Provision for discount allowable

This level of accounting tutorial series focus on the allowance created by the business to increase the probability of making an accurate estimate of the expected receipts from the debtors or payment to be made to creditors. Remember that in level two/intermediate level, we only considered discount allowed and discount received which was categorized as operating expense and operating income respectively for in this case, actual financial loss and actual financial gain is realized accordingly.

Provision for discount allowable is an additional allowance created to adjust the debtor values in addition to losses experienced from the aforementioned cash discount and provision made on doubtful debts. The lesson below substantiates this concept and demonstrates the accounting treatment of discount allowable allowance.

Provision for discount allowable is an additional allowance offered to the customer by the business in addition to the normal cash discount allowed, bad debt written off and provision for doubtful debt. Provision for discount allowable comes about especially when management feel that there are still some chances/probability of some or all debtors managing to pay their debts within a certain discount allowance bracket term. For instance, the debtors who are yet to pay their debt may comply with the cash discount terms given in the future. That is, if debtors who bought goods today are to pay in three months period and the terms of credit are as follows;

If pay within first 10 days, a cash discount of 15% will be provided.

If pay within first 30 days, a cash discount of 10% will be provided.

If pay within first 60 days, a cash discount of 5% will be provided.

If pay after 60 days are over, no cash discount will be provided.

The debtors may enjoy this anticipated allowance terms aforesaid if they comply and it is on this basis that discount allowable is computed. As an entrepreneur/learner, remember that for discount allowed expense is associated with the debtors who have already paid their debts in the previous period hence an actual financial loss has been suffered by the business. Whereas, the provision of discount allowable, is an estimation of the anticipated financial loss if and only if (iff) the debtor(s) clears their debts within the discount bracket given. So just like provision for doubtful debts, discount allowable is an allowance but not a business expense.

Accounting treatment of Provision for Discount Allowable

Provision for discount allowable is treated in the same manner as it is the case of provision for doubtful debts. However, the amount computed is based on the good debtors after subtracting the provision for doubtful debts from debtor’s value.

This can be summarized as follows;

Case one: If First Time Provision for Discount Allowable

NOTE: The first time provision for discount allowable amount is treated as an operational expense hence charged in the DR side of P&L A/C

i) Arithmetic Approach;

ii) Journal entries;

Amt.$

DR P&L Account XX

CR Provision for discount allowable XX

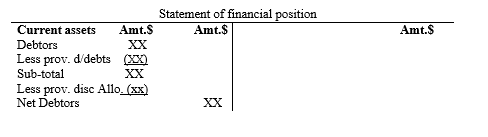

iii) Statement of financial position Extract (vertical format);

Case two: Increase in Provision for Discount Allowable Amount

NOTE: The amount of increase in provision for discount allowable amount is treated as an operational expense hence charged in the DR side of P&L A/C

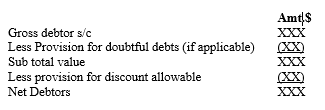

i) Arithmetic Approach;

Amt. $

Gross debtor s/c XXX

Less Provision for doubtful debts (if applicable) (XX)

Sub total value XXX

Less Provision for discount allowable (XX)

Net Debtors XXX

ii) Journal entries;

DR P&L Account XX

CR Provision for discount allowable (with increase) XX

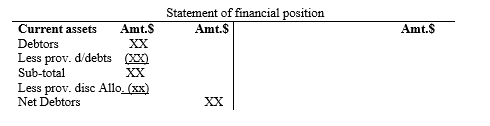

iii) Balance sheet Extract (vertical format);

Case three: Decrease in Provision for Discount Allowable Amount

NOTE: The amount of decrease in provision for discount allowable amount is treated as an operational income hence charged in the CR side of P&L A/C

i) Arithmetic Approach;

Amt. $

Gross debtor a/c XXX

Less Provision for doubtful debts (if applicable) (XX)

Subtotal value XXX

Less provision for discount allowable (XX)

Net Debtors XXX

ii) Journal entries;

DR Provision for doubtful debts (with decrease) XX

CR P&L Account XX

iii) Balance sheet Extract (vertical format);

Illustration one

Your co. Ltd provided you with the following debtor related information for three years as follows;

Amt.$

31/12/2017 Debtors 200,000

31/12/2018 Debtors 250,000

31/12/2019 Debtors 220,000

The management set a discount allowable policy effect from 1/1/2017 of 10% of the good debtors in each financial year.

Required

Enter the following transactions in the respective ledger account and balance the accounts where applicable, prepare profit and loss account and extract the respective statement of financial position for the three years, 2017, 2018 and 2019

