Properties Plants And Equipment (PPE) Schedule

The subject of non-current assets is wide and its accounting treatment is diverse. Non-current asset accounting treatment is governed by International Accounting Standard (IAS) number 16. The main objective of IAS-16 is to guide how non-current assets ( also referred to as properties, plants and equipment-PPE) is maintained in the books of account for the sake of users of financial statement such as investors who wish to discern information about the organization’s investment in its non-current assets and any change occurring over the years.

The key issue of accounting for PPE as guided by IAS-16, is to recognize the assets thereof, determination of their Net Book Value (NBV) also referred to as Carrying Amount (CA), depreciation charges, revaluation and any impairment losses. It is advisable as an entrepreneur/learner to read the IAS-16 document for there is a lot of information pertaining these nature of assets. At this level, the focus will be on PPE schedule preparation.

PPE schedule is a matrix that summarizes all transactions associated with PPE. It is a detailed explanation of causes of change in carrying amount of PPE at the end of the financial period. In other words, the matrix incorporates all types of PPE the firm has and of course it will vary from one firm to the other. The format is as follows;

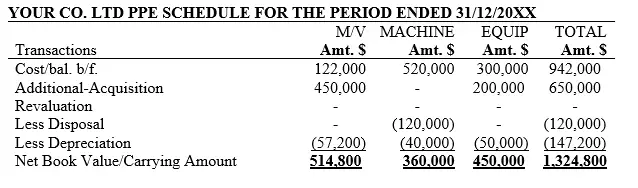

Illustration one

Your co. ltd provided you with the following transactional information for its Properties, Plants and Equipment (PPE)

1st/1/2018 Bal b/f-motor vehicles $122,000; machines $520,000; office equipment $300,000

2nd/1/2018 purchased three motor vehicles at $150,000 each and paid by check

1st/7/2018 purchased office equipment amounting to $200,000 on cash

1st/7/2018 disposed one machine which initially had cost $120,000.

Additional information;

Ratable depreciation policy applies and the rate of depreciation pa is 10% per cent at cost.

Solution

Depreciation amount;

1. Motor vehicle

10%*(122,000+450,000)= $57,200

Machines

10%*(520,000-120,000)= $40,000

2. Office Equipment

10%*(300,000+200,000)= $50,000

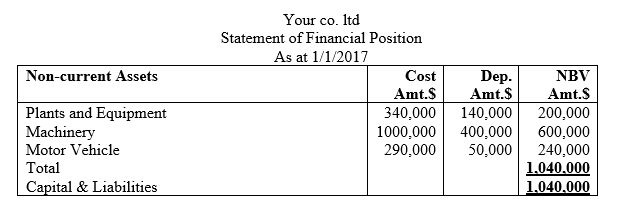

Illustration two

The opening statement of financial position of Your co. ltd on 1/1/2017 was as shown below

Additional information

i) Your co. ltd management invited an asset valuation agent who recommended the following; that all non-current assets be revalued at 10% of the net book value

ii) Depreciation rate for plants and equipment be 5% per annum and the other non-current assets be depreciated at the rate of 10% on reducing balance.

iii) 1/1/2017 purchase of new plant and equipment for $200,000 on cash and two motor vehicles at a total cost of $300,000 by check

iv) 1/1/2017 one of the old motor vehicle was disposed at $75,000 on cash. Its original cost was $100,000 and the accumulated depreciation at the time of sale/disposal was $15,000.

