Capital affiliated transactions

In lesson three, illustration one the monetary values of capital and inventory remained unchanged. That is all the transactions which took place did not affect them. This is because the transactions that affect capital and inventory are unique. Therefore they are equally treated in a special way when recording their occurrence. This online tutorial substantiates each case at a time giving clear illustrations for better understanding.

Capital is a special liability. There are four specific transactions which cause capital value to change. Each transaction is first defined and further explanation is given on how such transaction affect the capital item. These transactions are;

-

Profit

-

Loss

-

Investment/additional capital

-

Drawings

Profit Transaction

Profit is defined as the excess income generated over cost incurred in either a case of ordinary or extra-ordinary dealings of a firm. It can also be defined as the difference between total revenue and total cost, whereby the amount of revenue is more than the cost. Before we look at the illustration on the accounts affected, it has been mentioned that profits can either originate from ordinary business operations of the firm or extra-ordinary activities.

Ordinary business activities; it is a case whereby the income generated is from the main and incidental objective which justified the formation of the business. Profits originating from ordinary operations is of revenue nature and entails buying and selling of goods or services as stated in the Memorandum of Association (MoA) of that organization where applicable. For example, if a firm was formed to undertake trading activities of buying and selling of cereals, then the difference between the total incomes and costs associated to this business will translate to trading profits. Those profits are further classified as gross and net profits as it will be demonstrated during preparation of the financial statements of firms in the forthcoming main illustrations.

On the other hand, extra ordinary activities refer to tasks such as disposal (sell) of capital goods/properties which results to either profits or loss commonly referred to as capital gain or capital loss respectively. Most countries, does not recognize capital gain/loss as part of taxable income/loss for the firm. Whichever the case, for the accounting purposes, when profit transaction takes place, it results to increase in capital value. That is;

The accounts affected are;

-

If the transaction is of revenue nature (refer to Table 1.1);

Profit

Sales

Cash/debtor

Inventory

-

If the transaction is of capital nature (refer to Table 1.1);

Capital gain

Fixed asset disposal account

Provision for depreciation (this account will be substantiated later from level two to four).

Cash/other debtor

NB: The accounts affected are determined by the nature of transaction that took place at that particular time. The entrepreneur/learner need to assess and do the right interpretation.

Example one

Our co. ltd sold 100 units of inventory which had cost the firm $22,000, for $26,000. The accounts affected are more than two, but the double entry principle still holds. These accounts are;

Sales a/c (income), increased from 0 to $26,000, therefore CR

Profit (represented by profit& loss a/c) (income), increased from 0 to $6,000 (26,000-22,000), hence CR.

Inventory (asset), decreased by 100 units (Inventory valuation process to determine the current inventory value of the unsold inventory units)

Cash or Debtor (asset), increased from 0 to $26,000, therefore it is DR.

NB: Sales can be either on cash or credit form. Therefore, if it is in cash form, then cash a/c is affected otherwise if credit sale it is trade debtor account that will be considered in this case.

Loss Transaction

This is the opposite of profits and it refers to the excess of costs incurred over income generated in the ordinary or extra-ordinary dealings of a firm or it is the difference between total cost and total revenue, whereby the amount of cost is more than the revenue. Just like in the case of profits, loss transactions can either originate from ordinary business operations of the firm or extra-ordinary activities.

The ordinary business loss transactions originate from main and incidental operations of revenue nature which entail buying and selling of goods or services as stated in the memorandum of association of that organization where applicable. For example, if a firm was formed to undertake trading activities of buying and selling of food produce, then the difference between the total incomes and costs associated to this business will translate to trading loss if the cost is more than the income generated. The loss classification is a replica of the profit categories stated earlier. On the other hand, loss from extra ordinary activities involve tasks such as disposal (sell) of capital goods results to loss commonly referred to as capital loss. For accounting purposes, when loss transaction takes place, it results to decrease in capital value.