Solution

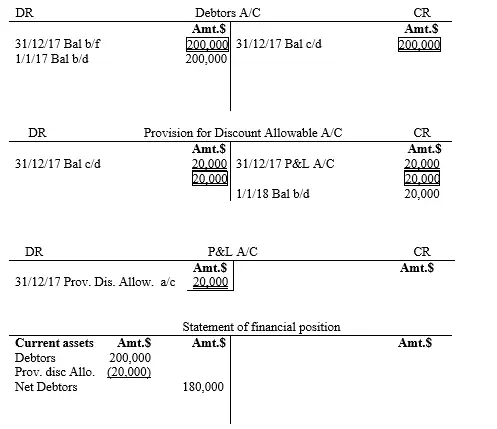

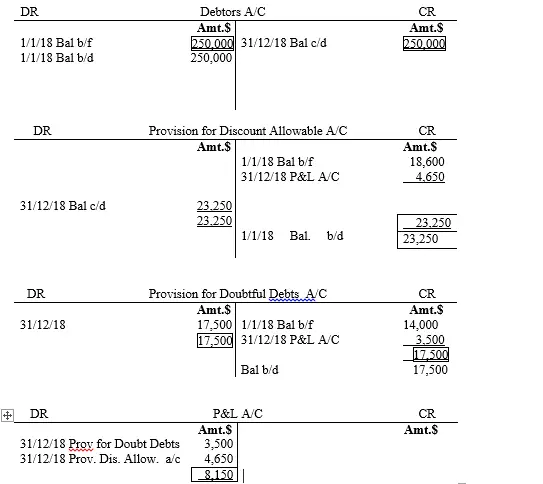

YEAR 2017

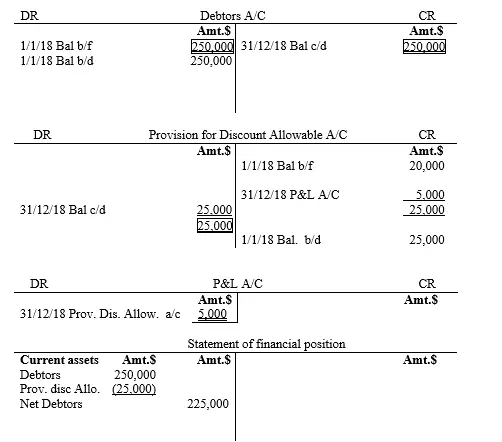

YEAR 2018

Workings; prov. for discount allowable= 10%*250,000=25,000

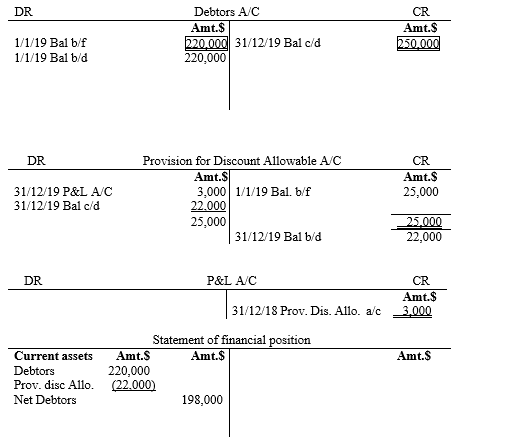

YEAR 2019

Workings; prov. for discount allowable= 10%*220,000=22,000

Ilustration two

Your co. Ltd provided you with the following debtor related information for three years as follows;

Amt.$

31/12/2017 Debtors 200,000

31/12/2018 Debtors 250,000

31/12/2019 Debtors 220,000

The management set a discount allowable policy effect from 1/1/2017 of 10% of the good debtors in each financial year. It is further assumed that debtors value given were gross (ie provision for doubtful debts not yet deducted) and the provision for doubtful debts for the three years were as follows;

Amt.$

2017 Provision for doubtful debts 14,000

2018 Provision for doubtful debts 17,500

2019 Provision for doubtful debts 15,400

Required

Enter the following transactions in the respective ledger account and balance the accounts where applicable, prepare profit and loss account and extract the respective statement of financial position for the three years, 2017, 2018 and 2019

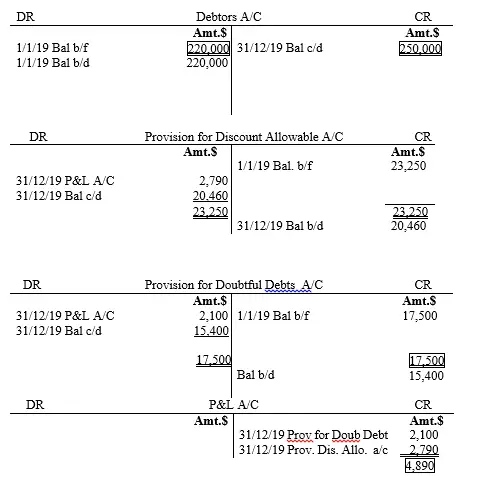

Solution

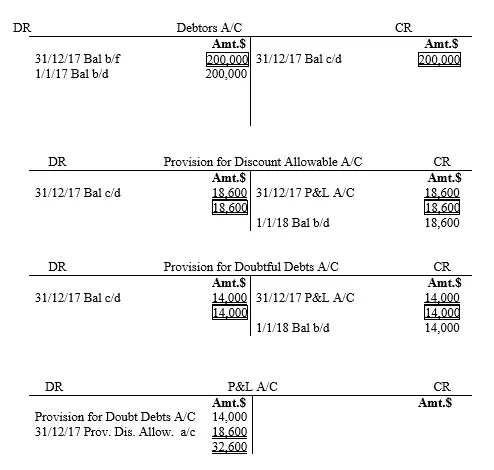

YEAR 2017

Workings; prov. for discount allowable= 10%*(200,000-14,000)=18,600

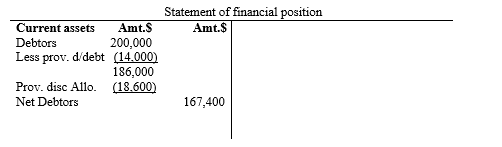

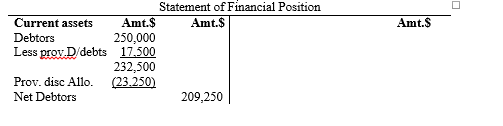

YEAR 2018

Workings; prov. for discount allowable= 10%*(250,000-17,500)=23,250

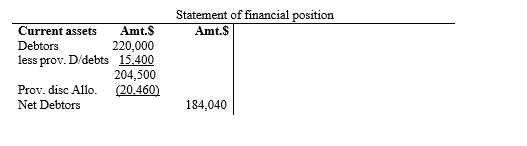

YEAR 2019

Workings; prov. for discount allowable= 10%*(220,000-15,400)=20,460