Required

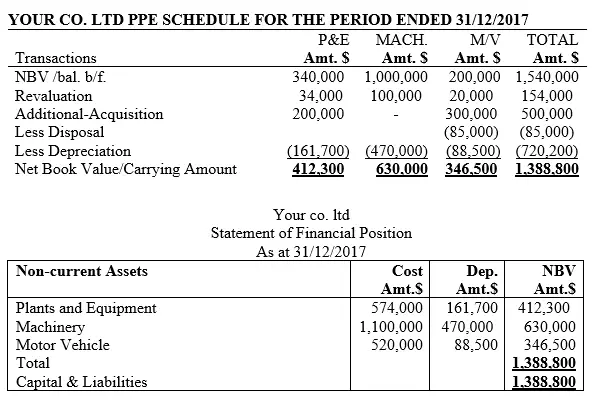

i) Prepare the PPE schedule of Your co. ltd as at 31/12/ 2017

ii) Prepare closing statement of financial position/balance sheet as at 31/12/17

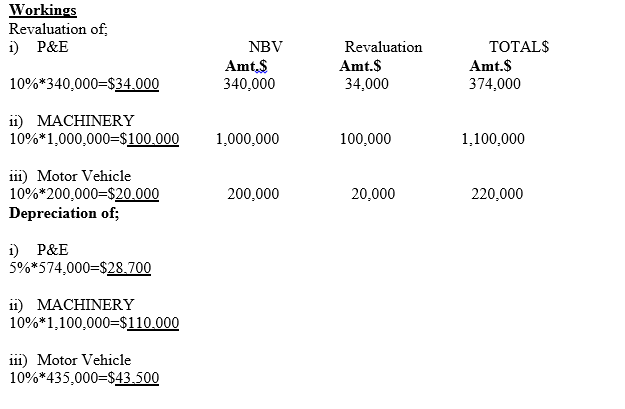

Solution

Workings

Summary

Chapter four was a furtherance of the end of the year adjustments. In this chapter, the focus was establishment of missing items in both the operating expense and operating income accounts which form either prepaid and accrued expenses or accrued and income in advance. This items are arrived at by considering the balance brought down at the end of the financial period in the respective operating expense account or operating income account. Such that, if the expense account has a debit closing balance brought down, it is a case of prepaid expense. Whereas, if the expense account has a credit closing balance brought down, it is a case of accrued expense. On the other hand if the income account has a debit closing balance brought down, it is a case of accrued income. Whereas, if the income account has a credit closing balance brought down, it is a case of income in advance.

The missing item in the respective expense and income accounts is determined by simply considering all the accounting entries related to that particular operating expense or income which include balance brought forward, cash paid or received, closing figure to profit and loss account and more importantly the balance carried down (bal c/d). it is worth noting that balances carried down (bal c/d) is a business transaction for it carries a monetary value and as we had discussed in level one of this accounting tutorial series, any activity that can be assigned a monetary value is referred to as business transaction.

It is also worth noting that any of the items of either operating expense or income can be the missing item for such an item is the balancing figure when we prepare a complete ledger account. At this level, it is also appropriate for the entrepreneur/learner to consider using a number line for the sake of allocating the expenses or income for the right periods. This is because, sometimes the payment made or cash received could be for a period of more than a year or a shorter period. Use of a number line as we discussed in this chapter can aid one especially in an examination setting to align the expenses or income in the right period duration so as to establish the per annum amount to be charged in the profit and loss account or determine the accruals and prepayments in that order.

In this chapter, we also conclude that there is a difference between balance brought down and balance brought forward. For balance brought down, abbreviated as (bal. b/d) is used when balancing ledger accounts in the course of the financial period or at the end of the financial period. On the other hand, balance brought forward, abbreviated as (bal. b/f) is used in the beginning of the proceeding financial period. This means that the closing balance brought down (bal/ b/d) becomes the balance brought forward (bal. b/f). On the same breathe, when balancing the ledger account, be it operating expense account or operating income account, the balance brought down (bal. b/d) is the same as balance carried down (bal. c/d) for it is the balancing figure. The only slight difference for the two balances is that they are recorded in the opposite side of the ledger account as we discussed earlier in this chapter.

This chapter also focused on accounting for depreciation which was a furtherance of our earlier discussion on the same subject only that in this case, we incorporated the various depreciation policies commonly used by firms and in addition, we factored the case of change in depreciation policy and how to factor in such changes. Lastly, we considered the PPE schedule which is a detailed summary of transactions associated with non-current assets. In this case we incorporated the guidelines as provided by the international accounting standards-number 16. It is again advisable as an entrepreneur/learner to consider reading the whole document of IAS-16.