The accounts affected are;

-

If the transaction is of revenue nature (refer to Table 1.1);

Loss

Sales

Cash/debtor

Inventory

-

If the transaction is of capital nature (refer to Table 1.1);

Capital Loss

Fixed asset disposal account

Provision for depreciation (this account will be substantiated later in higher levels).

Cash/other debtor

For the accounting purposes, loss transactions result to decrease in capital value and the accounts affected with the corresponding accounting entries to be made are as demonstrated in illustration two below;

Example two

Our co. ltd sold 50 units of inventory which had cost the firm $2,600, for $2,200. The accounts affected are more than two, but the double entry principle still holds. These accounts are;

Sales a/c (income), increased from 0 to $2,200, therefore CR

Loss a/c (represented by profit& loss a/c) (loss), decreased by 400 (2,200-2,600), DR

Inventory (asset), decreased by 50 units (inventory valuation process to determine the current stock value of the unsold stock units)

Cash or Debtor (asset), increased from 0 to $2,200, therefore it is DR

NB: Transactions involving capital gain or loss on disposal of a capital good, will be dealt with in other advanced levels of this tutorial series.

Investment Transaction

Investment is the additional capital contributed by the owner(s) to an already existing business. This is not the same as the initial capital used to start a new business. The input can either be in monetary or non-monetary form. Transactions of investment nature result to increase in capital value.

Example three

The owners of Our co. ltd brought in additional cash of $200,000 after a year since inception of the firm to boost the financial status. Accounts affected are;

Investment/additional capital (liability), increased, hence CR

Cash (asset), increased, hence DR

NB: If the owner(s) brought in non-cash items such as furniture, motor vehicle etc, then the cash account will be replaced by either of those asset accounts.

Drawing Transaction

This is taking away of firm resources, be it cash or non-cash items by the owner(s) for personal use. This should not be confused with contra entries transactions which apparently involves taking away firm resources for business purposes. The two are different and treated in a different manner as it will be illustrated in the preparation of a two and three column cash book.

Example four

The owners of Our co. ltd took some cash $20,000 to pay school fees for their children. The accounts affected were;

Drawings a/c (expense), increased, hence DR

Cash a/c (asset), decreased, hence CR

NB: That if the withdrawal was in a non-monetary form, then the asset affected will decline in value in the same way. So the entrepreneur/learner should be careful of the nature of the transaction of drawing nature

The learner should note that, these transactions, namely; profit, loss, investment and drawing are not recorded expressly to capital account when they immediately occur. In other words, they are used to adjust the capital value. That is, once those four items are established, the final stage is to adjust the change in the initial capital account to determine the new capital level.

Illustration

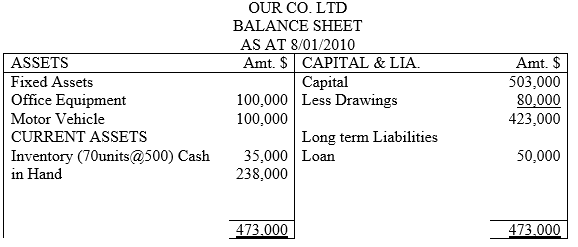

Assume that the balance sheet of Our co. ltd on 1/1/18 was as shown below

-

Suppose the following transactions took place in the month of January 2018 as follows;

2nd/01; 20 units of stock which had cost $10,000 were sold on cash at $15,000

The accounts affected were;

Sales (income), increased from 0 to $15,000 hence CR

Profit (profit & loss a/c), (income), increased from 0 to $5,000 (15,000-10,000), hence CR

Cash (asset), increased from $100,000 to $115,000 hence DR cash account by $15,000.

