Material Inventory Valuation Procedure-Standard Price Inventory Valuation Method

Specific objective; definition; standard price inventory valuation; method; example

Specific Objectives

This article is guided by the following 2 specific objectives. The learner/user of this article will be able to;

- Define the term standard price inventory valuation method

- Compute inventory monetary value using standard price inventory valuation method

Standard Price Inventory Valuation Method

Definition

Standard inventory valuation method is an approach of determining the monetary value of closing stock which entails use of predetermined price to value issued out inventory.

The predetermined price is anchored on the relevant factors such as the level of demand of raw materials and future changes in prices that is expected to take place. The following illustration clarifies this method of inventory valuation.

Example

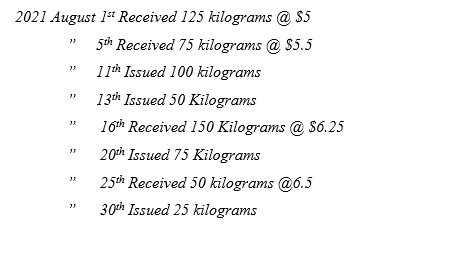

Polite Notice (PN) company ltd provided you with the following inventory details for the month of August 2021

Required

Using the above information, determine the monetary value of closing inventory at the end of August under STANDARD PRICE inventory valuation method.

Solution

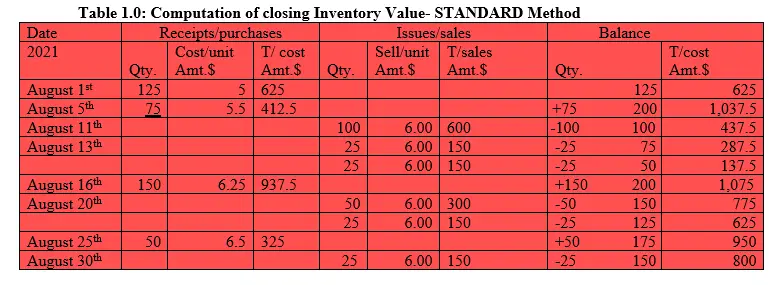

Explanation of inventory Issuance-STANDARD PRICE inventory valuation Method above

Note: That, total units of inventory before issuance begins was 200 units made up of 1stAugust 125 units plus 5th August 75 units. Then…

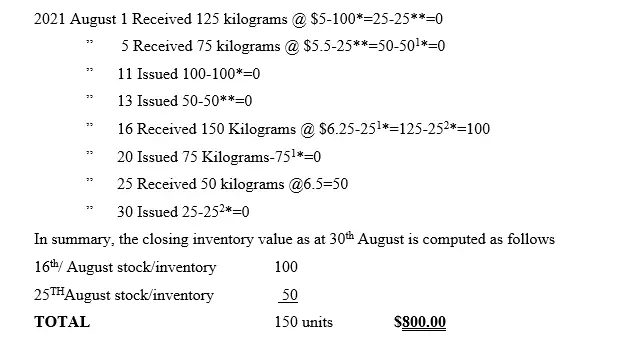

11th August the first 100 units of inventory was issued and was from the 1st August 125 batch of units of inventory received. The balance after that issuance was 25 units of inventory. On 13th August the next issuance of 50 units of inventory was made and was from two batches; first, 25 units were gotten from the 1stAugust batch of inventory whose balance was 25 units and second, the remaining 25 units was picked from the 5th August batch. On 16th August, received additional inventory of 150 units. Such that the total units of inventory so far were 50+150=200. On 20th August, another issuance of 75 units of inventory was made. So, 50 units were picked from the 5th August batch which had a balance of 50 units. That batch got exhausted. Therefore, the remaining 25 units to be issued was gotten from the 16th August batch where by the balance left was 125 units. Then another additional inventory was received on 25th August of 50 units translating to a total of 175units of inventory. Then the last issuance was 25 units which was picked from the 16th August batch resulting to a balance of 100 units. So, after the last issuance, there was a balance of 150 units (made up of 100 units of 16th August batch plus 50 units of 25thAugust batch).

Note that the superscripts (i.e., *, ** ,1*, and 2*) used below will guide you on which inventory batch each issuance was picked from. This inventory analysis is a computational proof of monetary value of closing inventory as at 30th/08/2021.