What is a balance sheet?

The first question we need to ask ourselves is what is a balance sheet, when to prepare it and why we need it in our business. A balance sheet is also known as a statement of financial position and it is a financial statement that shows the financial position of a business within a particular period of time usually a year. It discloses the financial position of a business at any given time and reveals the monetary values of the assets and liabilities of the firm.

From this definition, we can conclude that;

-

A balance sheet can be prepared at the end of the financial period or any other time as demonstrated hereafter.

-

A balance sheet discloses the monetary value (book value and not market value) of the firm assets and liabilities. It should be noted that, assets and liabilities of the owner is excluded (see sub-section 3.2.1 on Separate entity concept).

-

It shows the financial status of the business at any time horizon

-

The balance sheet represent both investment and financing aspect of the firm

Balance Sheet Format

Balance sheet can be presented in two ways;

-

Vertical format

-

Horizontal format

Both approaches are the same in content and meaning but for the sake of understanding of how this financial statement works, the tutor will use the vertical format commonly referred to as capital letter “T” format. Monetary perspective will be represented by US dollars ($) all through to demonstrate the accounting activities. To make our study unique. The name of the firm to be used in this tutorial will commonly be referred to as ‘OUR company ltd” and the individual names used such as Mr. Zack the owner of the business should not confuse you.

In this study and all the other three to follow, we will make use of “cases” and by extension illustrations to demonstrate how the balance sheet information is presented using the ‘T’ format. The learner should note that horizontal format carry the same accounting information. Let us get started now;

Case one

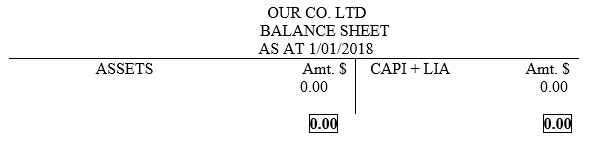

Assume that Zack (the owner of our company) intents to start a business. Before injecting any financial or non-financial resources on 1st/01/2018, the financial position was zero as follows;

You can see in this case, the financial position is zero for no investment has taken place so far.

Case two

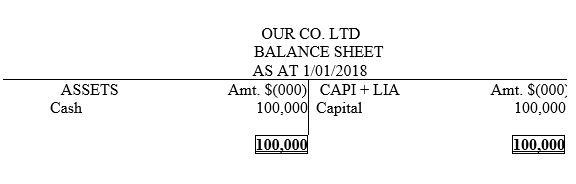

On 2nd/01/2018, Zack injected capital amounting to $100,000,000 in to the business. The new balance sheet will disclose the current financial position from zero level to be $100,000,000 as follows

From the two examples, it can be concluded that, a balance sheet can be prepared any time it is required by the user and also the totals on both right and left hand side have equal values. This is because of two reasons, one; balance sheet equation is used to prepare the balance sheet and its assets and liabilities are equal and two; all transactions have a dual effect as explained later in this tutorial. The entrepreneur need to note that the starting point for any business is the balance sheet. Some accounting authors are proponents that business transaction is the starting point which is not true for before the business promoter start transacting, the financial position is the critical perspective one has to establish. You know that there is no business that can get started without capital. Therefore, the financial position is preeminent.

For more on Balance Sheet Format please check our blog discussion.

Steps of preparing balance sheet given the trial balance

If provided with trial balance transaction details, it is possible to extract the balance sheet also known as statement of financial position. The following are the steps the learner need to adhere to;

-

Step one: Classify all the items into either, assets, capital, liability, revenue or expense

-

Step two: Select those items, which are of balance sheet composition.

NB: Utilize the Balance sheet equation i.e

A=C+L Where;

A=Assets

C=Capital

L=Liability

-

Step three: Prepare Balance sheet format, where vertical or horizontal

-

Step four: Post all the items of asset nature on one side, either the right hand side or left hand side

-

Step five: Post all the items of capital and liability nature on the opposite side of the balance sheet.

-

Step six: Add the monetary values on both right and left hand side each in isolation

Overall outcome;

The right hand side monetary totals will be equal to the left hand side monetary totals

Example of balance sheet preparation

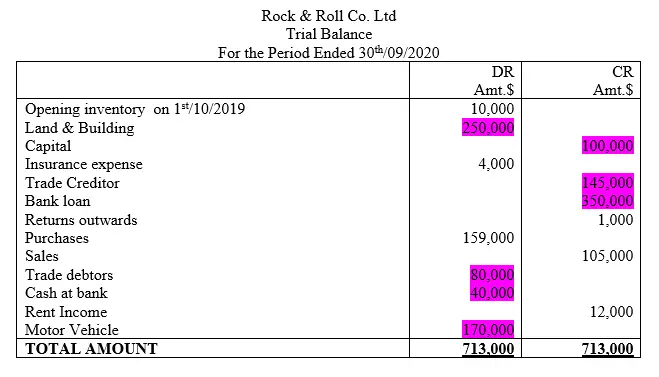

Rock & Roll Co. Ltd provided you with the following trial balance information extracted from the books of accounts as at 30th/09/2020

Additional information

Closing inventory on 31st/09/20 was $55,000

Required;

Using the trial balance statement information, extract a balance sheet to portray the financial position of this business as at 31st/09/2020

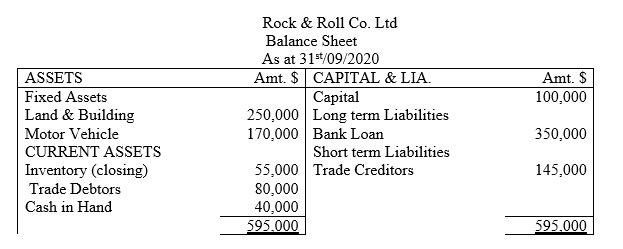

SOLUTION

Conclusion

That it is only closing inventory which is included in the balance sheet/statement of financial position

More articles on balance sheet