The quantity of inventory also changed and valuation of this item is as per International Accounting Standards number 2 as explained briefly below

Inventory is valued as per IAS-2. That is, at;

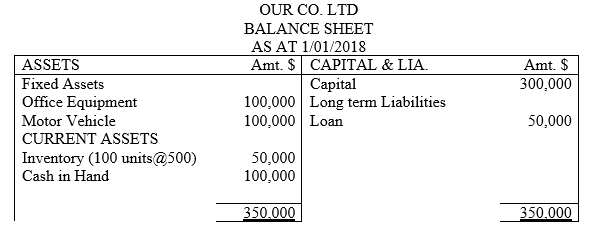

Now that at the time of selling the 20 units of stock, the market value (selling price was $750) and was higher than the purchasing price (cost of inventory-$500), then cost value was used for valuation of this item for it is lower. Therefore, the new balance sheet will be as shown below

-

Cost value or

-

Market (net) value whichever is lower

Workings

Profit= sales-cost of goods sold

15,000-10,000=$5,000

The revenue income of $5,000 is added at the end of the period to the original capital value of $300,000. The new capital value is $305,000 as shown in the balance sheet as at 2/01/18.

-

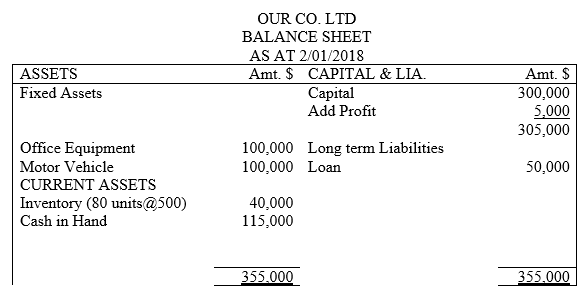

Suppose that another transaction of loss nature took place on 4th 2018 as follows;

4th/01; 10 units of inventory which had cost $5,000 was sold on cash at $3,000

The accounts affected were;

Sales (income), increased from 0 to $3,000 hence CR

Loss (profit &loss a/c), (expense), increased from 0 to $2,000 (3,000-5,000), hence DR

Cash (asset) increased from $115,000 to C118,000. So DR cash account by $3,000

inventory-quantity of inventory decreased from 80 to 70 units valued at $500

The new balance sheet as at 4th/01/18 will be as follows;

Workings

Loss= sales-cost of goods sold

3,000-5,000= (2,000)

The $2,000 trade loss is later subtracted from the current capital value of $305,000. The new capital value is $303,000 as shown in the balance sheet as at 4/01/18.

-

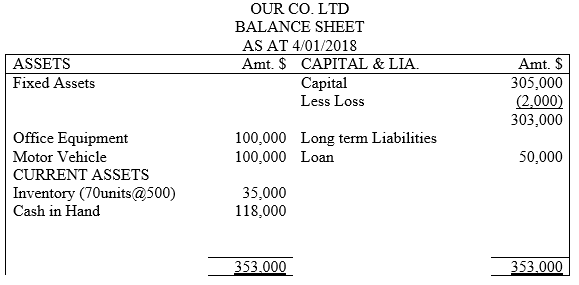

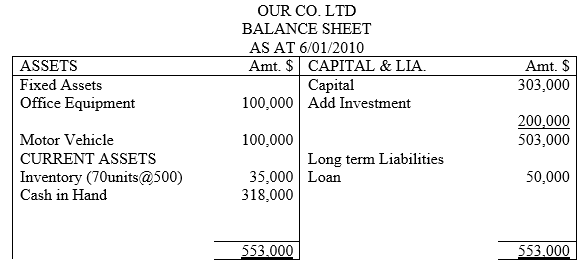

Suppose that another transaction of investment nature took place on 6th 2018 as follows;

6th/01; The owners introduced additional cash of $200,000 to the business, The accounts affected will be;

Investment (liability), increased in value hence CR

Cash (asset), increased in value hence DR. The new balance sheet would be as follows

-

Suppose the owners withdrew some resources for personal use on 8th as follows;

2010; 8th/01; The owners took cash $80,000 from the business,

The accounts affected were;

Drawings (expense), increased in value hence DR

Cash (asset), decreased in value hence CR. The new balance sheet would be as follows