Return on Assets (ROA)

Return on Asset is a profitability gauge to assess the efficiency of assets in generation of income or earnings. It is similar to return on investment (ROI) for assets are acquired by a business to generate income and that acquisition is the aspect of investing.

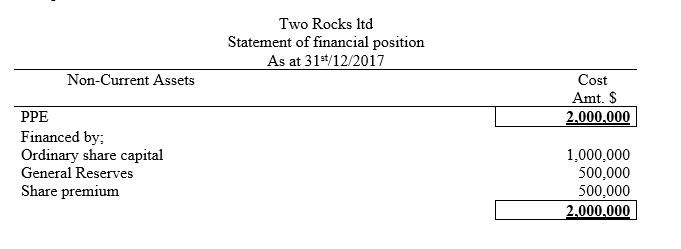

Example

Earnings after Taxation was $1,200,000

Required

i) Determine Returns on Equity (ROA) for the period ended 31st/12/2017

ii)Interpret the results in (i) above

For every $1 currency invested in assets, $0.60 units of currency is generated as returns.

Applicability of ROA in Decision Making by Management

The management will use the ratio in decision-making

whereby;

On Denominator Factor

The management has to make decision pertaining repair and maintenance of the assets is ok to avoid low performance. So it should ensure repair, maintenance and replacement plans are will set to ensure the asset performances. The denominator factor is in their control. Also the aspect of cost need to be incorporated to ensure that acquisition cost is not exploitive for the organization by the suppliers.

On Numerator Factor

The management has less control on the numerator factor for the market price is externally controlled by the forces of demand and supply while taxation is also an external force for it variability is determined by the tax regime in use in the various countries. Such that if tax rates are high, they will affect the returns of the organization in an adverse manner and if favorable, then the better, returns will be high hence ROA will be high.