced by the salvage value. Such that when the estimated salvage value is low the computed net profit will be low and when the estimated salvage value is high the net profit is high. In other words, there exists a direct relationship between salvage value and net profit of the business

Illustration

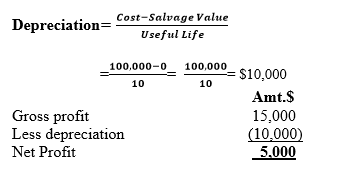

Assume the two examples given of Rolly co ltd and assume that the gross profit for the year was $15,000

Example one

The computed depreciation amount is

Example two

If the computed depreciation amount is

Then it is true that the net profit of the business is directly related to estimated salvage value

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.