What is capex ?

CAPEX in full is Capital Expenditure and it is the expense paid or incurred to acquire goods or property to be used for day-to-day operations of the business. It applies where the intention of purchasing the good or property is for furthering business operations but not for re-selling purposes.

CAPEX works as capital outlay and it is subjective to depreciation. The initial cost incurred to acquire these type of assets is an investment for the organization. Any additional cost of the same nature or for mega repair is usually capitalized.

Example of CAPEX

Is when one pays or incurs expenses to acquire fixed assets/non-current assets such as fixtures and fitting, motor vehicle, machinery, office equipment, loose tools and plants (heavy earth moving machinery), land and buildings, will be categorized as fixed assets. On acquiring them, a corresponding ledger account named after the acquired fixed asset is opened.

Scenario one: If the business purchases office equipment, an office equipment account will be opened for this is a case of capital expenditure.

Example

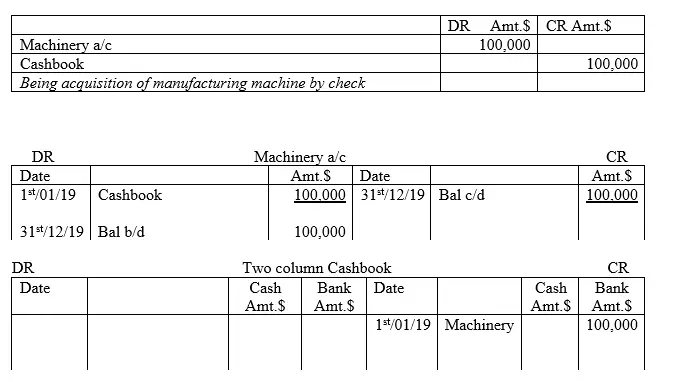

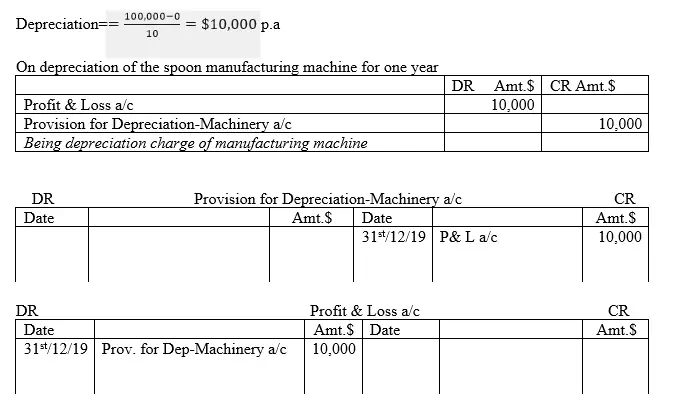

Power House co ltd manufacture kitchen utensils for cooking. On 1st/01/2019, the organization bought a spoon-manufacturing machine of $100,000 by check. The machine has useful life of 10 years. The machinery engineer assessed and concluded that the appropriate depreciation approach is the straight line method with zero salvage value for the machinery cannot be disposed after the ten year of usage.

Required

Show the journal and ledger account entries at the time of purchase and at the end of one year

Solution

On purchasing of the spoon manufacturing machine

When the machinery depreciates at the end of the financial period

Workings

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.

About the Author - Dr Geoffrey Mbuva(PhD-Finance) is a lecturer of Finance and Accountancy at Kenyatta University, Kenya. He is an enthusiast of teaching and making accounting & research tutorials for his readers.